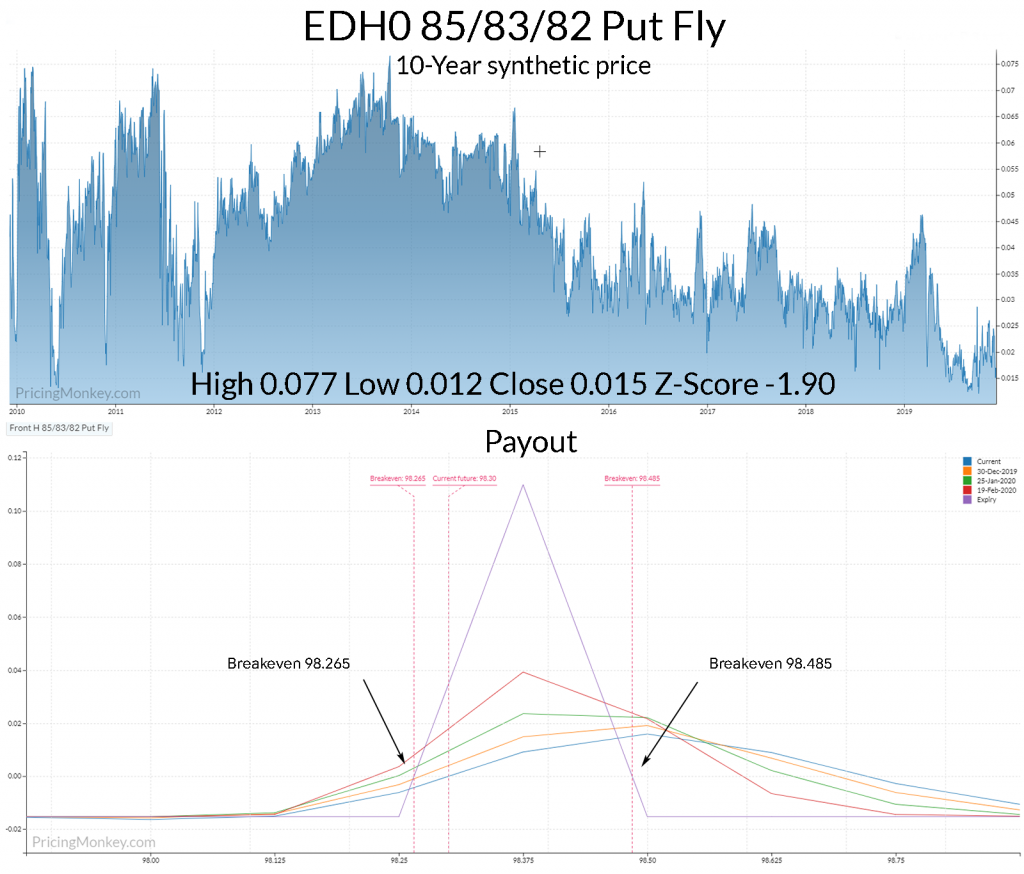

March Eurodollar 85/83/82 Put Fly with 101 days to expiry (Buy)

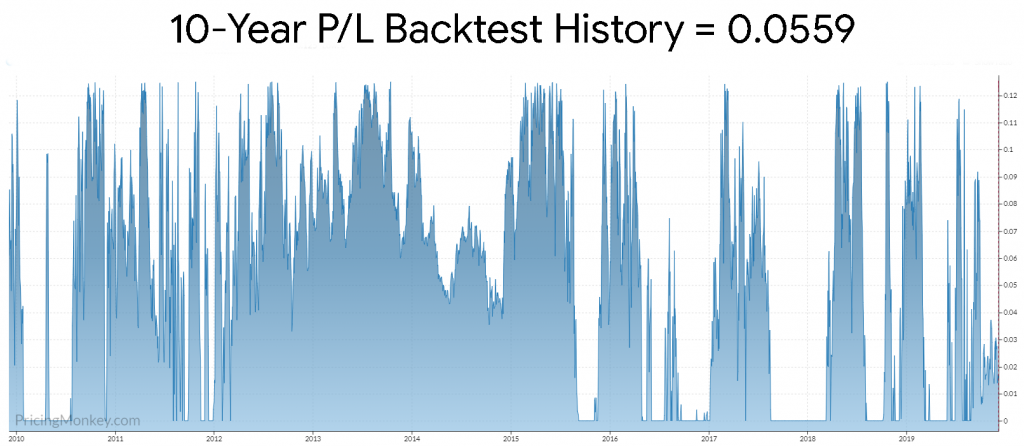

Just spotted this trade going through @ 0.0175. Closed at 0.015 last night vs Futures @ 98.30. It’s trading close to 10-Year lows at 0.012 (Z-Score -1.90). It sounds a long shot, but it has a 10-Year backtest average value of 0.0559. (This is not one for strike pinners, as they will be totally focused on the EDH0 83/82/81 Fly that closed at 0.06).

The Backtesting chart over 10-Years shows the potential of this trade. A quick also shows the trade as a reasonable risk, handling ±20 tick underlying, date moves and ± 10 Vol shifts well. In 35 different scenarios, 10 end up out of the money.

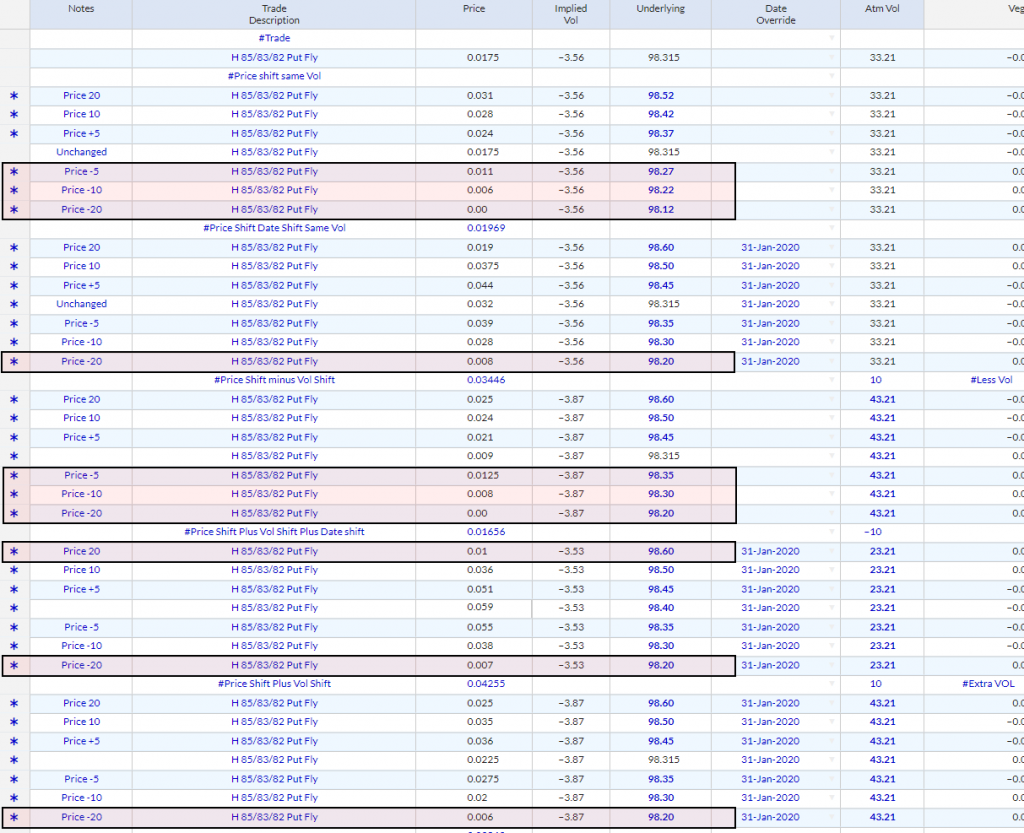

A quick scenario analysis also shows the trade as a reasonable risk, handling ±20 tick underlying, date moves and ± 10 Vol shifts well. In 35 different scenarios, 10 end up out of the money.

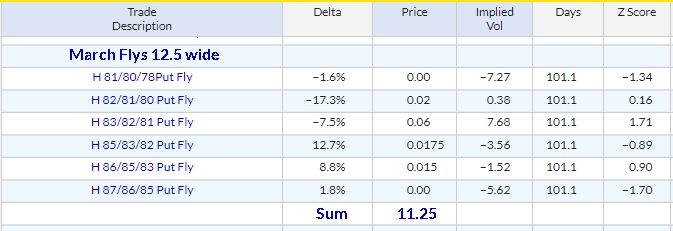

Another consideration with same width Flys is that should all add up to the Max Payout (12.5 here) across the payout range. Here they add up to 11.25 over a 97.825 to 98.75 range, the missing 0.75 probably being explained by the tail risk outside this area. This is a key area to monitor if you focus on Fly trading/monitoring.

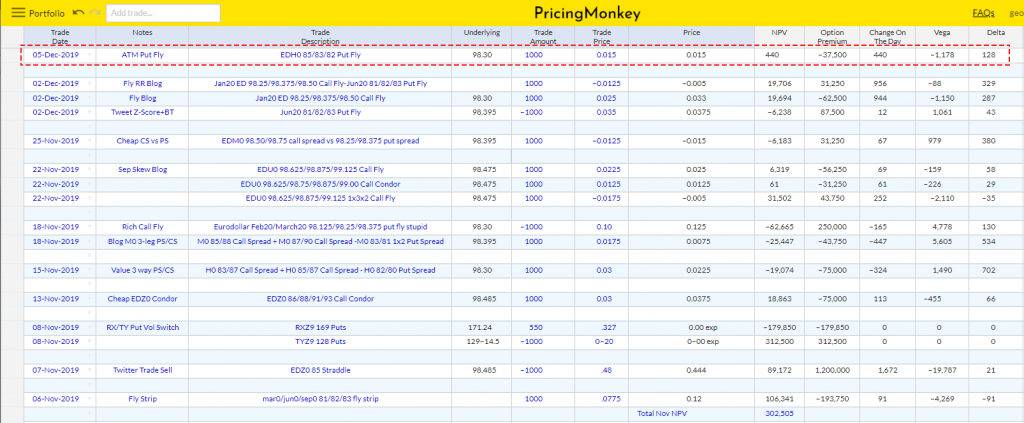

Trades that we’re following currently.