Eurodollar Feb/March 98.125/98.25/98.375 put fly stupid with 87 & 118 days to expiry

This trade printed 10 in 15k yesterday, not bad for a trade that can only payout 25 if both Feb & Mar expiry settle bang on 98.25. Looks a long shot on paper.

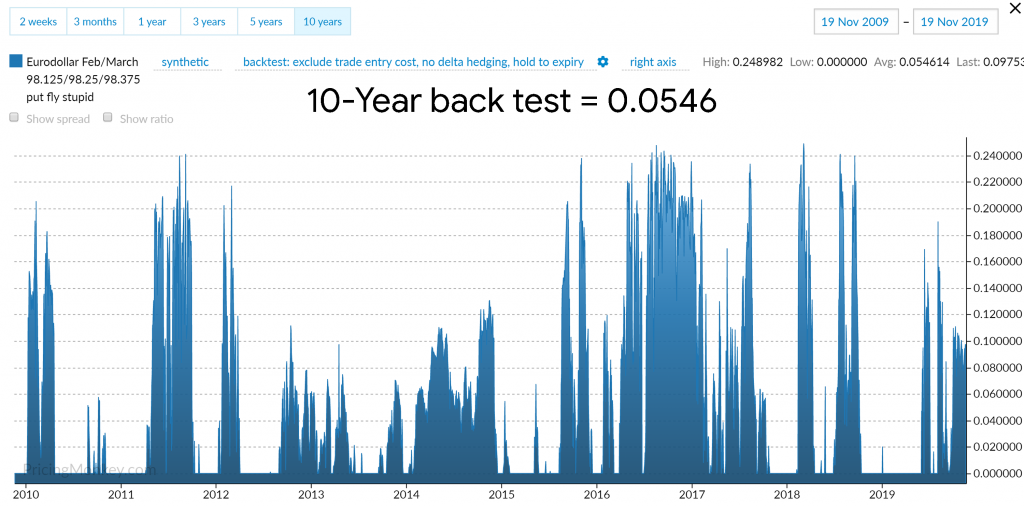

One of the best ways to assess this trade is to look at its historic success, same trade (synthetic) with same days to expiry & same moneyness over a long period, hedged (delta) & unhedged. What does this trade pay? With no Delta Hedging its paid out 0.0546.

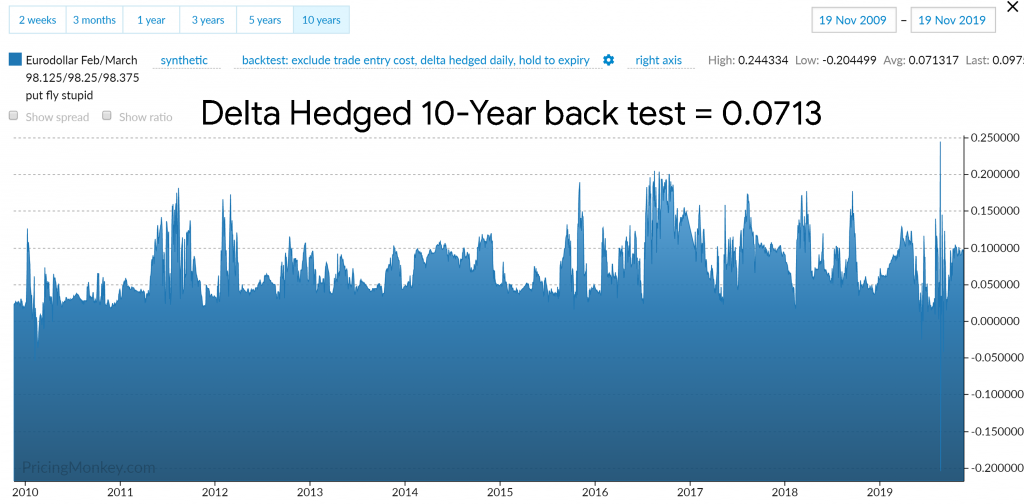

With Delta Hedging it does slightly better @ 0.0713 (assumes daily hedge using settlement price)