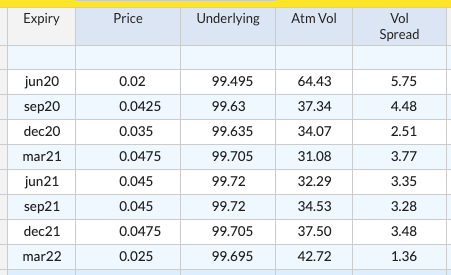

As the political dialogue switches away from managing the crisis to what-was-done-when and who-said-what-to-who, we take a look at the recent pop in the mids in 99.625 / 99.75 / 99.875 call flies in Eurodollars. Let’s start with a run:

Jun21 was lifted at 5 last week in decent size – that’s a payout ratio of 2.5 : 1 assuming you pin it exactly in just over a year’s time, and Libor has to be within 0.175% and 0.325% to cover the initial premium. Is that rich though?

Plotting the price of the same fly on the 5th contract and looking back to the time the last time the Fed was on hold you get the following (fly price in blue on left axis, underlying future in orange on the right):

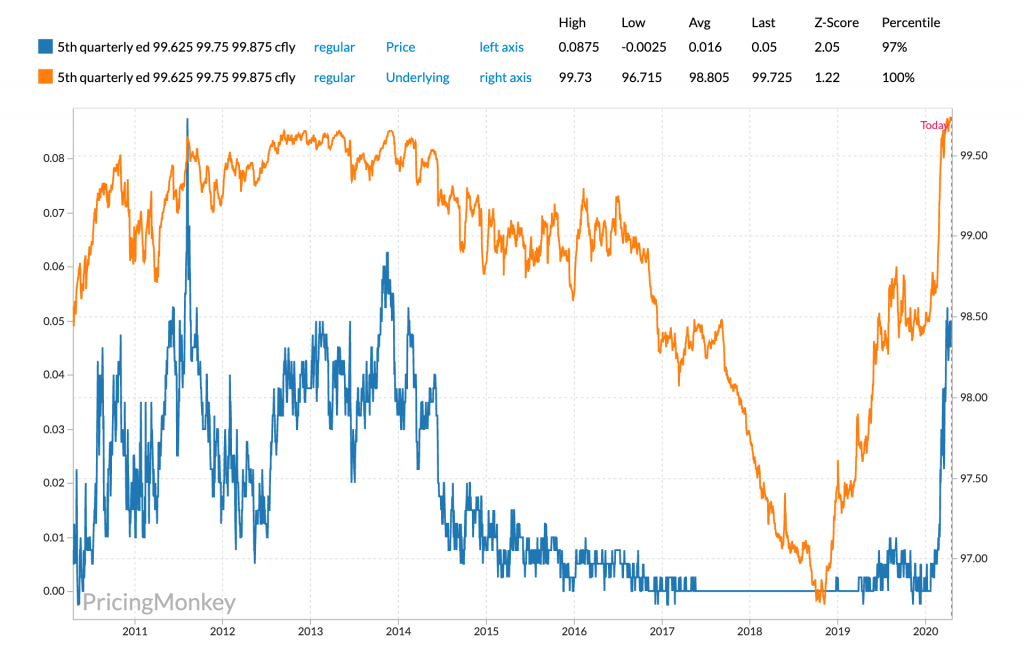

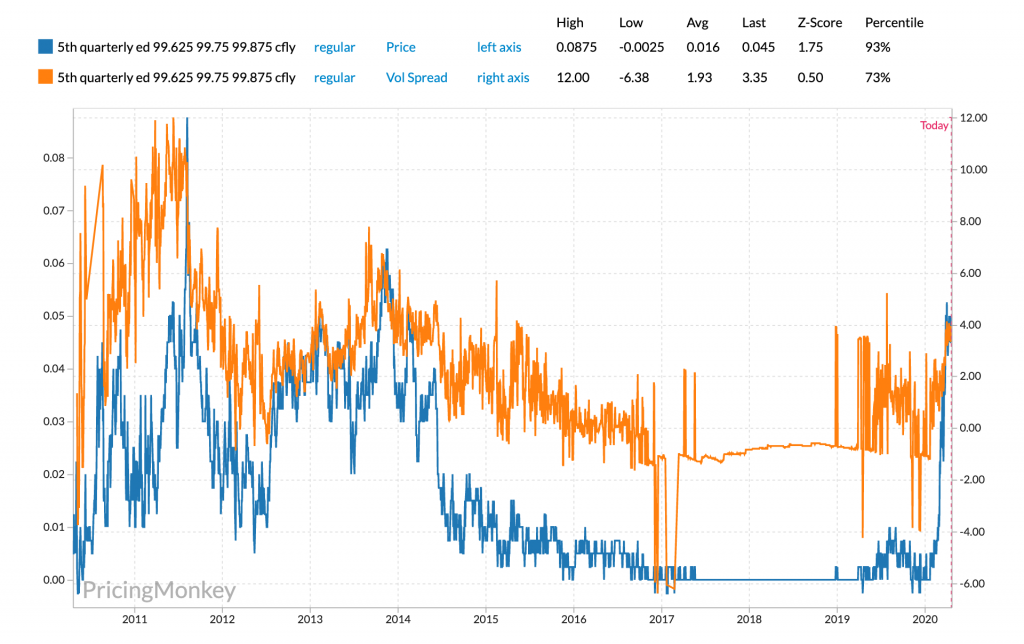

So 5 is definitely at the richer end of where things priced last time but the future is closer to the pin. What if there were some way to strip that out? Well we could look at the spread in implied vol between the wings and the belly. In the below chart the fly price is in blue on the left axis again, and the vol spread between the wings and the belly is in orange on the right. Note the vol spread is noisy when the legs are close to 0 like they were from 2017 to 2019 as rounding the price one way or another has a big impact.

Looking back at the run the previous close of 4.5 cents is 3.35bp on the vol spread, and 5 cents on the fly is 3.95bp on the vol spread. So again at the higher end of the range but nothing wild.

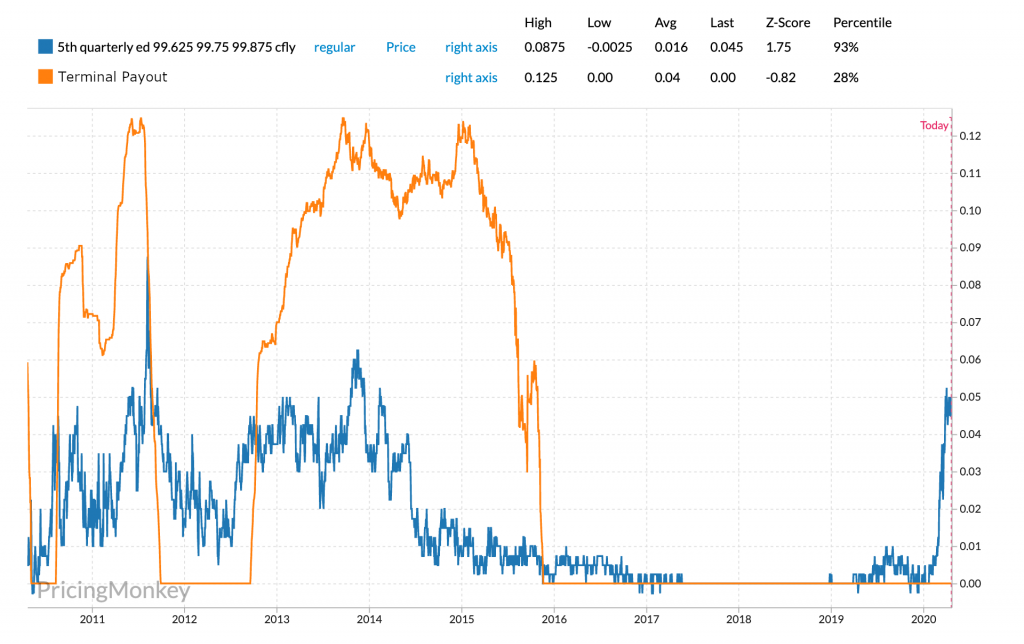

These are all comparisons to historical conditions however so the question becomes, is it more likely that we pin now than we did back then? Let’s start with how the pin went back then. In the below the fly price is in blue again, and in orange you have the terminal payout of a 99.50 / 99.625 / 99.75 call fly going out on that date. Note the fixing is spot, whereas the fly price is on something roughly a year out.

So in 2011 there was a fairly consistent run of payouts of 12 cents and the fly was closing around 5 and very briefly spiked higher in late 2011 just as the sovereign debt crisis heated up in the Eurozone. The Libor fixings ticked higher in the stress, the terminal payout went to 0 and the fly cheapened. When things came back in 2013-2015 the fly was around 4-5 while the payout was tracking around 11bps.

Perhaps the more interesting points here are that Libor took over 18 months to fall back to it’s previous level. Should it be quicker this time around and manage it in a year? Sure, but is it really obvious that this particular crisis should resolve itself quicker than the sovereign debt crisis. Another potential spanner in the works here is the fact that the end of Libor is supposedly nigh. Will the fixing be well behaved (and therefore “pinnable”) into its autumn years?

So, what’s the trade? Overall it feels like these flies are on the rich side, but not so much they are an obvious sell. When one fly is rich though, it’s neighbours are normally cheap, and for choice I would err on aiming for the fixing to go out above 0.25% rather than below it. So perhaps the Jun21 99.75 / 99.625 / 99.50 put fly which currently mids around 1.5 on screens is worth a look. Chances of pinning that seem very low, but if the fixing goes out at 0.30% in a year it’ll be worth 5.