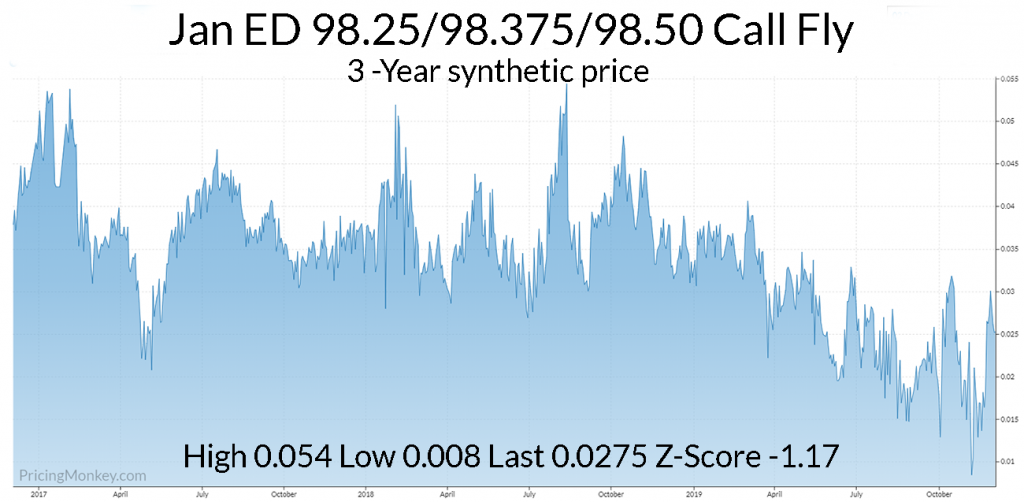

Buy Jan ED 98.25/98.375/98.50 Call Fly with 39.3 days to expiry, Z-Score -1.17

Sell June 98.125/98.25/98.375 Put Fly with 195.8 days to expiry Z-Score 2.05

Flys seem to be very en vogue today, with numerous trades aiming to pin strikes via the flys going through. From our backtesting we can see this is a super tough gig, for example, this June 98.125/98.25/98.375 Put Fly going through at 3.5 trading earlier has a backtest history of only 0.0147 ticks (10 years), this low probability of return is in line with the June Deutsche Bank findings on the poor predictive power of Fed Funds.

Value (better payout probabilities) can be found, for example, check out this Jan ED 98.25/98.375/98.50 Call Fly that’s also printing in decent size:

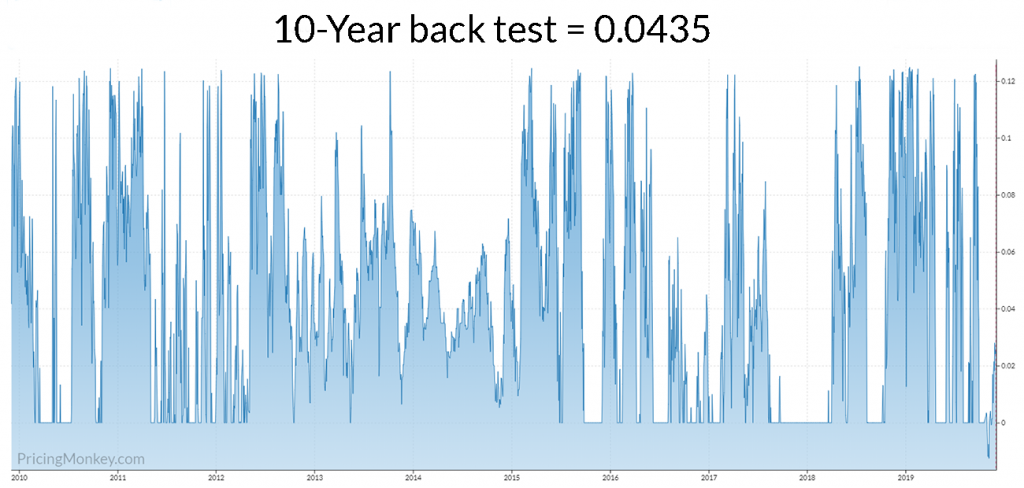

This has a very strong payout history, with a pretty constant payout over the last 10 years (0.0435). Traded at 0.0275 this afternoon, on a -1.17 Z-Score.

Maybe get creative and Buy the cheap Jan ED 98.25/98.375/98.50 Call Fly & Sell the rich June 98.125/98.25/98.375 Put Fly that’s trading close to 3-year lows on a Z-Score of -2.55. That backtests to 0.0278 over 10-Years (backtest result assumes end on first expiry on 10th Jan 20) and should come for a 0.01 credit (-0.01). It’s 3-Year is range -0.015 to 0.04.