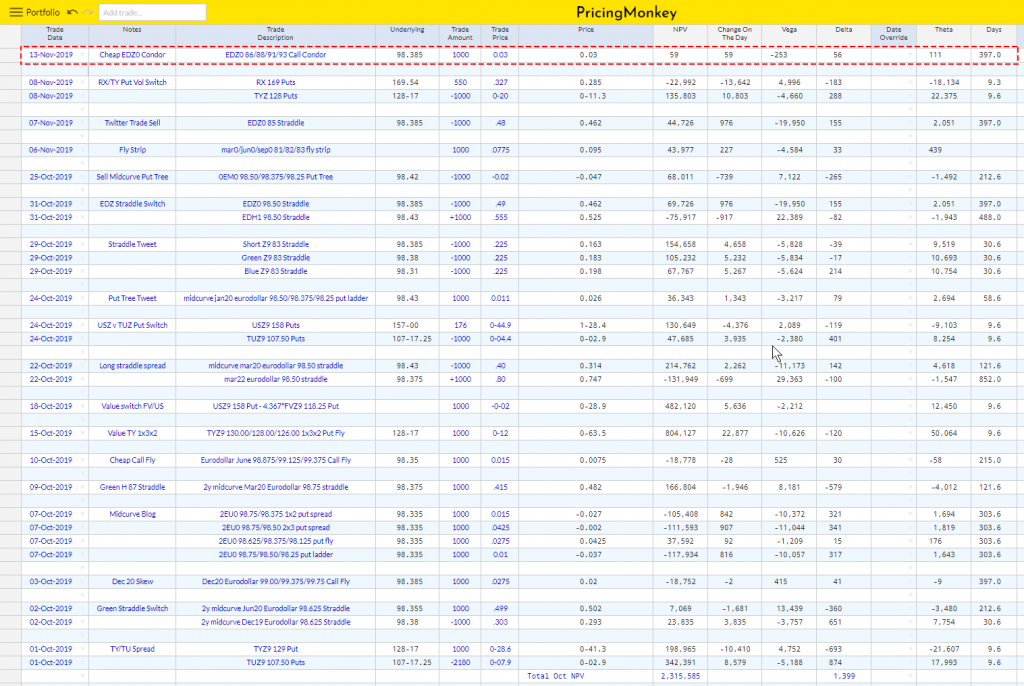

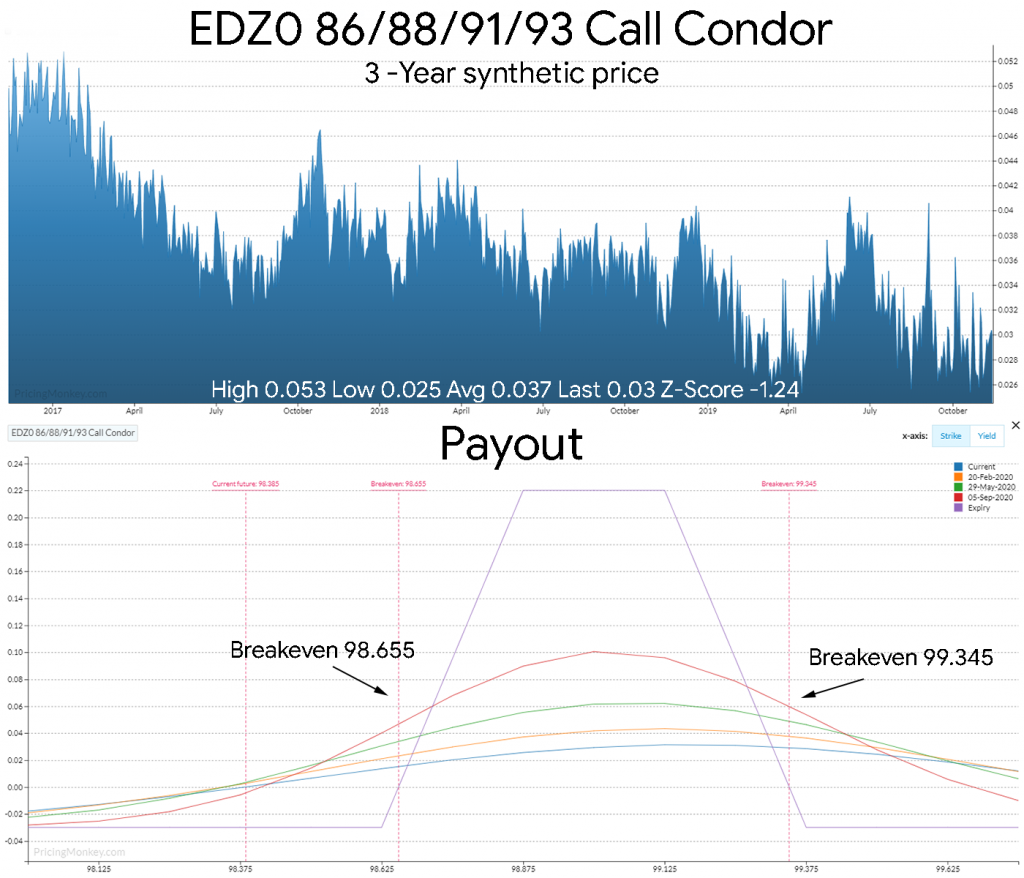

EDZ0 86/88/91/93 Call Condor with 397 days to expiry, 5.6% Delta

Steady but size buying of Sept20 & Dec20 Call Spreads over the last couple of sessions, with yesterday the EDZ0 98.75/99.25 call spread trading 7 in 20k. If these sort of trades appeal ( ie trades targeting the 99 strike and above into end of next year), check out the EDZ0 86/88/91/93 Call Condor which looks very good value.

Trading close to 3-year lows which seems to be caused by the elevated Vol levels in the 99.00 centered strikes (the Sell strikes in this Condor). Early payout profiles also look decent (Green, Orange, Blue lines on lower chart).

Risk + Historic Payout

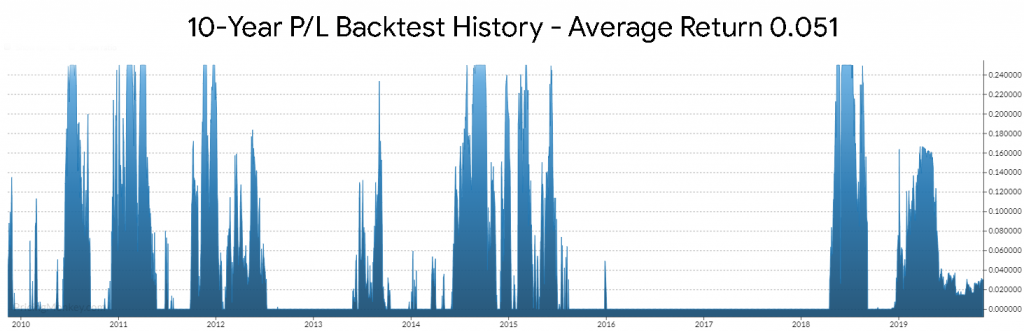

Its paid out an average of 0.051 ticks, so it’s trading below is long term payout average, interestingly the EDZ0 98.75/99.25 call spread mentioned at the start only has a 0.055 tick payout using the same test, i.e. its trading above its 10 year payout average.

Trade booked for tracking