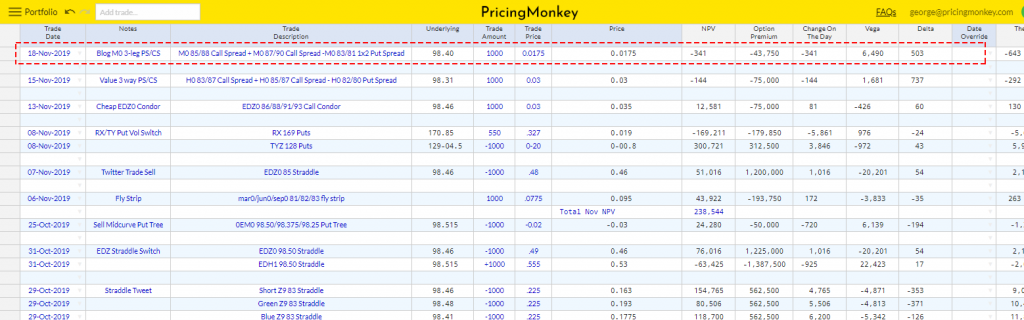

EDM 85/88 Call Spread + EDM 87/90 Call Spread -EDM 83/81 1×2 Put Spread with 210 days to expiry 70.4% Delta

This is a variation on a trade we looked at late Friday, but uses 1×2 Put Spreads to finance a very bullish upside structure (in June here). Provides a hedge for any inflation talk that seems to be increasingly creeping into conversions + sits nicely at the start of the election debate next year. Should trade around 0 on a move down to 98.36.

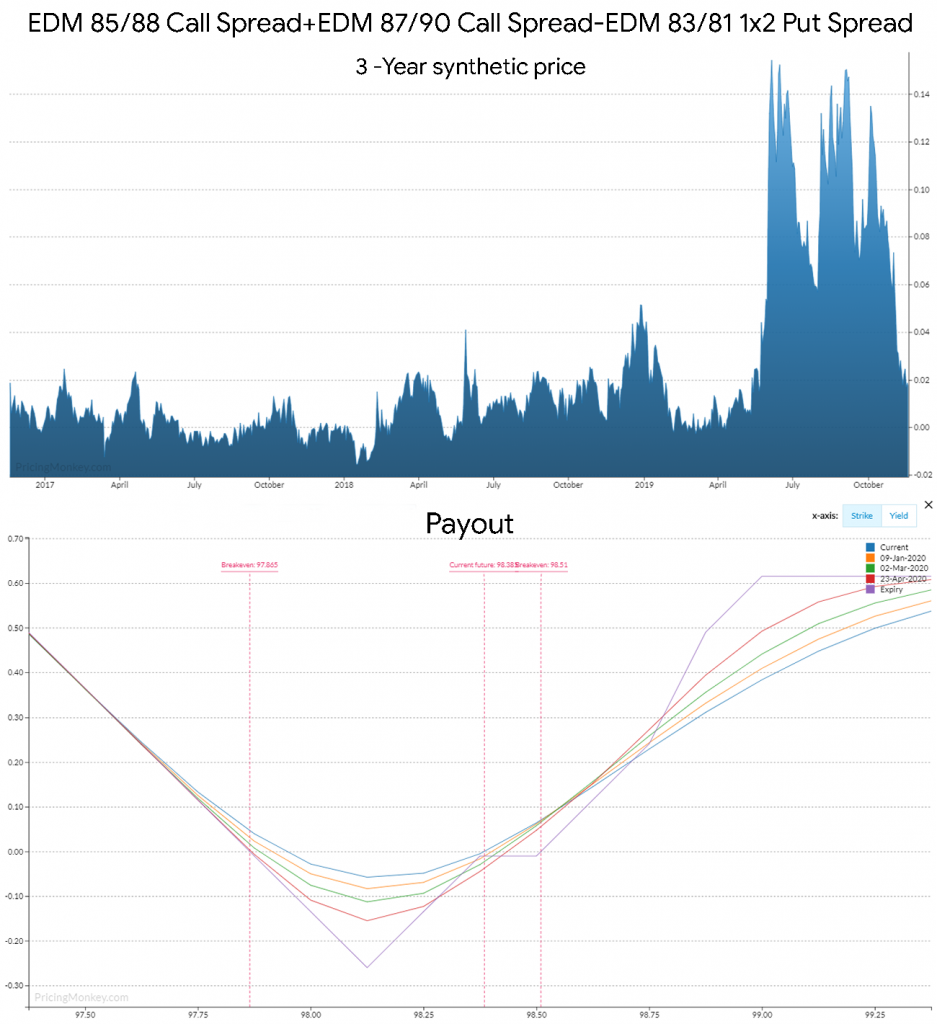

Looking at all the strikes versus the Skew profile shows a pretty good RV fit.

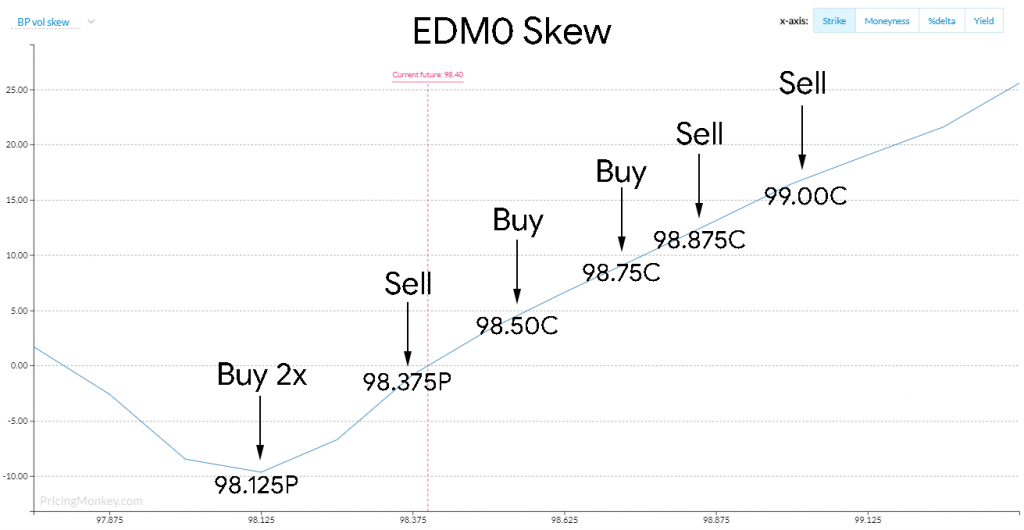

Risk & Return

Back testing shows a gross return of 14.1 ticks over 10 years. A quick stress test using a few overrides on Data & Vol also show the trade to be pretty robust. Also a rough VAR test, here best & worse overnight result over 3 years looks good, with a low of -0.048 and high of 0.091.

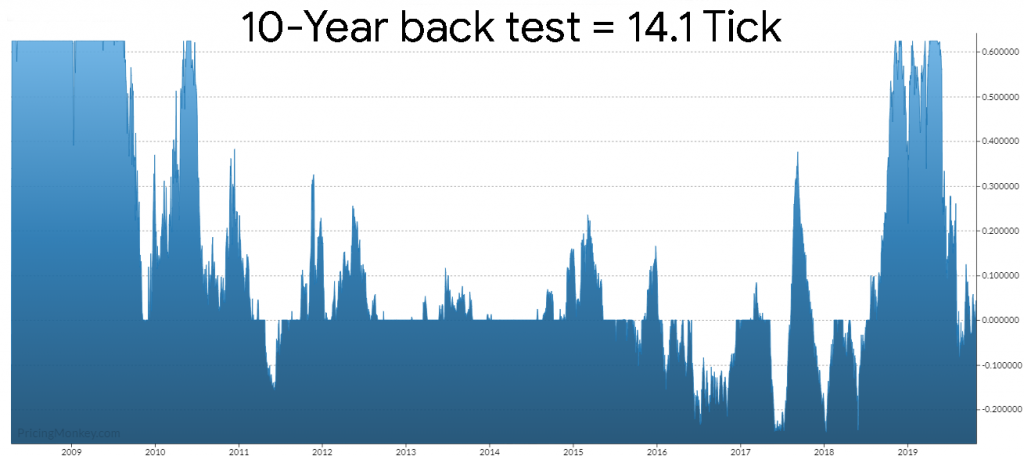

Trade booked for tracking