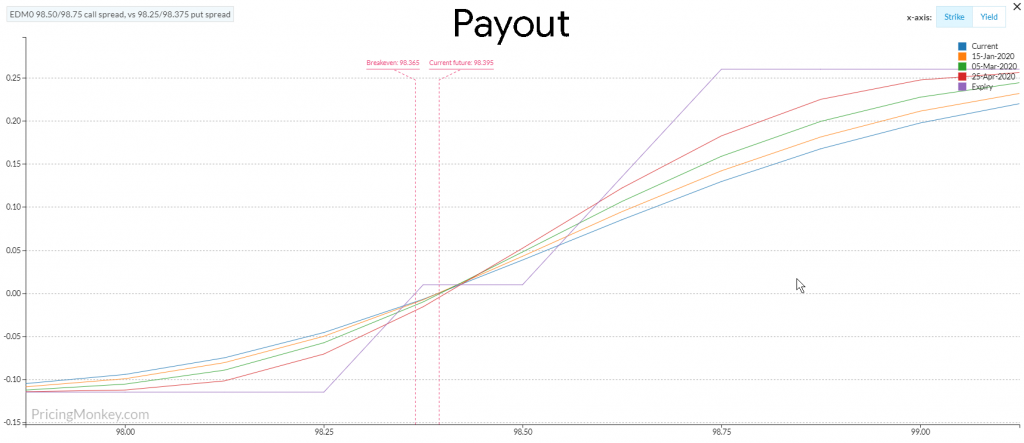

EDM0 98.50/98.75 call spread vs 98.25/98.375 put spread with 202 days to expiry. +34.9 Delta.

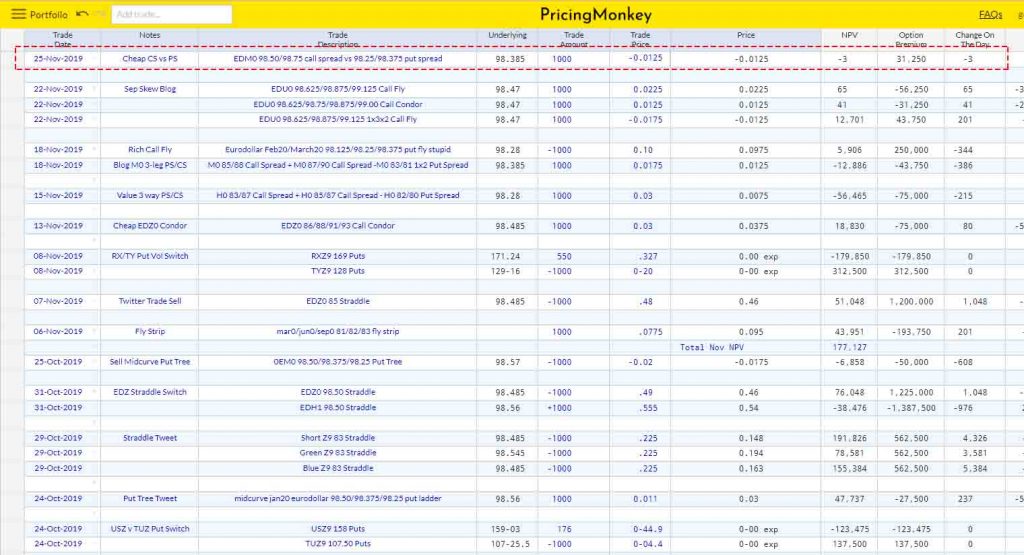

Have seen this trade printing heavily today, with around 50k going through so far. The Buy-Side flow is being reported as buying the Call Spread vs the Put Spread. Closed at -0.0125. Trades at a -0.72 Z-Score, and has a historical 10-Year payout of 0.03 Ticks, looks pretty decent value on paper. Potentially one to watch if you’re looking for a value upside trade here.

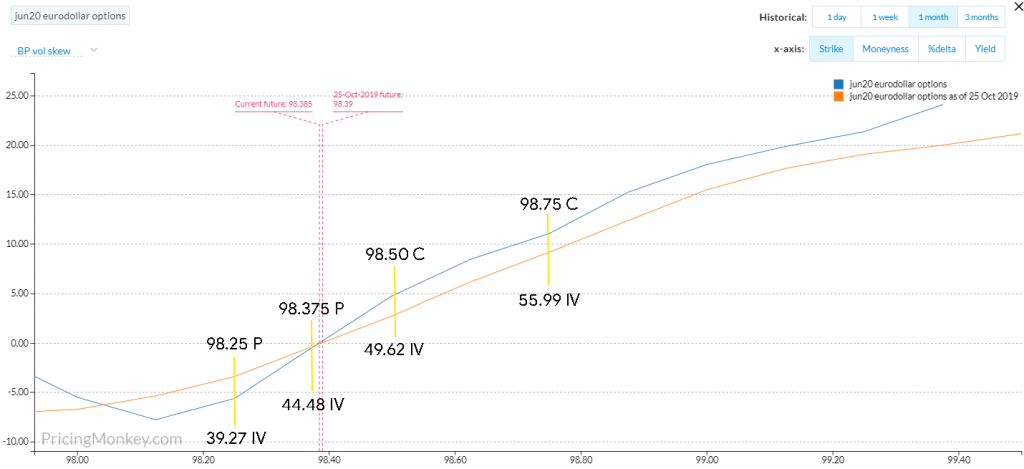

Why is this trade cheapening? The skew shift over the last month shows the Puts cheapening and the Calls richening relative (the Blue line below), driving the value of this package down. Note that the Puts Spreads here are at 10-Year highs, the value of the out of the money Puts is really undermining them.

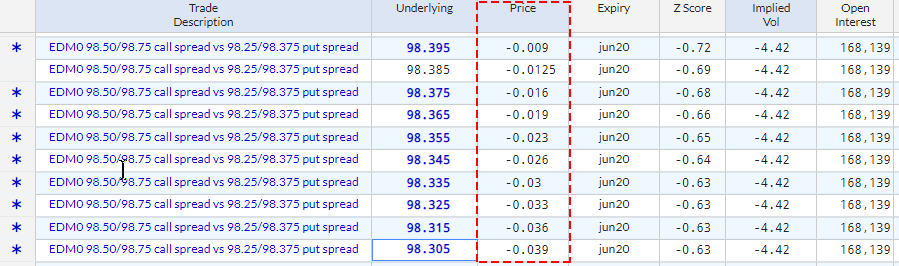

How cheap can this structure get into this holiday week? A couple of cents dip in the underlying (EDM0) could push the price to around -2.

Payout profile

Trade booked for tracking.