Jan Bobl^-.203*Jan Bund^-3.25 (1.3)*2RZ^ with 23.3, 23.3 & 16.3 days to expiry, Z-Score -1.30, 10-Year Backtest Value 0.105, closed -0.056 last night

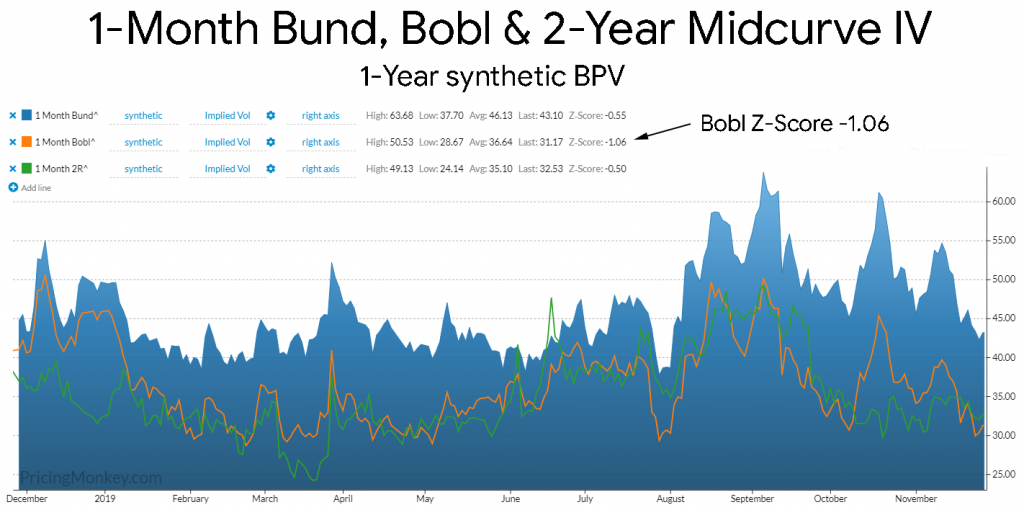

Low Bobl Vol is creating some interesting opportunities as we saw last week with our Calendar Bobl Strangle Spread idea. Another one flagged up this morning as cheap the Bund, Bobl, 2-Year Midcurve Fly.

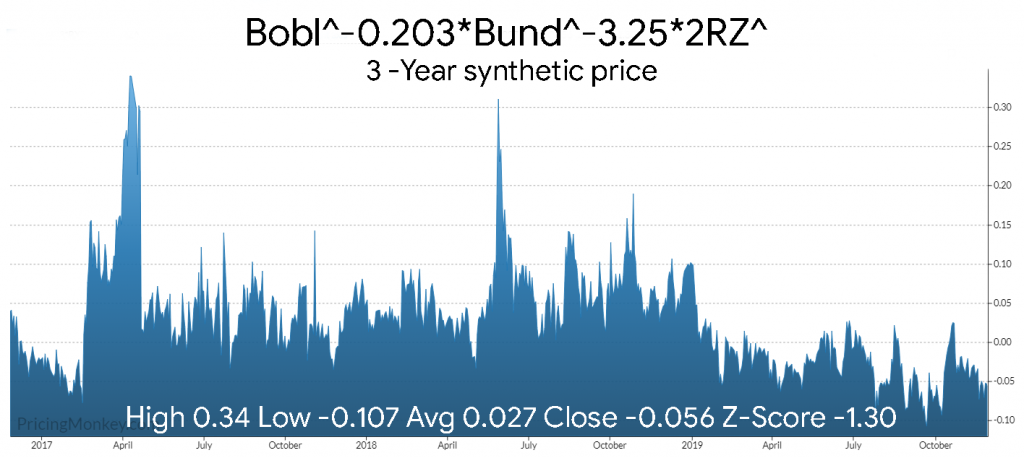

To look at this relationship you can weight the Implied Vols as a Fly Structure (2xBobl Vol-Bund Vol-2RZ Vol) or create a vega weighted CIX price structure, both will give you very similar charts, the CIX weighted Fly here is Jan Bobl ^-0.203*Jan Bund^-3.25*2RZ^, charted here you can see the current weakness in the Bobl vs Bunds and 2-Year Midcurve. Closed at -0.056.

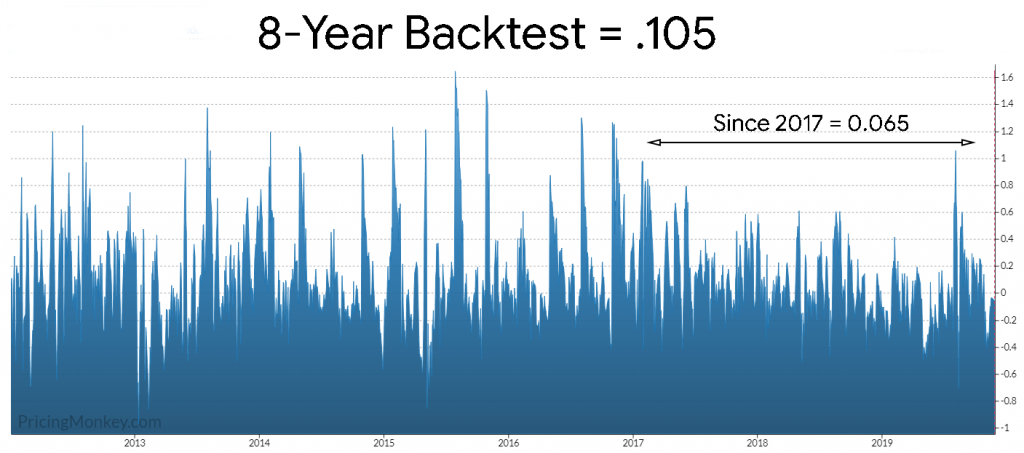

The key to understanding the value of this trade is by checking its historic backtest values, how has this trade delivered over time? It’s delivered 0.105 on average over the last 10 years, 0.065 in the last 2 years.

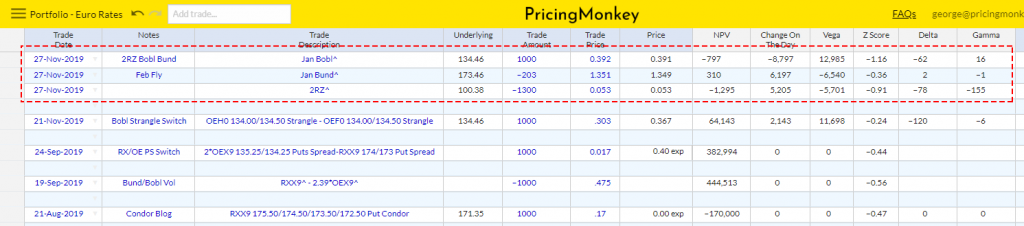

To execute this trade you’ll need to adjust for the Euribor tick size and downsize the by a factor of 2.5 against the chartable CIX above. Trade booked here as an example. Interesting? Best to speak to your broker on execution/hedging weightings/backtesting or chat us for more details.