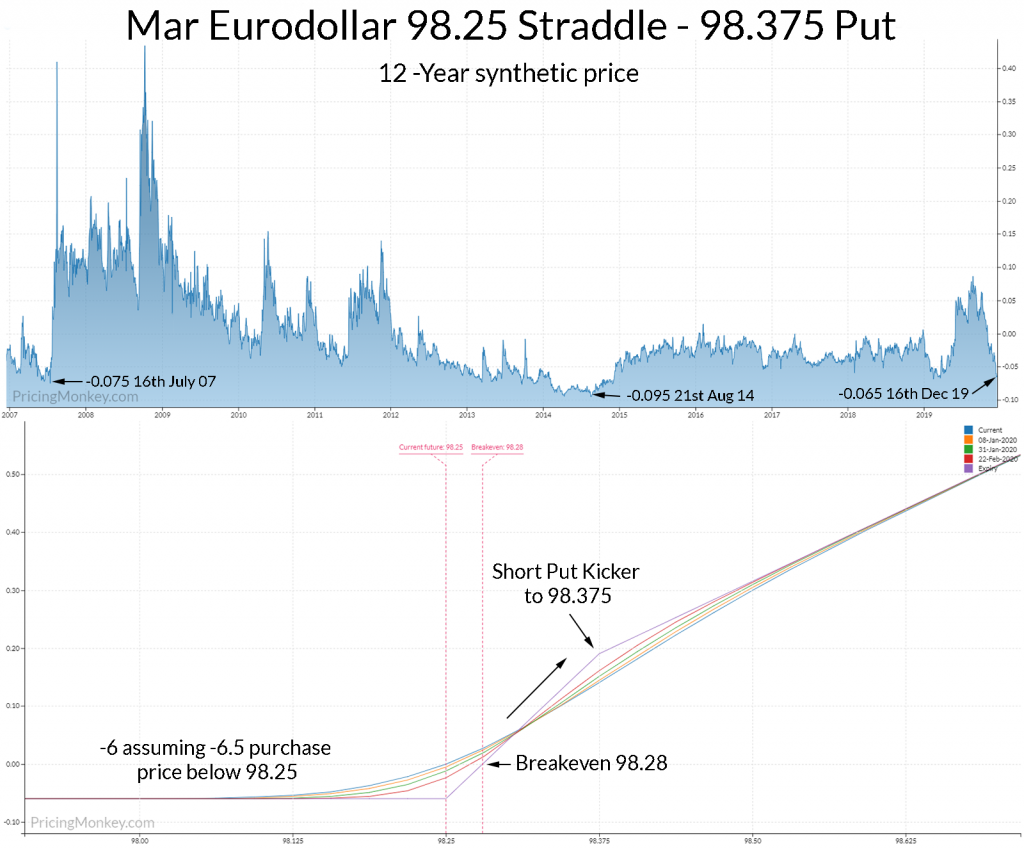

EDH 82^ vs EDH 83 Put with 90 days to expiry 80.3% Delta

If you’re looking for a cheap upside hedge/trade here, check out this trade. Its low was -0.095 back in Aug 2014, if the 98.25 straddle remains under pressure this week, this trade should come at -0.065 and maybe below.

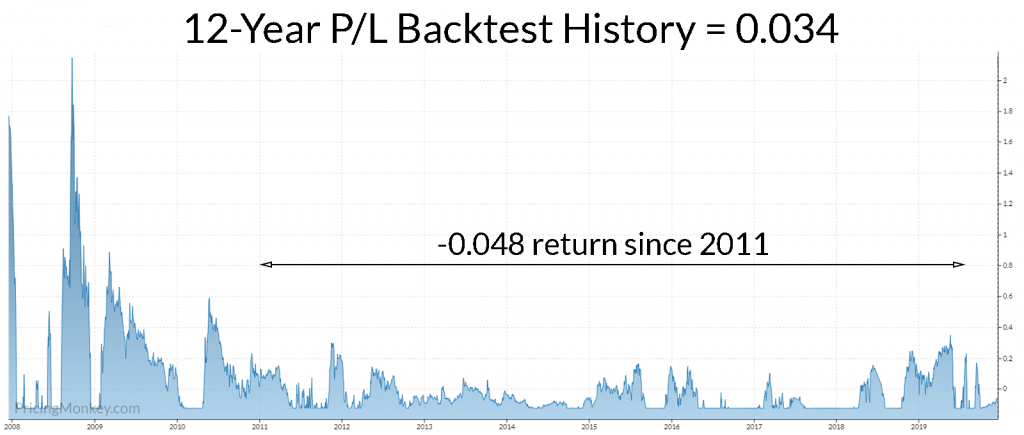

Backtest

Tested to expiry. It’s returned on average 0.034 over 12 years, but -0.048 since 2011. It’s returned more than the current premium (-0.065, ie been above breakeven at 98.28) on 47.5% of the time.

An alternative would be the EDH 98.25/98.375 Call Stupid that closed at 0.0525 last night, this has a higher breakeven 98.3025, and only pays on a single leg up towards 98.375, unlike the structure above.