Feb Bobl 134^- 0.4*Feb Bund 172^-6.2 (2.48 Trade Size)*2RF 100.25^+ 3.1*Feb Shaz 112^ Condor with 29 & 43 days to expiry

Jan0 Bund 172^-2.4*Jan0 Bobl 134^ Straddle spread with 7 days to expiry

Feb Bobl 134^-.203*Feb Bund 172^-3.25 *2RF 100.25^ with 29 & 43 days to expiry

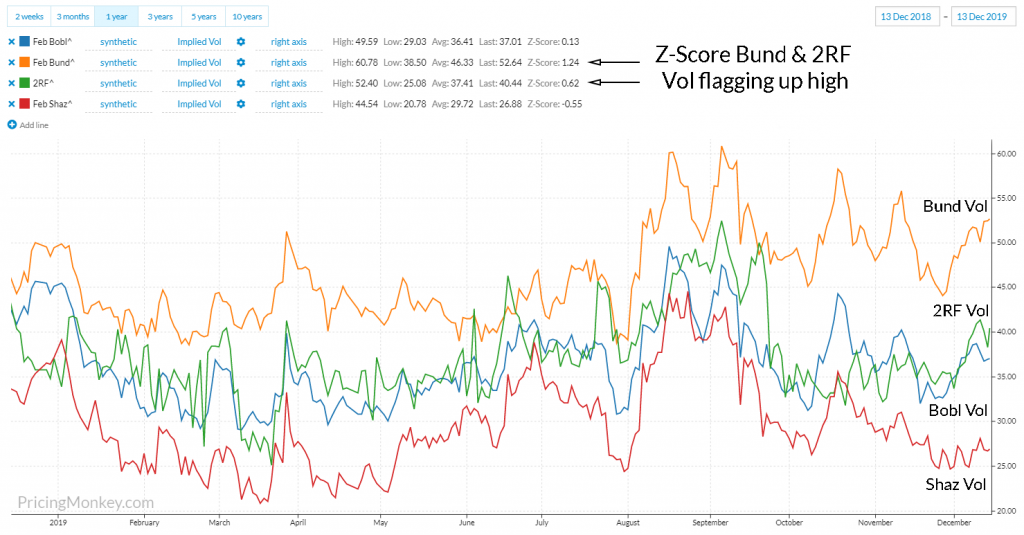

If you’re following Eurozone Implied Vols you will have seen a chart similar to this, with Schatz Vol & Bund Vol heading different directions.

Obviously, there are plenty of ways to approach and trade this anomaly (Sell Jan Bund Vol hedged with Jan Bobl Vol expiring in 7 days for example which has a good weighted credit pickup and good Delta Hedged backtest history). Too easy! Here we look at Vol Condor to keep your brokers happy for Christmas.

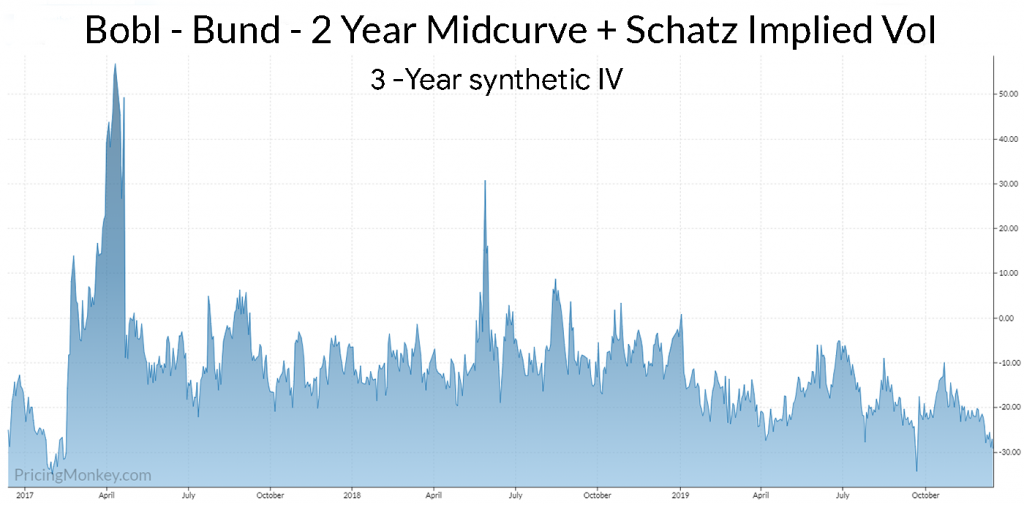

If you plot the combined Implied Vol of Bobl – Bund – 2 Year Midcurve + Schatz you will get a chart looks like this:

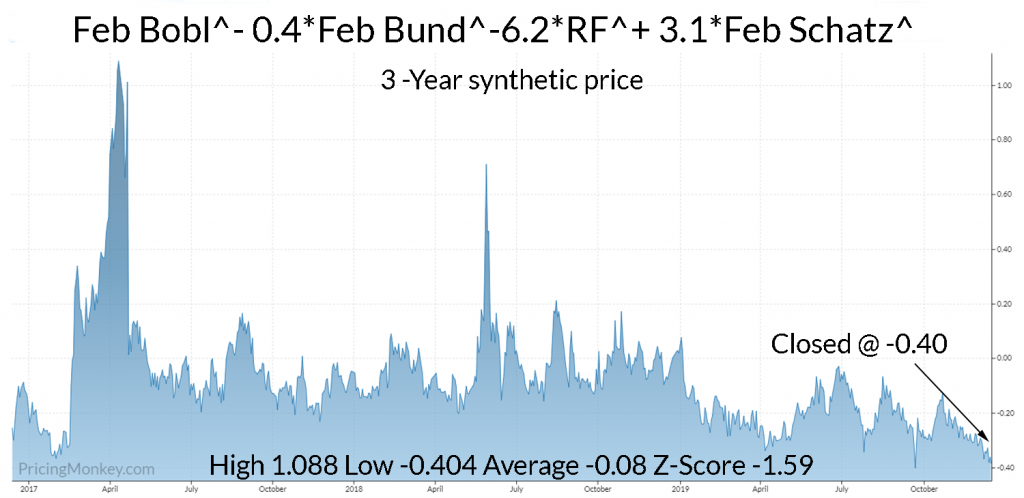

This can easily be changed into a combined Price structure using Vega weightings. Here an equivalent structure is Feb Bobl^- 0.4*Feb Bund^-6.2*2RF^+ 3.1*Feb Shaz^. If you plot this structure you will see that it’s very similar to the Implied Vol chart above.

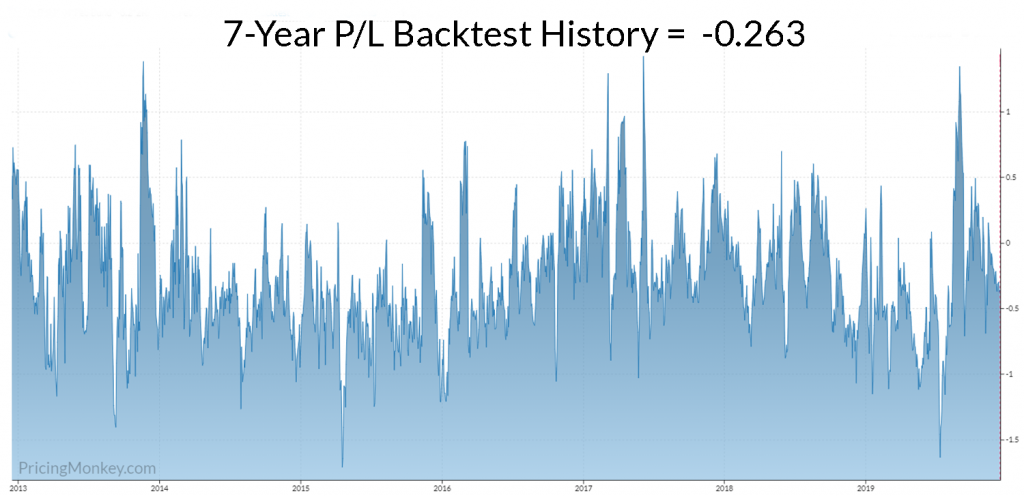

Once you have the CIX you can then Backtest the structure to see how it’s delivered. It’s returned -0.263 on average over the last 7 years. 20 cents (bobl ticks) more than last night closing price.

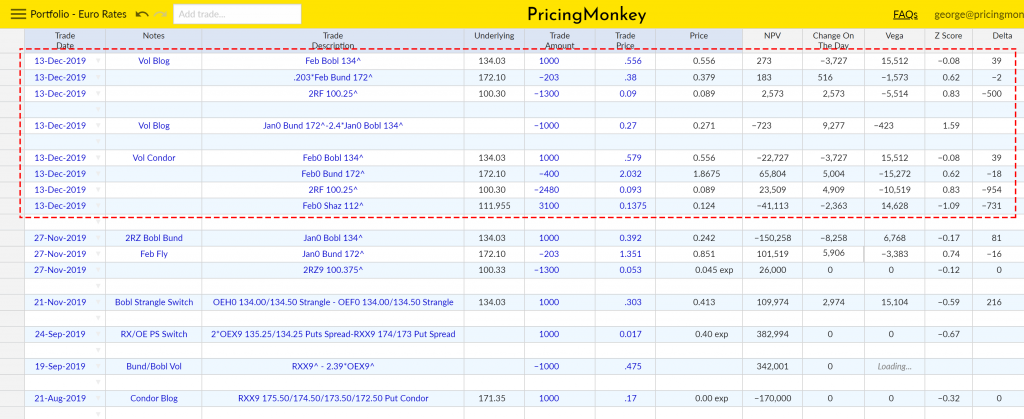

Trade booked with Trade weightings (Euribor needs to be tick adjusted).

Other similar trade ideas to check

The Feb Bobl^-.203*Feb Bund^-3.25 *2RF^ structure that we looked at recently, this is priced around -0.11 and has a Delta Hedged Backtest value of 0.02.

The Jan Bund vs Bobl Straddle spread Jan0 Bund 172^-2.4*Jan0 Bobl 134^ as mentioned above, is priced around 27 above it Delta Hedged backtest value, of 12, so a good potential sell with just 7 days to go. Interestingly the Jan Bund Straddle at around 85 has a Delta Hedged backtest value of 77, just 8 tick beneath its current price, probably not a good value sell.