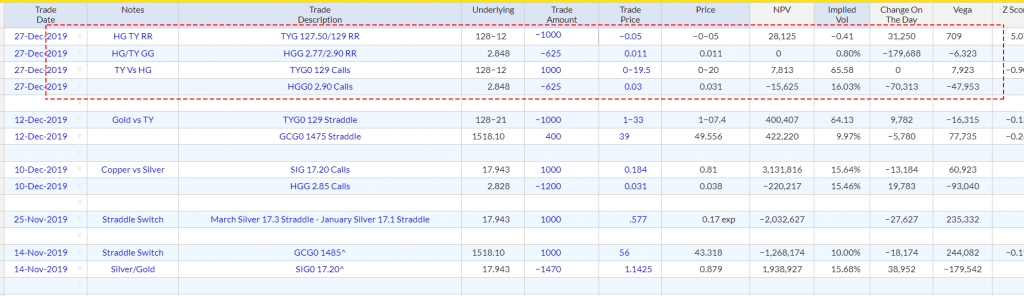

Buy TYG 129 Calls vs HGG 2.90 Calls approx. 30 Delta switch 29 & 33 days to expiry

Sell the HGG 2.77/2.90 Risk Reversal (calls over) sell the TYG 127.50/129 Risk Reversal (puts over) with approx, 29 & 33 days to expiry. Should come for a good credit depending on your weighting rations.

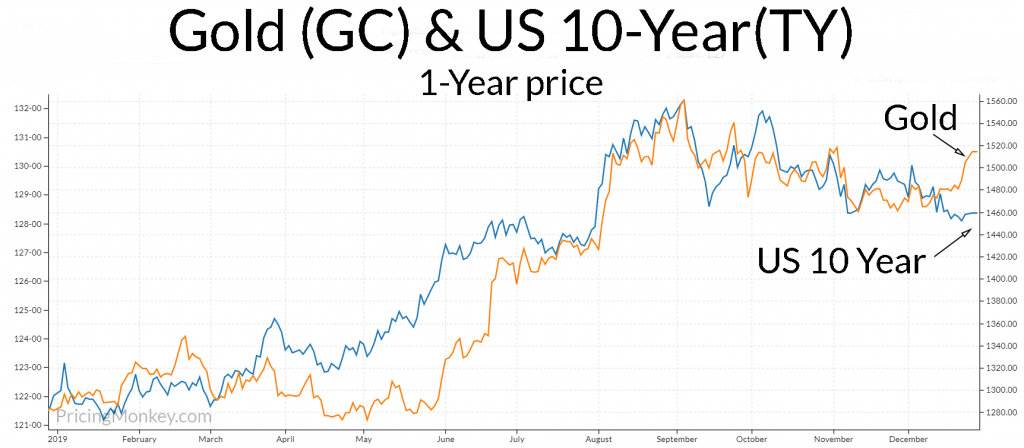

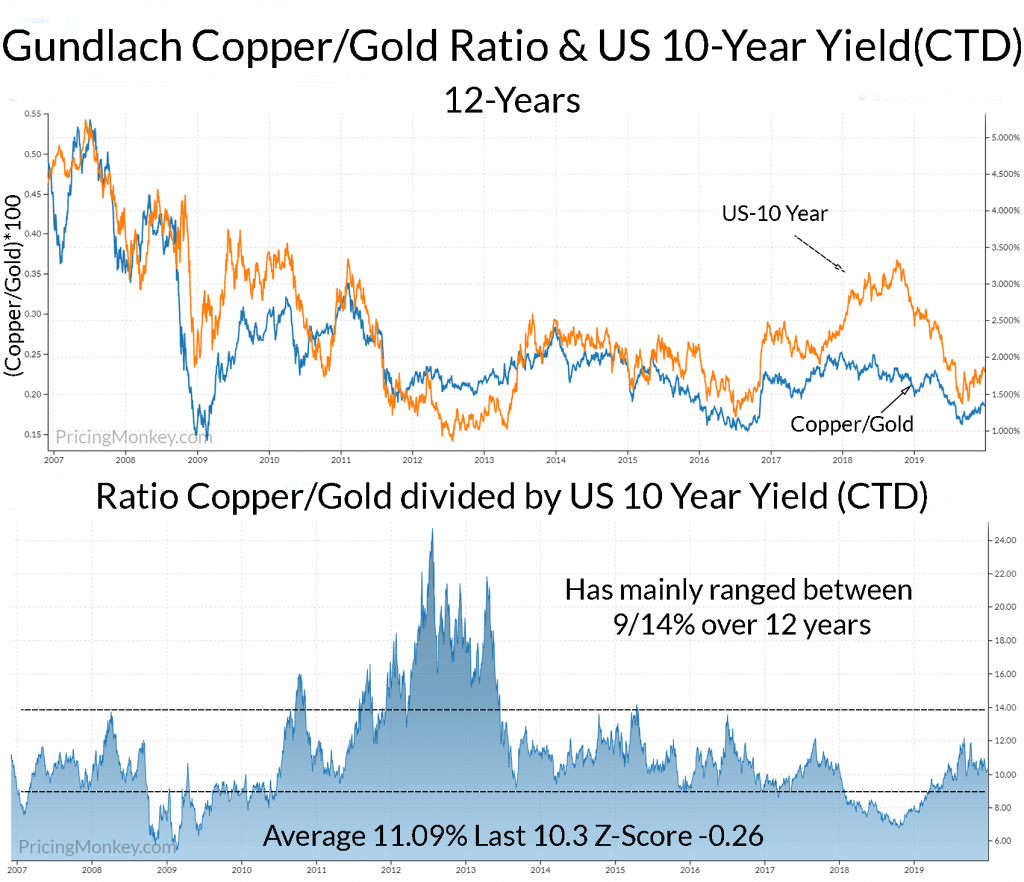

This recent sudden move up in Gold may have an interesting impact on Copper & US-10 Years if you adhere to the Gundlach finding on the historic relationship between US 10-Year yields & the Copper/Gold ratio. Interestingly at the start of December Jeffrey Gundlach was suggesting US Yields would rise as Copper outpaced Gold. Gold has totally outstripped Copper since.

Longer-term it seems that US-10 Year yield track the Copper/Gold ratio very tightly. Rising Gold relative to Copper suggests lower US Yields. Higher US Yields suggest a higher Copper vs Gold ratio.

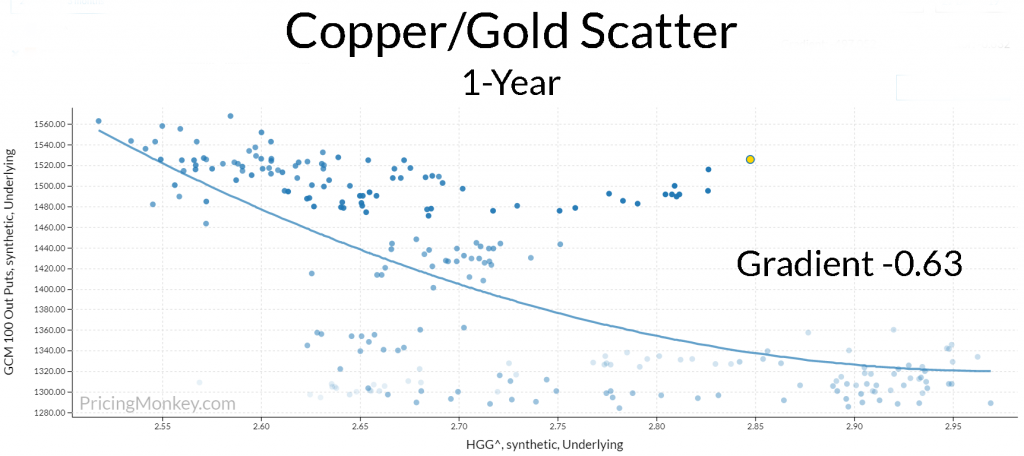

The Gold relationship with Copper recently (1-Year) has been negative, although very recently it’s been inline. The yellow dot shows the current point and recent dots.

What’s the trade here?

If you believe that Gold has another price discover excursion above here, as it has a lot of cheerleaders out there, so I expect it’ll have at least have a short term spike as these players jump on board again/leverage up. Impact being that it’ll sink the Gundlach Index (it’s the divisor), suggesting potentially weaker Copper, and lower US Yields short-term.

Buy TYG 129 Calls vs HGG 2.90 Calls both with similar 30 handle deltas.

Sell the HGG 2.77/2.90 Risk Reversal (calls over) sell the TYG 127.50/129 Risk Reversal (puts over) – so you’re buying HGG Puts vs Calls, and selling TYG Puts vs Calls, 2 different market conventions here (Metals & Rates).

We used a 1000 TY Calls vs 625 HGG Calls for our weightings here