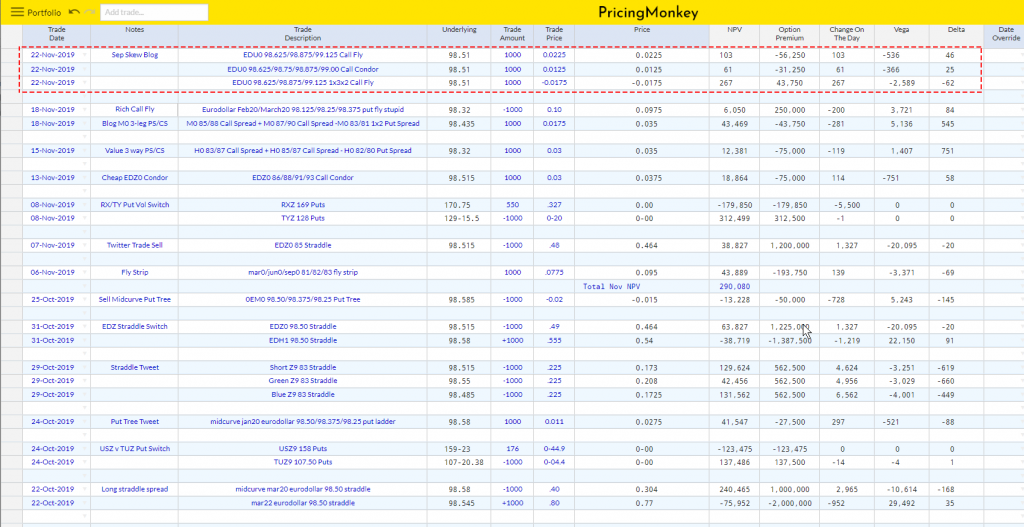

As everyone has probably read this week, Bloomberg has been pushing a story of a large ongoing Risk Reversal (RR) flow in Sep Eurodollars (Buying 98.00 Puts vs Selling 98.75/99.00 Calls in size). Oddly the direction of the Sept 98.00/98.75 Risk Reversal doesn’t seem to support the story very well, the RR has been trending sideways/down since 13th Nov (Puts Over Calls in Fixed Income), i.e Call Vol has been rallying vs the Put Vol.

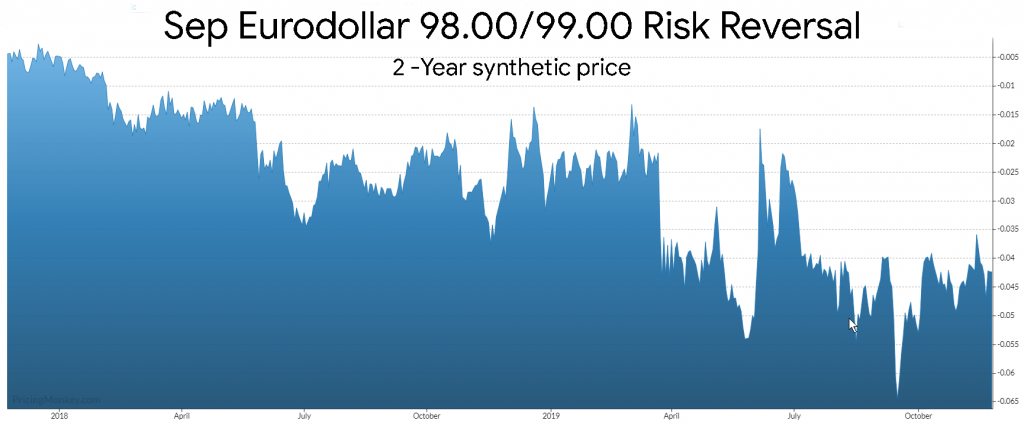

Current skew view on the EDU shows just how bullish the market setup is directly ahead of the US Election next year. The Risk Reversal also seems to have a lot of correlation to the US 2s/10s curve 84% over the last 3 years. Its recent move since Nov 13th was in sync with the curve flattening again.

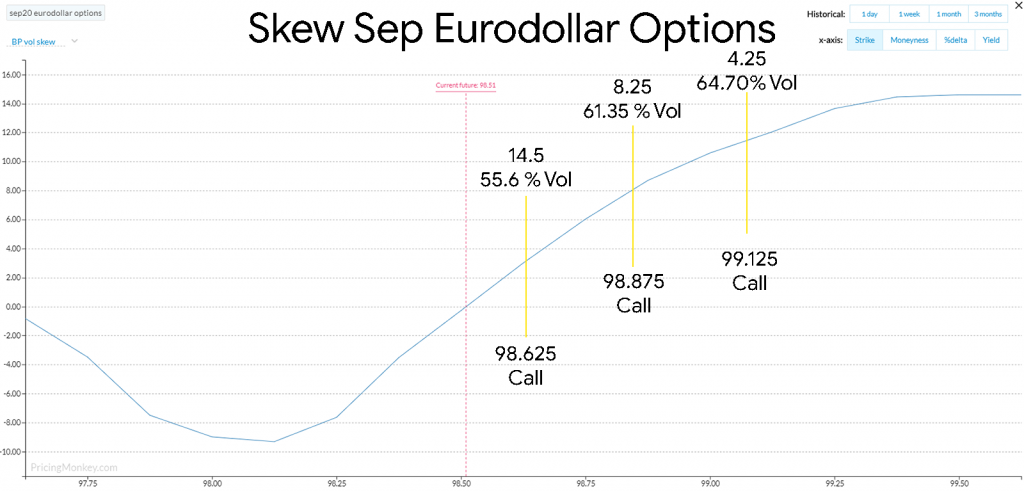

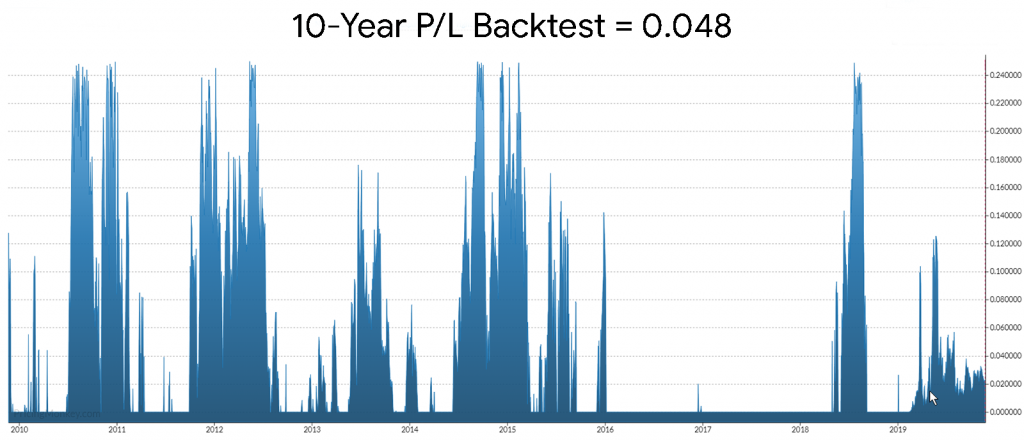

Trades ideas, with this steepness on the Skew, Fly & Condors are probably worth a look, for example just looking at the EDU 98.625/98.875/99.125 Call Fly which closed at 0.0225 last night, close to 3-Year lows.

Risk + Return

Priced at more than half its long term (10 Years) Backtest value of 0.048.

Other trades to consider:

EDU 98.625/98.75/98.875/99.00 Call Condor closed at 0.0125 Z-Score -1.66

EDU 98.625/98.875/99.125 1x3x2 Call Fly closed at -0.0175 Z-Score -1.40

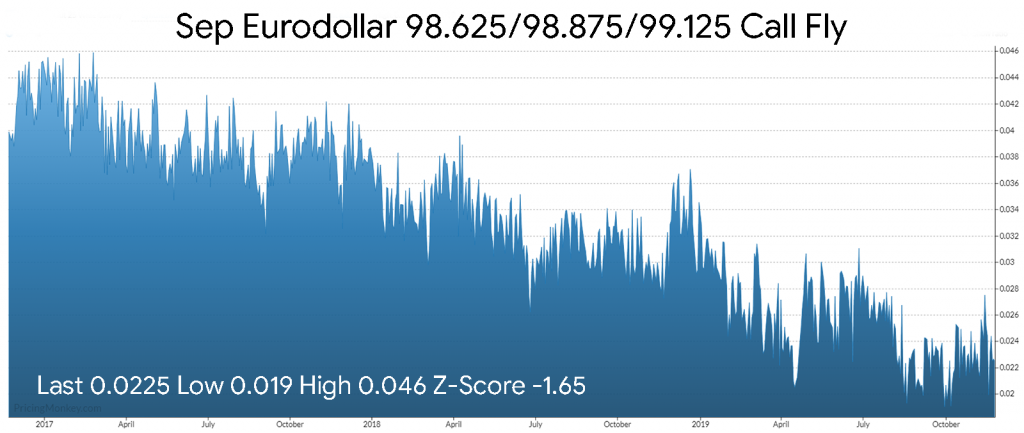

Recent $ tracked trades we like