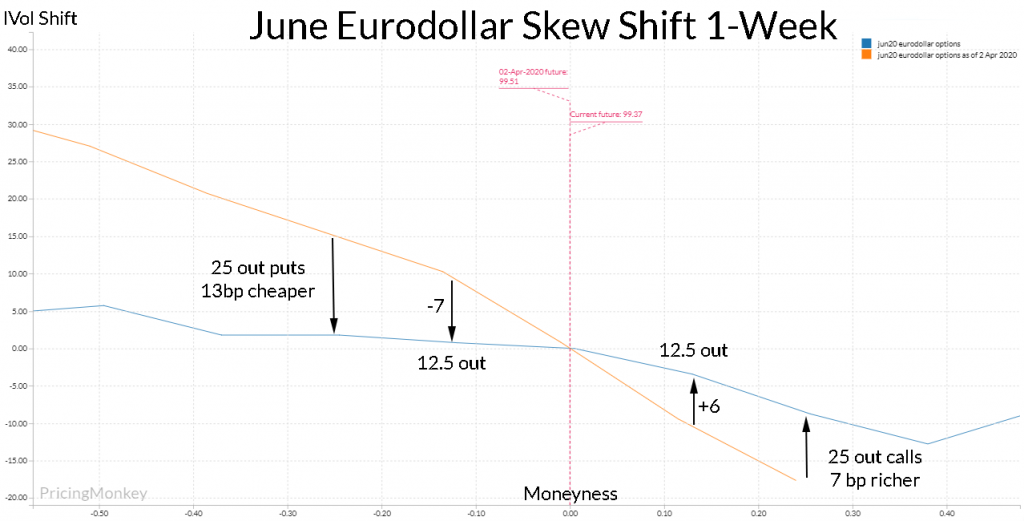

Check out the June Eurodollar skew shift this week, with the 3 Month Libor issues still very much on the radar it seems against the general market sentiment.

Impact

The main impact of this skew move will be richening any Put structures that involved selling an out the money second leg, these were cheap last week

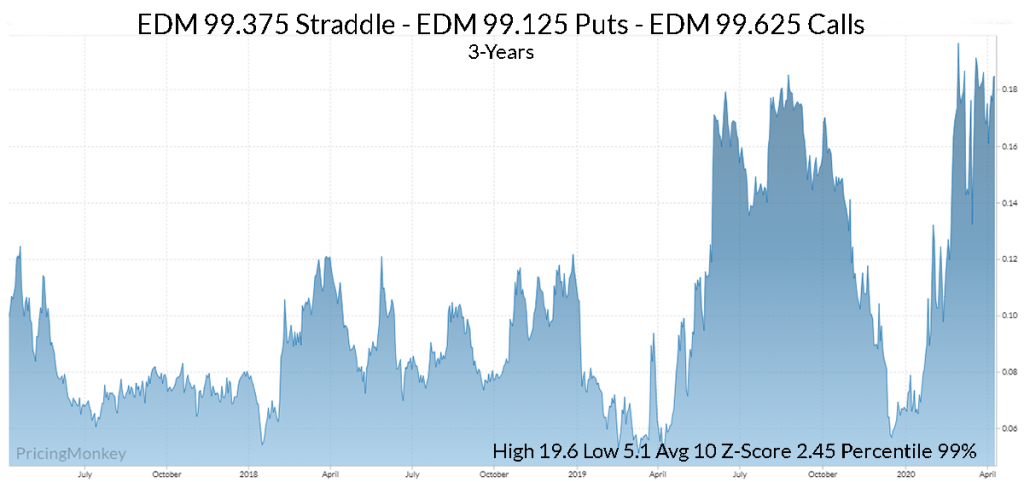

With this skew move the best trades (cheapest) to look at now will be ones that look at buying the out-the-money second leg(s). For example, look at the impact on the June 50 wide Iron Fly, at 3-year highs again.

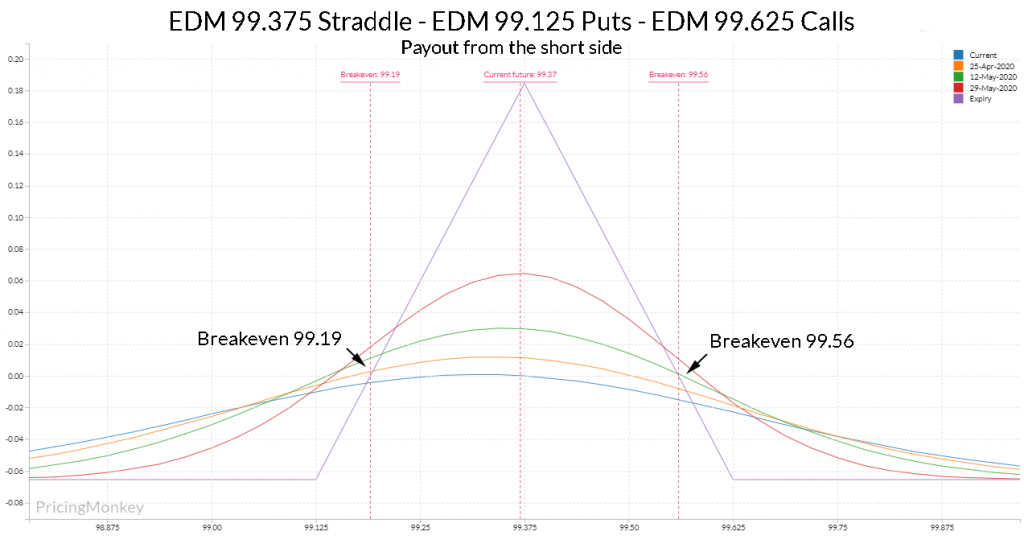

The payout for being short between 99.19/99.56

Other trades worth checking:

Short EDM 99.375 Straddle vs EDM 99.00 Puts & 99.625 Calls (deeper puts here, 37.5 out puts vs 25 out calls), also if you don’t see downside risk, the Big Lizard is also cheap here Short EDM 99.375 Straddle vs EDM 99.50 Calls. Also, check these types of trades on the May (K) expiry 37 days rather than 67 days to June expiry.

Options structures mentioned here – copy & paste if needed

-EDM0^+EDM0 62.5 Wide Strangle

-EDM0^+EDM0 50 Wide Strangle

-EDM0^+EDM0 99.50 call

With strikes:

-EDM0 99.375^+ EDM0 99.625 Call + EDM 99.00 Put

-EDM0 99.375^+ EDM0 99.625 Call + EDM 99.125 Put

-EDM0 99.375^+EDM0 99.50 call

Trades booked for tracking: