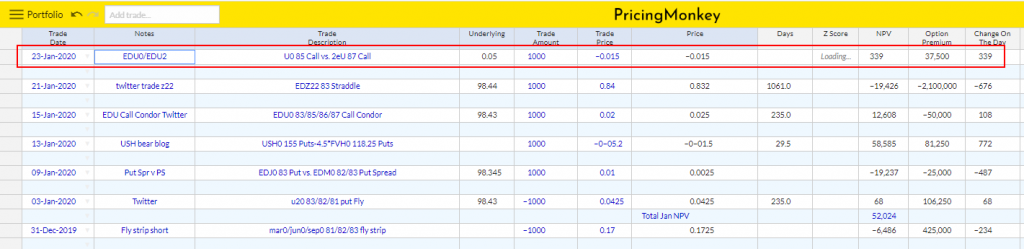

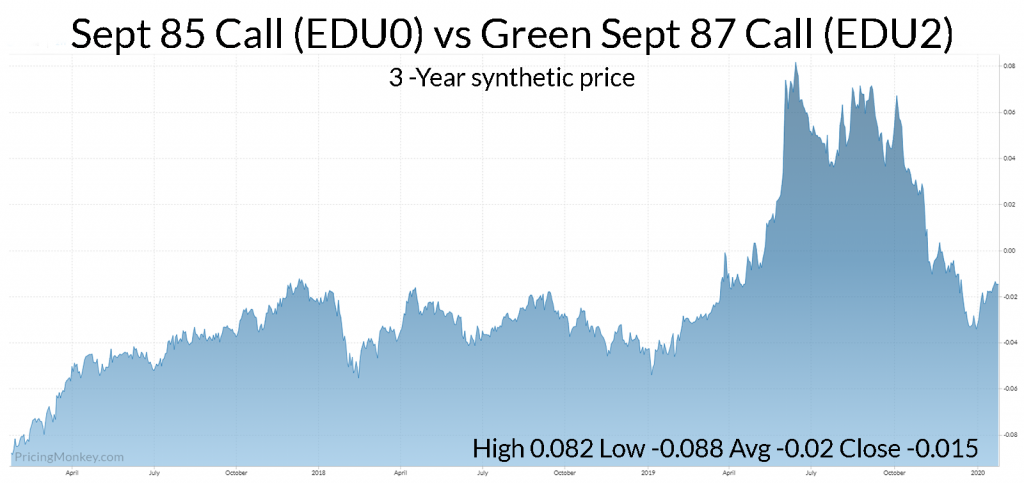

Buy Eurodollar Sept 98.50 Calls (235 days to expiry, 41.1 delta) vs Selling Green Sept 98.75 Calls (2-Year Midcurve) (232 days to expiry, -31.1 delta). This closed at -0.015.

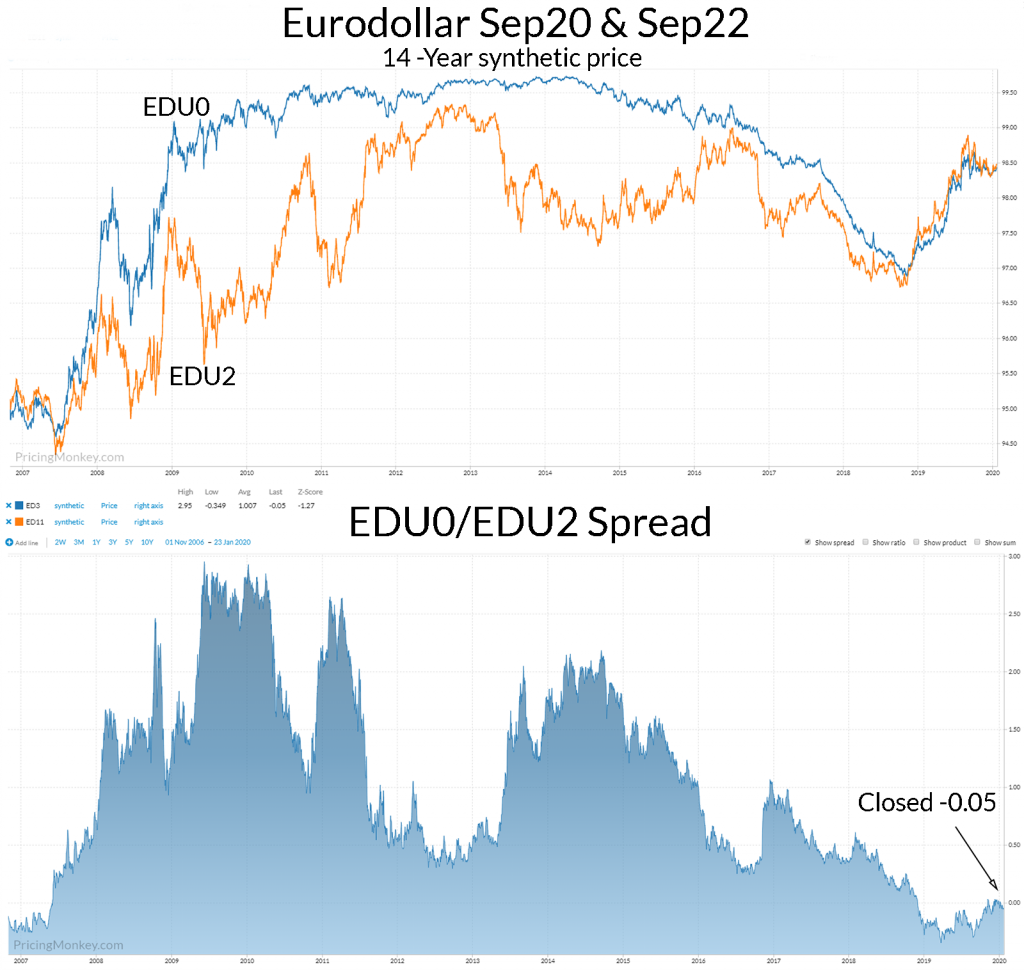

This is a trade we saw printing yesterday at -0.01 in 20k. Looks a very decent idea if you expect the EDU0/EDU2 to hold/steepen here. You can buy Sept 98.50 Calls & sell Green Sept 98.75 Calls (2-year midcurve) for a credit based on last nights closes. The underlying spread between EDU0 & EDU2 closed at -0.05 last night.

The options structure itself looks ok value (Z-Score 0.16), it’s not an RV trade, risk being that EDU22 Vol outpaces EDU20 Vol, which I think is probably unlikely after last summers Vol action.

Trade booked for tracking