Seeing both the Sep and Dec 87 Straddles printing this afternoon, Sep at around 0.35 ticks and Dec at 42. If you backtest these using contingent Vol levels (between 54 to 64 here), you can get an idea of how selling these high Vol structures have performed over the last 14 years (pretty well).

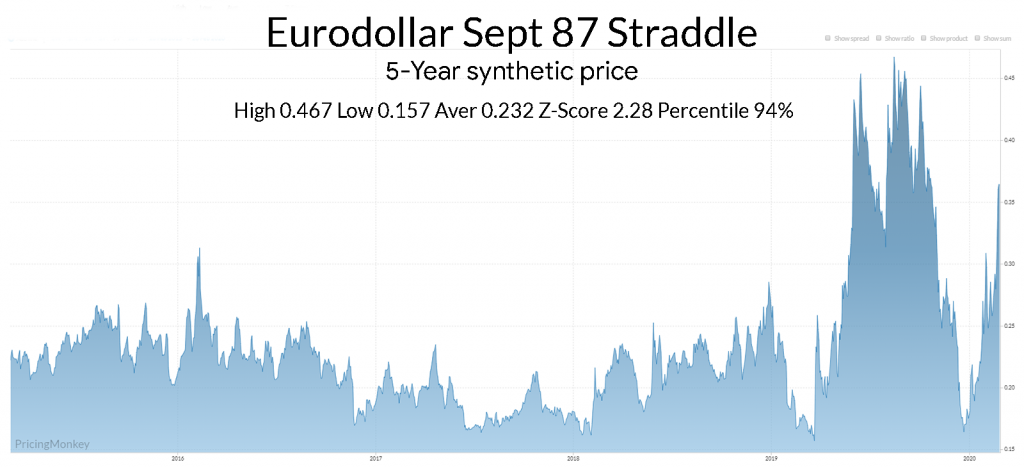

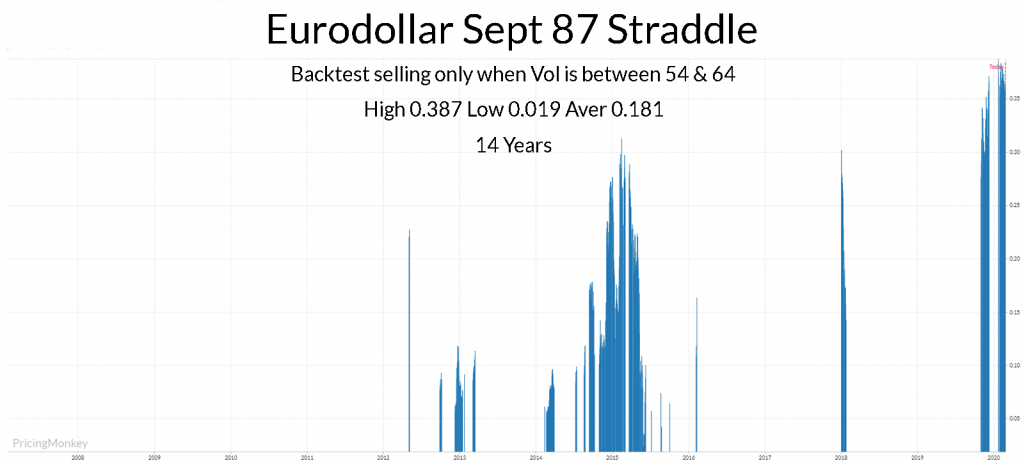

Backtested only looking at tests when the Vol was between 54 and 64 you can see that the Eurodollar 200 day forward pricing (Sep) is generally pretty good when Vol is spiked like this, with an average return on at the money straddles of just 18.1 ticks vs last trade today of 35. The worst performance of 38.7 tick is just above today price. This looks a decent Sell on these numbers.

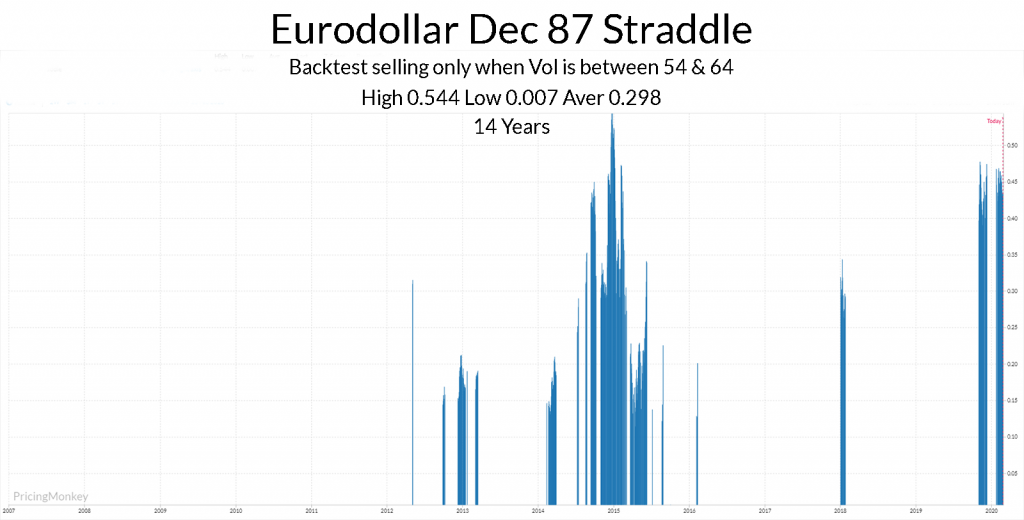

if you run the same tests on the Dec 87 straddle trading today at 42 ticks, you will see a similar result, although the average return is only 29.8 ticks versus currently trading price of 42 ticks, a sell but not as good at the Sep straddle.

Call or chat us if you want some help with using the contingent backtest function to pin down more relevant tests.

A potential variation would be to buy a Call to protect any upside move, for example, the Sep 99.00 Calls, to give a U 90 Call-U 87 Straddle option structure.

A recent list of trades flagged here and on Twitter (@G65).