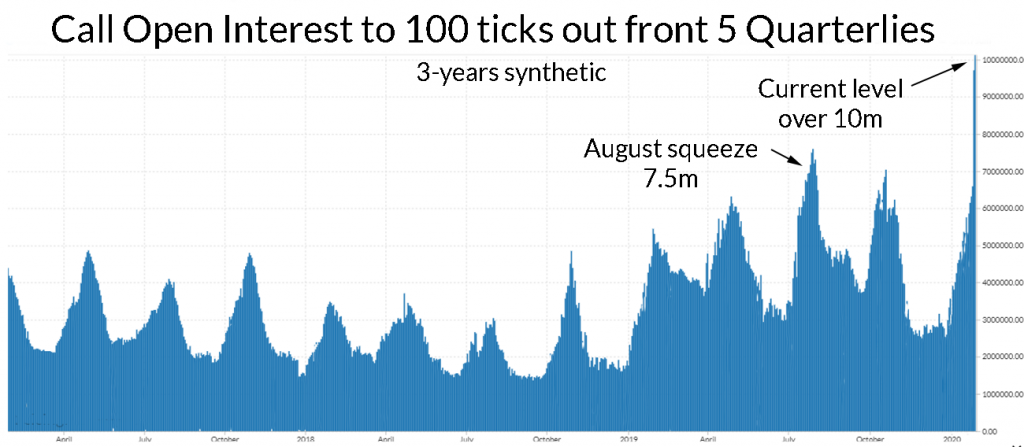

As everyone is aware we’ve seen non-stop buying of Calls and Call Structures on Eurodollars over the last 3 months which has caused the Call Open Interest to explode. Just looking at the Front 5 quarterlies here (Mar, Jun, Sep, Dec, Mar21), and focusing only on the Call strikes from At-The-Money (ATM) to 100 ticks out, we can see that Open Interest is at a 3 year high on these strikes, topping the previous high in August number by 2.5m contracts.

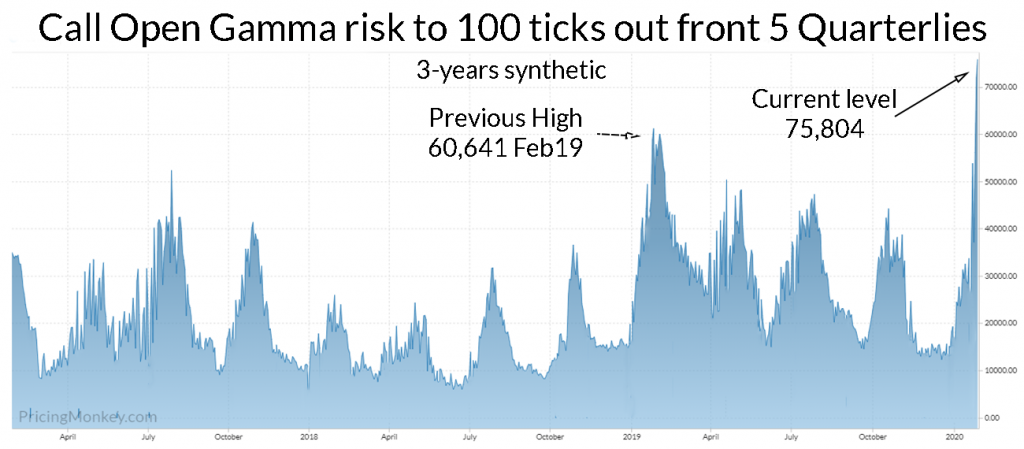

More importantly, what is the Gamma risk of this current record call open interest, which is set more by where the Open Interest expiries are and strike distances are over time.

As you can see Call Gamma is currently at a 3 year high, with over 75k of Gamma risk per tick currently, this has jumped sharply on the rally of the last couple of days.

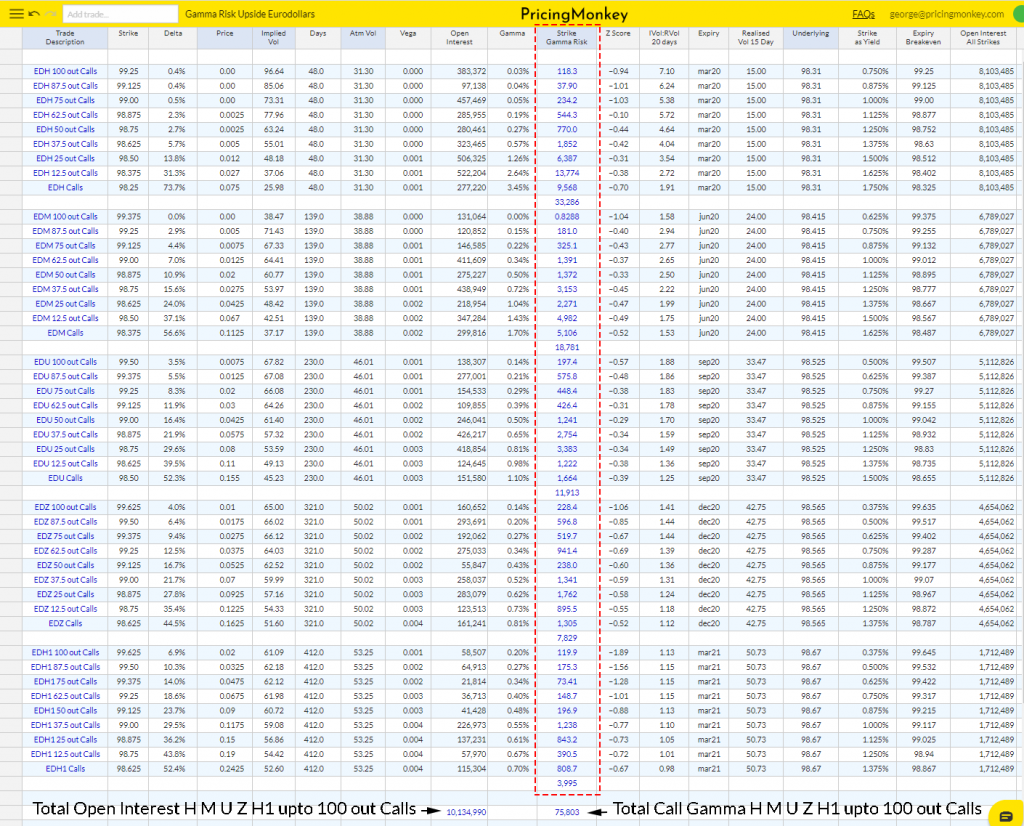

If you’re interested to see the gamma risk by strikes and expiries the table here shows a breakdown. Gamma strike risk is calculated by multiplying Open Interest by the Option Gamma.

If you’re using PricngMonkey this sort of insight is easy to create, especially useful if you’re following more volatile products such as US Bonds, BTP’s or Equity Indexes into expiries. Call us or email if you need any help in creating a similar table.