Garnering a “Check The Facts” link on social media almost seem to be a badge of honour these days but here the facts support this fake-news headline. Behold the strips in USD, EUR and GBP:

| USD | EUR | GBP | |

| Jun20 | 99.698 | 100.335 | 99.785 |

| Sep20 | 99.715 | 100.375 | 99.820 |

| Dec20 | 99.695 | 100.390 | 99.815 |

| Mar21 | 99.770 | 100.405 | 99.860 |

| Jun21 | 99.790 | 100.415 | 99.870 |

| Sep21 | 99.780 | 100.415 | 99.865 |

| Dec21 | 99.750 | 100.410 | 99.850 |

| Mar22 | 99.755 | 100.405 | 99.845 |

The spread between the 1st and 9th contracts are 2.25bps, 6bps and 4.5bps respectively. This is what the surface of planet ZIRP looks like in rates terms, what about the vols? Here is a run of the at-the-money’s:

| USD | EUR | GBP | |

| Jun20 | 25.72 | 21.5 | 25.14 |

| Sep20 | 22.12 | 22.71 | 25.15 |

| Dec20 | 24.41 | 22.47 | 24.52 |

| Mar21 | 24.56 | 24.1 | 26.36 |

| Jun21 | 26.65 | 25.24 | 28.06 |

| Sep21 | 29.5 | 25.39 | 29.57 |

| Dec21 | 32.08 | 25.79 | 31.98 |

| Mar22 | 35.3 | 26.76 | 34.33 |

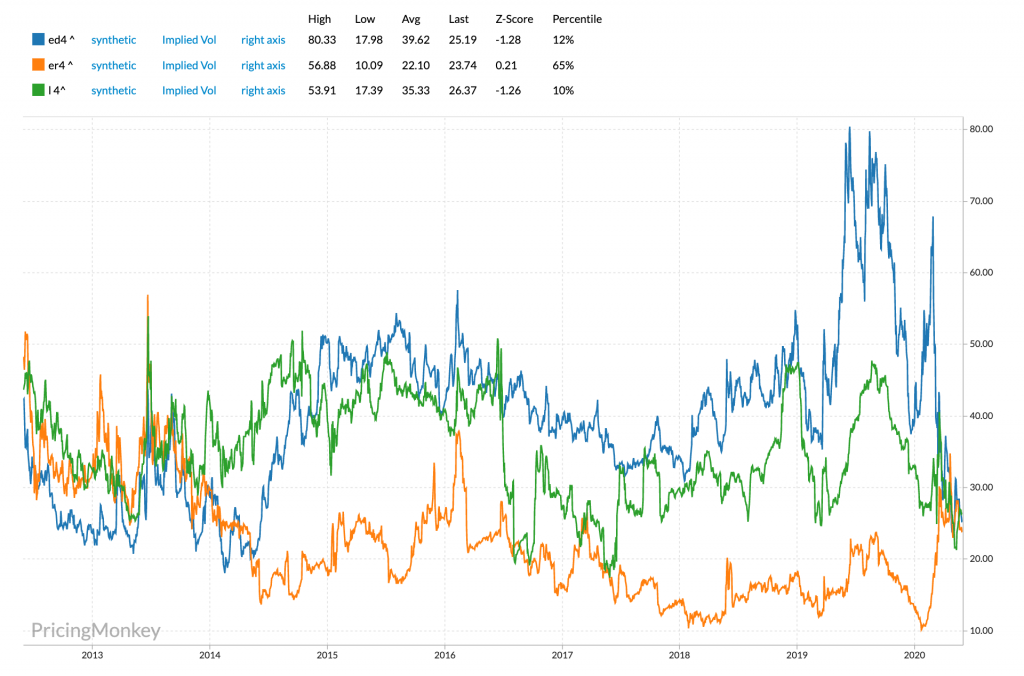

Again pretty flat, most are less than 2bps per day, and out to the 5th contract it’s eerily similar. So rates have gone to the “zero” bound for their respective central banks, and from the above it looks like the vols have gone to some kind of lower bound too but is it really that simple? Lets look at where the ATM vols on the 4th contract have been for the last few years:

First off, you could halve the current implieds and still not get to the lows in EUR, rates might be at zero but vols definitely aren’t there yet.

Next, from this it looks like the exception rather than the rule that these vols all converge. Feels like there should be something to do here, but what’s the trade?

Just purely at the past behaviour of vols it looks like you want to sell the euribor straddle and buy either sterling or dollar straddles. Personally I would go with sterling because we’ve flip flopping headlines about negative rates, Brexit and plenty of political noise. Equally though the US strip was pricing 3% rates just 18 months ago so the potential to bounce back is arguably greater there.

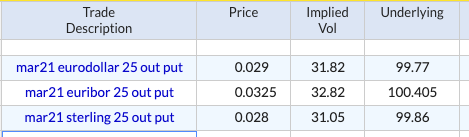

If you think there’s usually more juice in the out strikes, the put skews are also pretty similar:

So rather than going for the ATM you could go for the 25 out puts delta hedged.

The main risk with selling Euribor vs something else is obviously that Euribor starts moving while the other leg holds steady. Concerns around sovereign debt and the ECB’s bond buying programs would seem to be the most likely source of problems here. My feeling is that means there’s more likely to be a sell off than a rally in Euribor on the back of that. Seems counterintuitive to suggest a trade that involves selling Euribor puts in that case, but I find it hard to imagine funding pressure from a crisis in EUR manifesting only in EUR and not propagating to other markets.

With the puts your final PnL is more likely to be small, but perhaps it’s a better leverage as you are playing off the probability of a EUR only funding crisis vs surprise to the upside in the recovery of the world economy. Certainly there’s more scope for surprise after today’s weak Chicago PMI!

Stay safe and good luck.