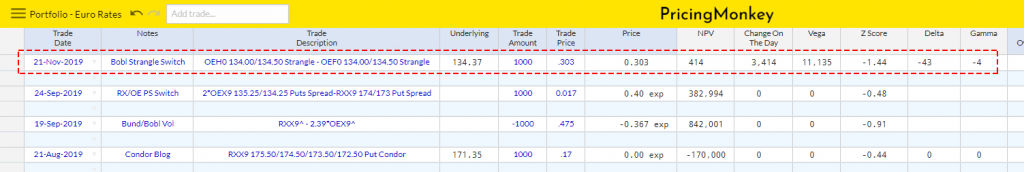

Bobl Mar 134.00/134.50 Strangle – Bobl Jan 134.00/134.50 Strangle with 92 & 29 days to expiry

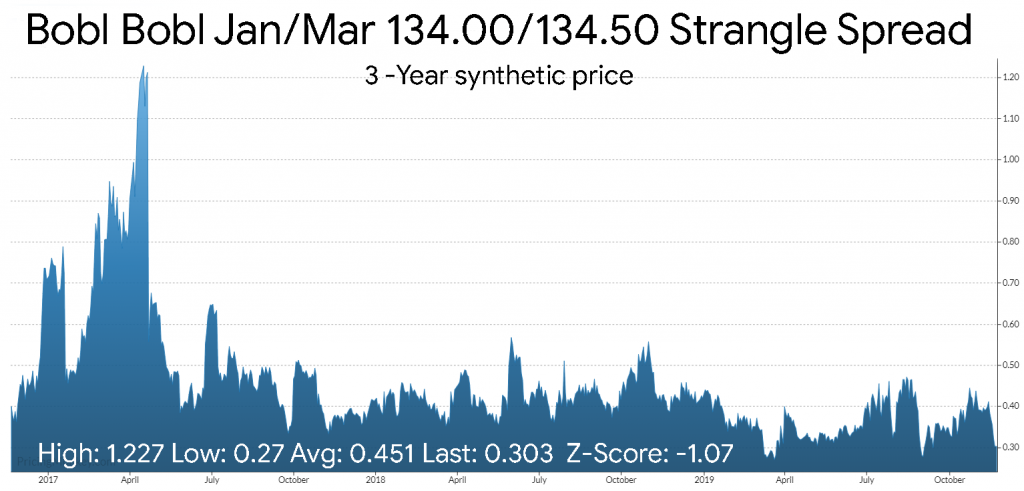

A low vol strategy for Bobls, the Mullet (short front, long back) seems to make some sense here. Selling the Jan 50 wide Strangle to Buy the Mar same 50 wide Strangle. Closed close to 3-year lows (0.27) at 0.303 with a -1.07 Z-score.

Risk + Return

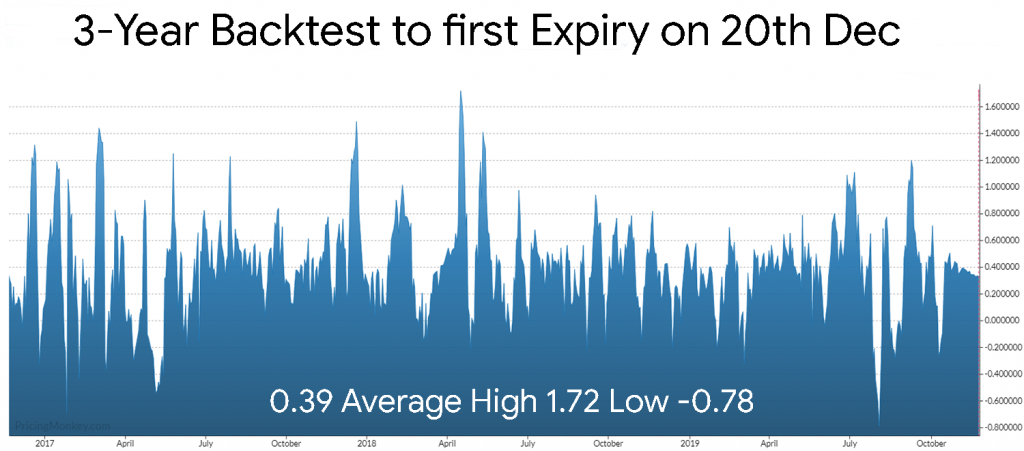

A 3-year backtest to its first expiry leg (Jan) on the 20th Dec shows it to have a 0.39 average return.

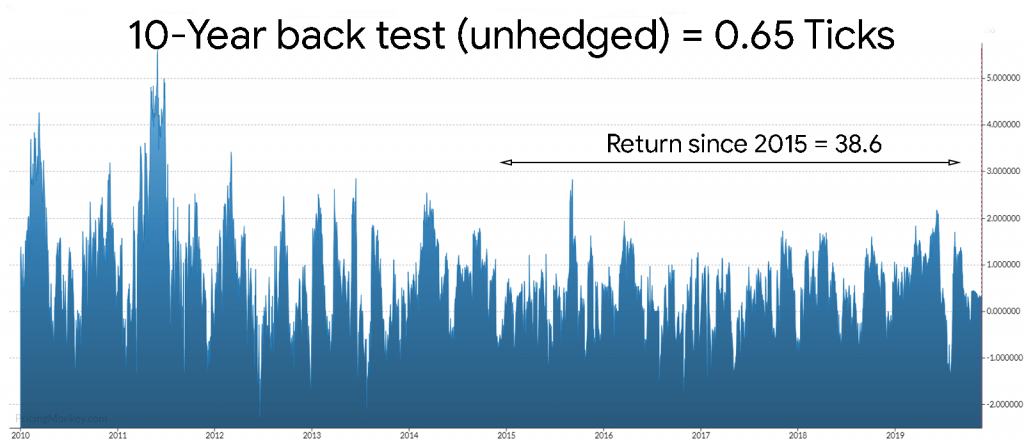

Its full 10-Year backtest shows at average .65 return, while the last 4 years have returned .386 ticks. This is the return to second (final) expiry.

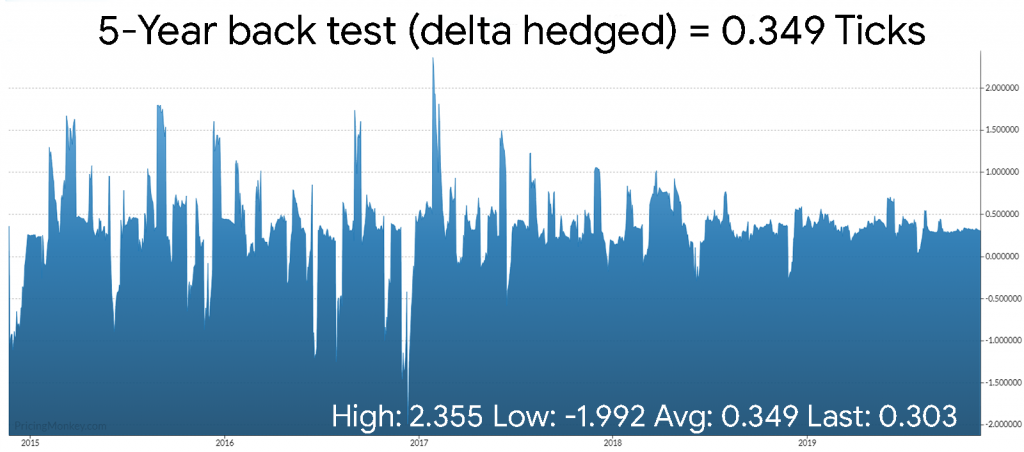

Delta Hedging the return is 0.349 over 5 years, letting both legs expire.

Variations, check out the US-5 Year which has Jan Vol marked over March Vol currently, which looks unusual (Short Vol over Long) at low Vol levels.