Silver options were a wild ride in 2020, and implied vol continues to remain high. In this post we discuss how best to wager on lower volatility for the year ahead.

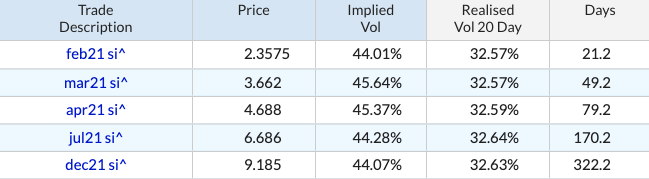

Here is a current run of Comex silver straddles:

The volatility term structure is very flat, the forward vol implied by straddle spreads is still up in the mid 40s:

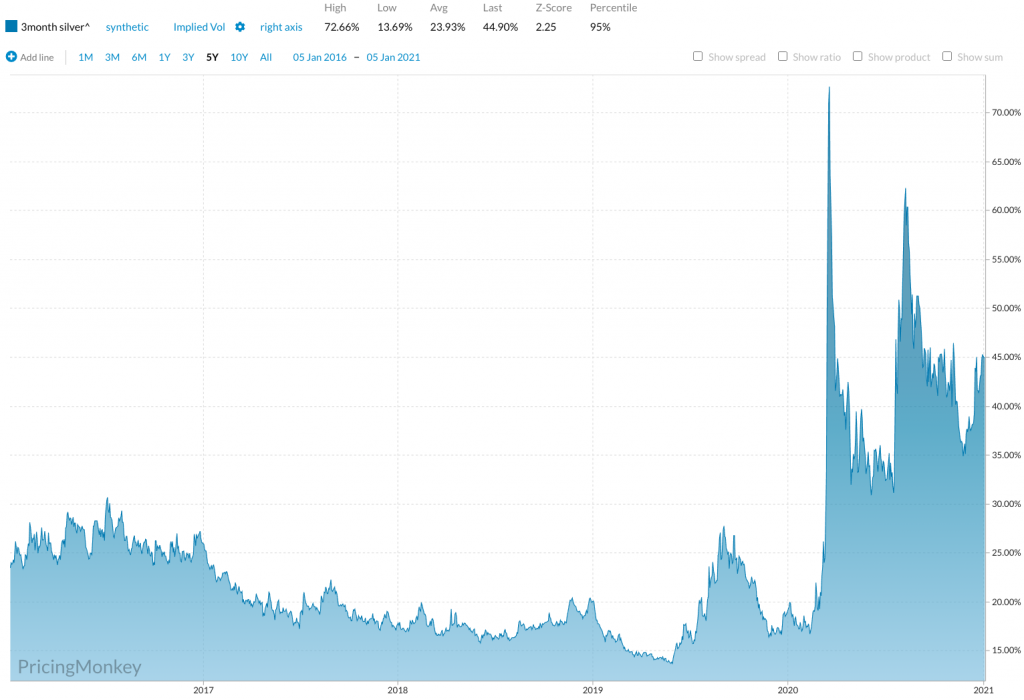

We think vol is likely to drift lower. Here’s a chart of implied volatility (3month expiry) going back 5 years, the long term average is close to 20%:

However there is plenty of short term uncertainty around the price of silver. One way to play for a normalisation of implied volatility without being exposed to short term moves is to sell a straddle spread.

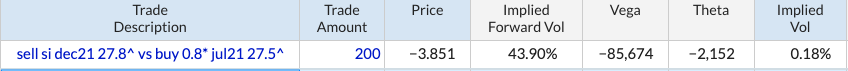

We like selling the dec vs jul straddle spread at a 1 to 0.8 ratio. Selling a longer dated straddle spread means there’s more time for implied vol to drop. Going underweight the july straddle puts the initial gamma/time decay close to zero.

For pricingMonkey users you can follow how this trade performs on a shared blotter here:

https://pricingmonkey.com/b/11bd2e06-1729-43c6-86ba-0f71d8298097

If you don’t have a Pricing Monkey account, would like one, and work at a financial institution, then please contact us about a free trial at [email protected]