If you expect the current near term Eurodollar spread issues (vs SOFR, T-Bills etc) to continue, then Sept Eurodollars are worth a look. Sept Eurodollars are trading on a 28 spread to Sept SOFR currently, not too far from its 2-year average of 24. June Eurodollar vs June SOFR is around 38.

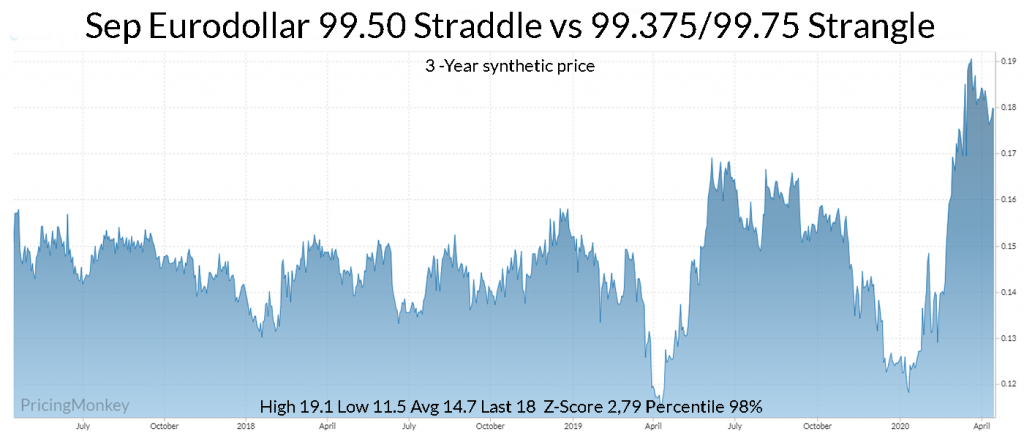

If this follows your thinking and you’re not looking for the Fed to move to negative rates anytime soon, check out the selling the Sept 99.50 Straddle (Sell) hedged with buying a 99.375 Put and a 99.75 Call (a strangle), which creates a Broken Wing Iron Fly. The out-of-the-money Calls and Puts here (the Strangle) are pretty cheap insurance. currently.

The structure priced close to 3-year highs, with 2.79 Z-Score on a 98% Percentile.

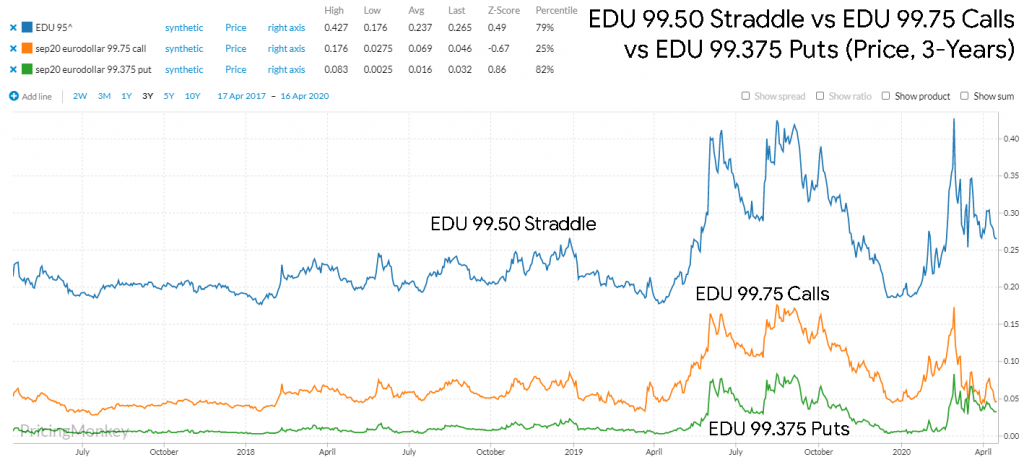

For a better understanding of why this is so high currently, plotting the Straddle vs the Wings, shows that the main driver seems to be the Strangle weakness.

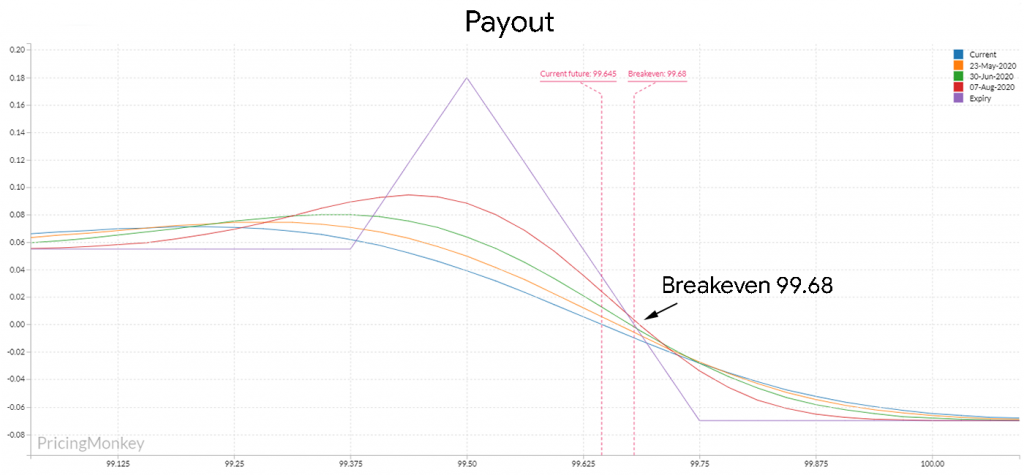

The effect of the broken wings is that it pays something on any selloff and has a capped loss of 7 above 99.75 (EDU). Max payout at 99.50, your selling premium (18), and 5.5 below 99.375

Options structures mentioned here – copy & paste if needed

EDU0 99.50 Straddle-EDU0 99.375 Puts- EDU0 99.75 Calls

EDU0 99.50 Straddle

EDU0 99.375 Puts

EDU0 99.75 Calls

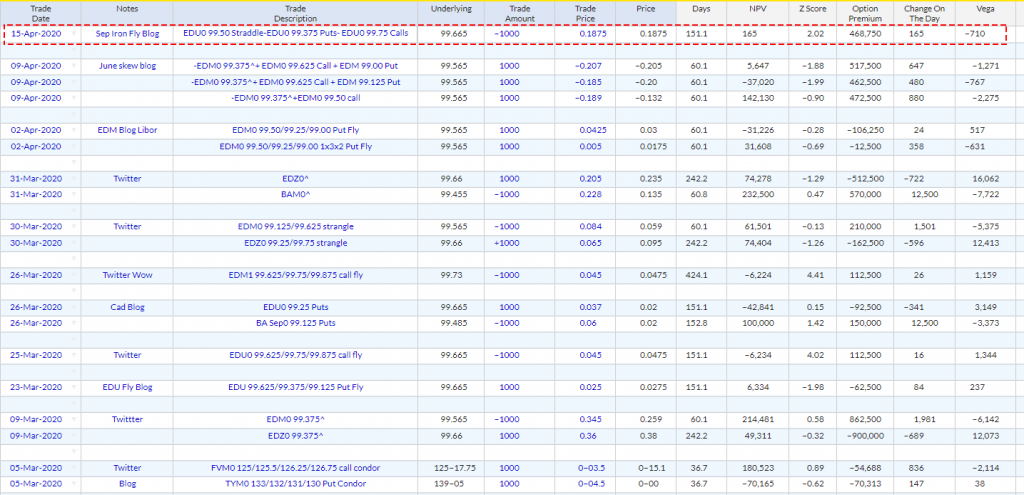

Trade booked for tracking: