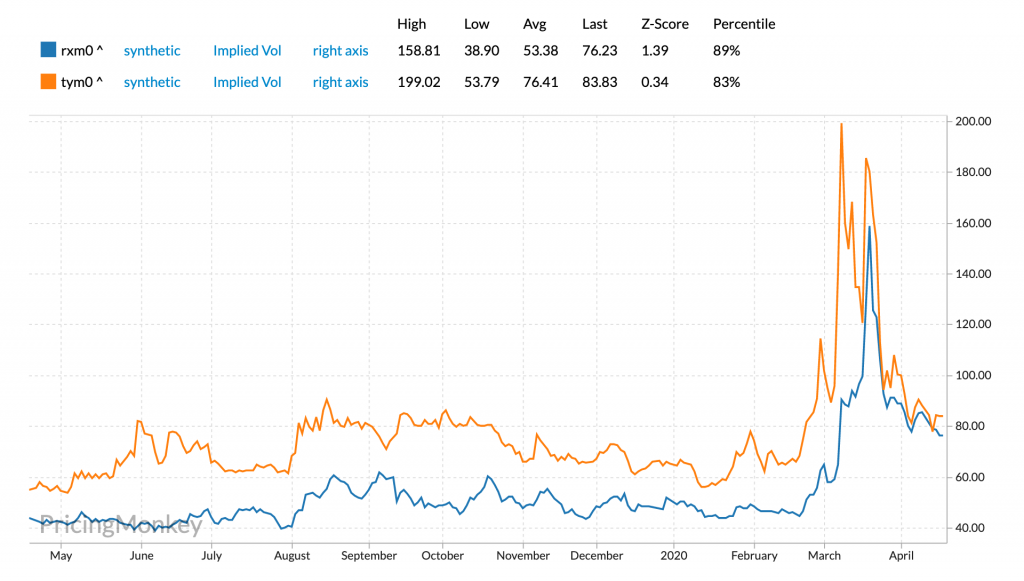

When long end rates move together in response to a global macro event, their realised vols converge. Structural flows also tend to stop as participants hold off to see how things will unfold. It’s natural that implieds also converge in this environment and that’s what we see below in the chart of ATM implied vols for Bunds and TYs Jun20 expiries (constant maturity, TY history in orange, Bund in blue). Is this where we should be going forward however?

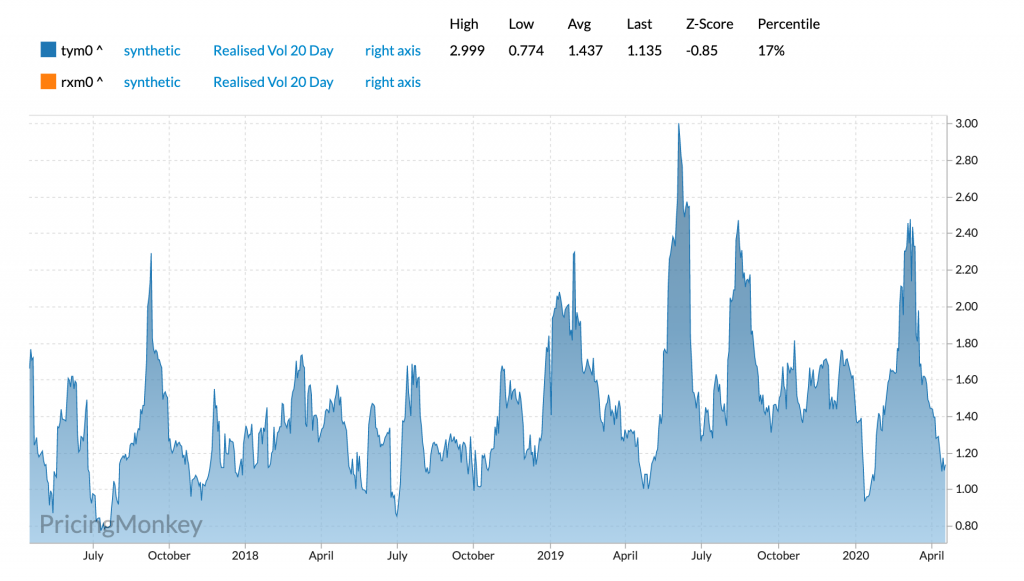

Looking at the ratio of 20 day realised over the last 3 years in the chart below (TY’s over) the answer is not very often. Not even when EUR 30s went to 0% in the maelstrom last year. There have been periods where TYs have realised double what Bunds have managed making being long TY gamma vs Bunds close to flat look like an asymmetric bet.

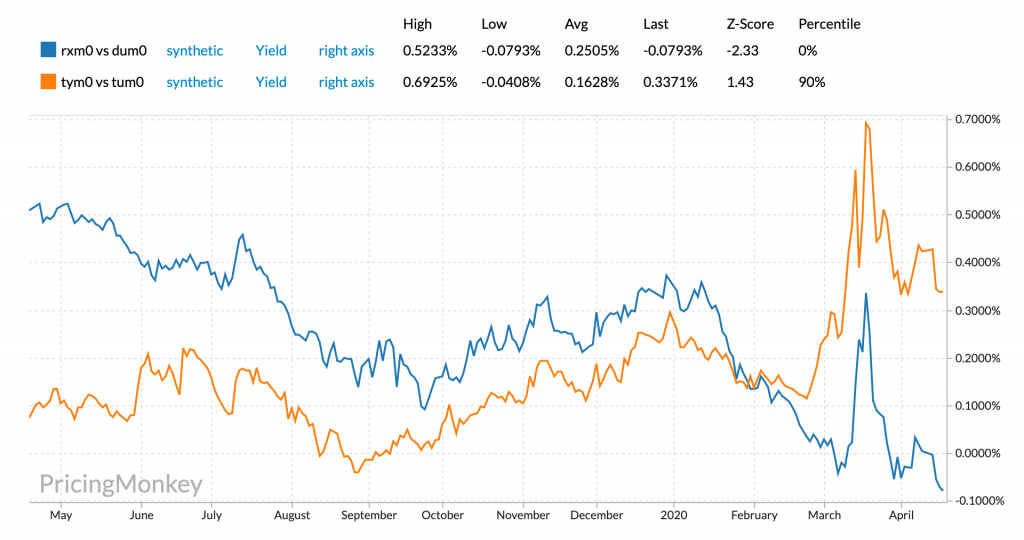

From a macro perspective both central banks are following ZIRP, but if you take the view that long end vol has to be lower if long end trades are close to short end rates because it’s hard to price a negative trajectory of policy into the curve then it still looks like there should be more juice in the US. Below is a plot of ty/tu yield spread vs rx/du yield spread. ty/tu is off the flats and trading around 35bps while rx/du is at -8bps.

Ok, yes the long end is trading through the short end in Germany so it can price a negative trajectory. The fact that uncollateralised rates are materially negative is evidence that technical factors can push the market to places that in a way defy empirical reasoning, but I still think there should be some dampening effect.

I think the most likely curve ball that will hurt this trade is further degradation in certain sovereign debt markets in Europe which challenges the ECB to pull out another “bazooka”, while the US is stable as the Fed maintains policy. BTP yields have been tracking higher taking Bund/BTP yield spreads to the levels seen after the pop of summer 2018, although in absolute terms BTP yields are only back to levels seen before the pop in summer 2018 of 2%.

So what’s the trade? If you’d like to play the pure realised you could trade the straddle switch and actively manage the delta.

If you are more macro inclined, I’d look at selling Bund calls vs TY calls, ideally with as long an expiry as possible to play on the idea that bund yields are closer to some kind of bound but the width of outcomes implied by the vols are the same. The longer the expiry, the further out your breakeven is on the Bund call.