Last night we flagged the FVM 125/125.5/126.25/126.75 Call Condor trading at 3.5 ticks, with someone targeting 0.25% rates in US 5yrs this strategy looked pretty decent value. Using condors might be handy if you have a medium-term target on rates here.

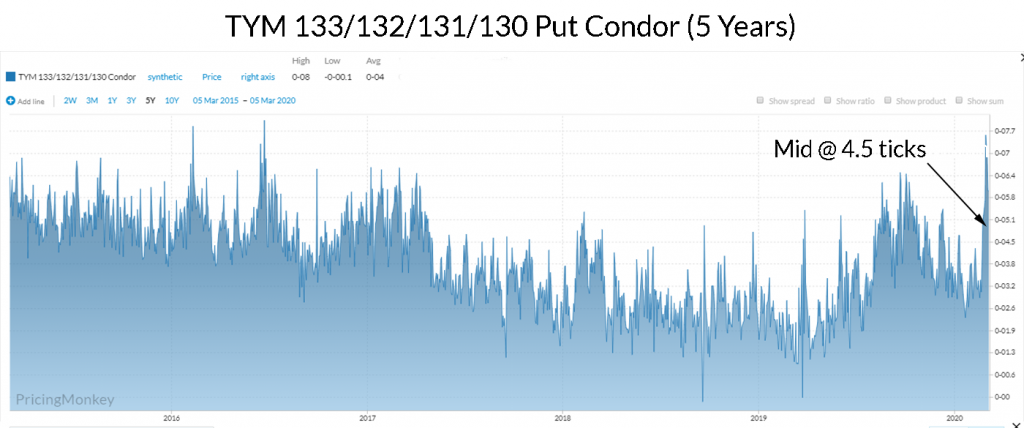

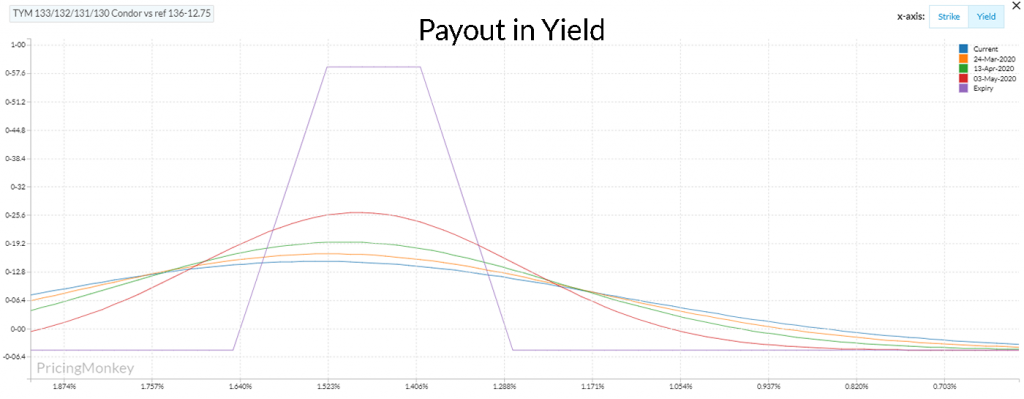

If for example, if you see a good chance that US 10yrs could revert to 1.50% yield in the next 78 days then a TYM 133/132/131/130 Put Condor should be a good play, with reasonable price and ok backtest result averages (just below its 10-year average payout).

Use the Payout switched to Yield to get an idea to potential yield targets that you’re looking for.

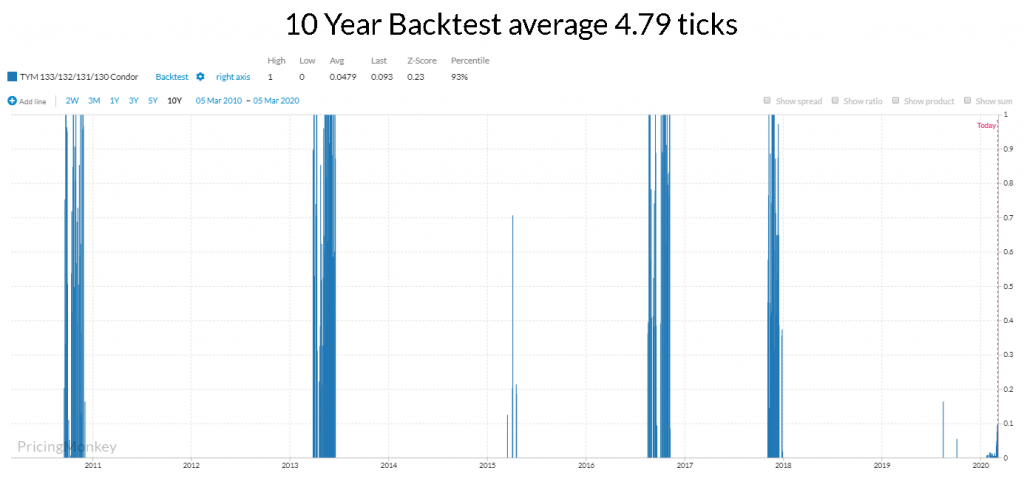

Use the backtest to establish that these sort of trades do have historic legs (ie they have paid out from time to time) and that you’re not paying too much over the historic average payout.