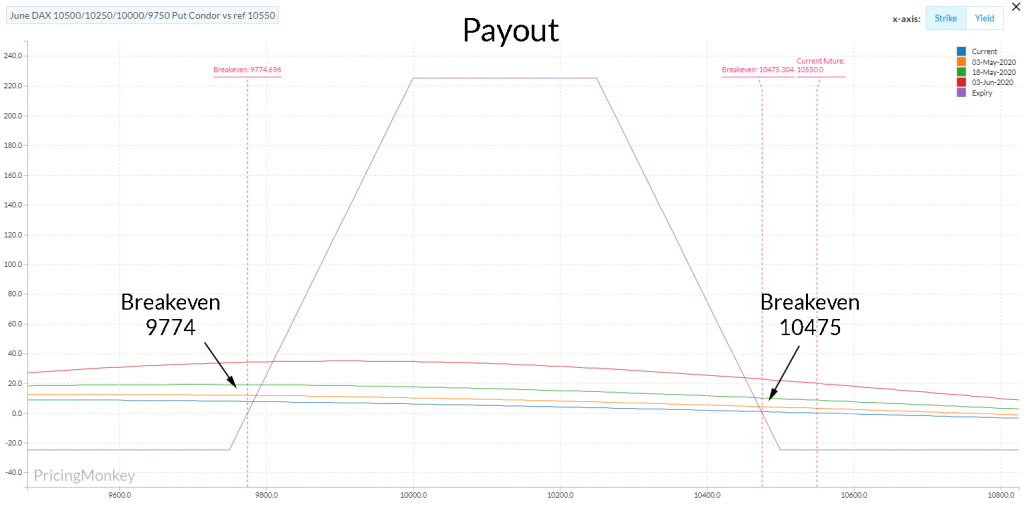

If you expect some consolidation here with a potential DAX pullback to the 10,000 area (currently trading around 10,550) check out Puts Fly and Put Condors here, trading close to multi-year lows, and well below historic backtest results.

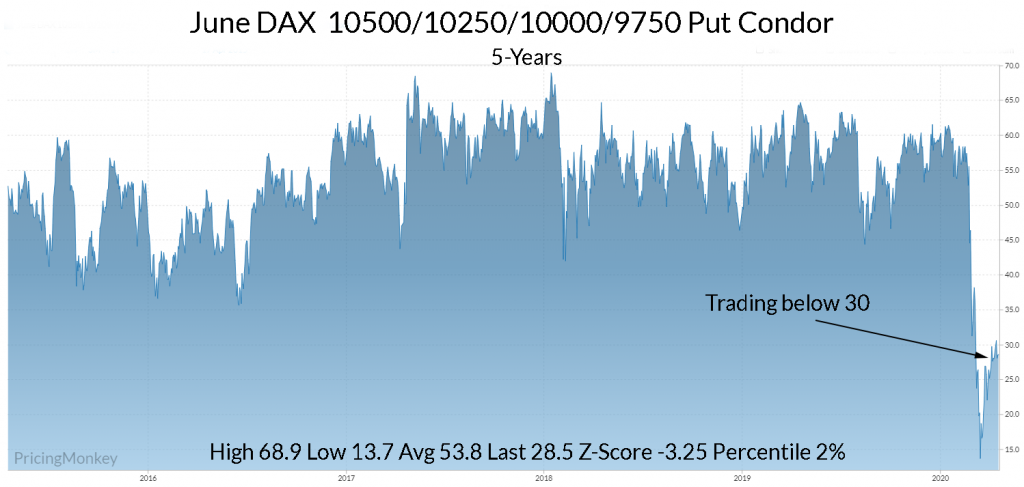

For example, look at the June DAX 10500/10250/10000/9750 Put Condor. Trading below 30 with a -3.25 Z-Score and a 2% Percentile.

Pays out 250 ticks between 10000 and 10250, breakeven between 9774 & 10475

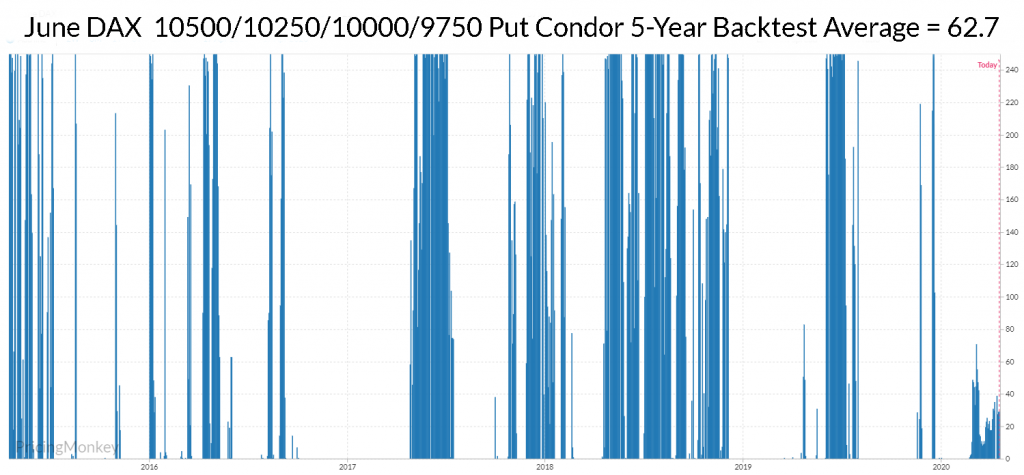

If you also Backtest it and see its historic average payout, 62.7 over 5 years, which is closer to its average price of 53.8 (first chart). It also paid out more than 30 ticks on 35% of its backtests over 5 years.