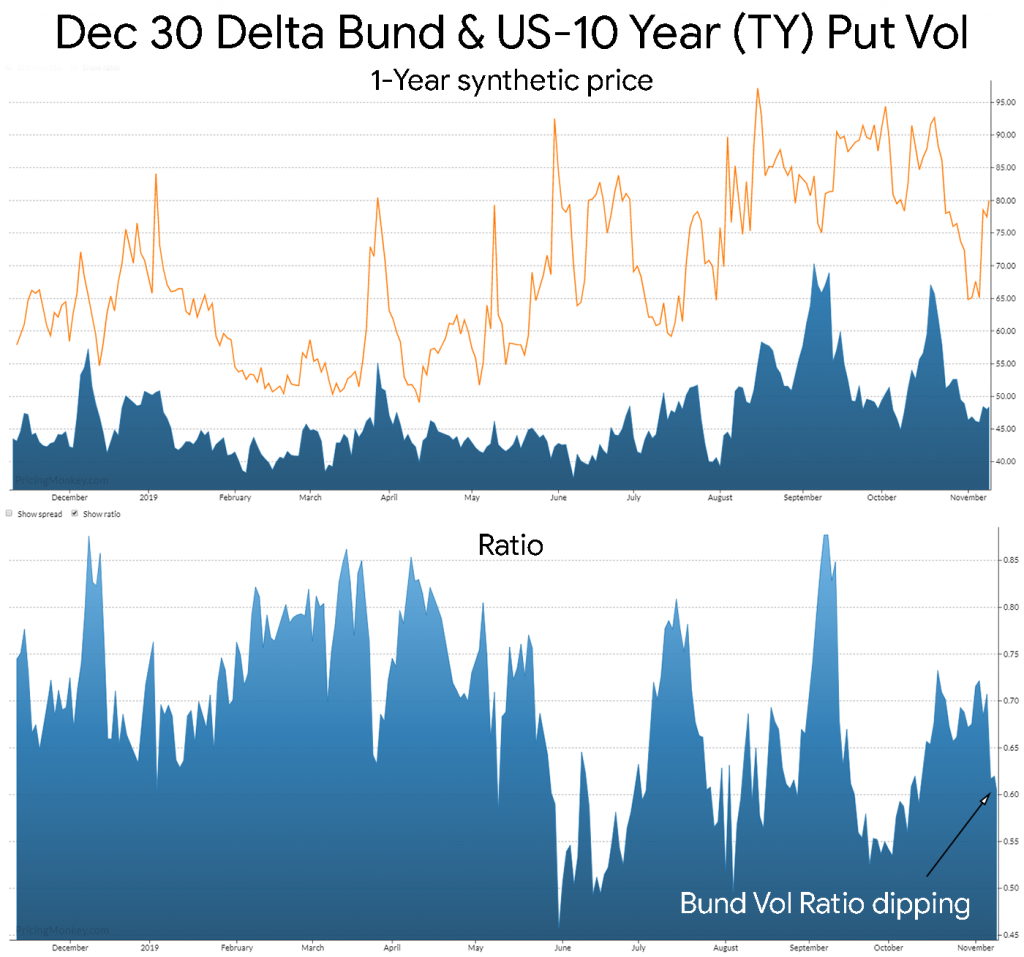

RXZ 169 Puts vs TYZ 128 Puts with 14 days to expiry

If you expect US-10 Year yield to hold here at 2% for the next 2-weeks , look to Sell the Dec 128 Puts and Buy the unsupported Dec Bund 169 Puts. It should come for a decent Vol and cost credit, providing some degree of cushion for the trade.

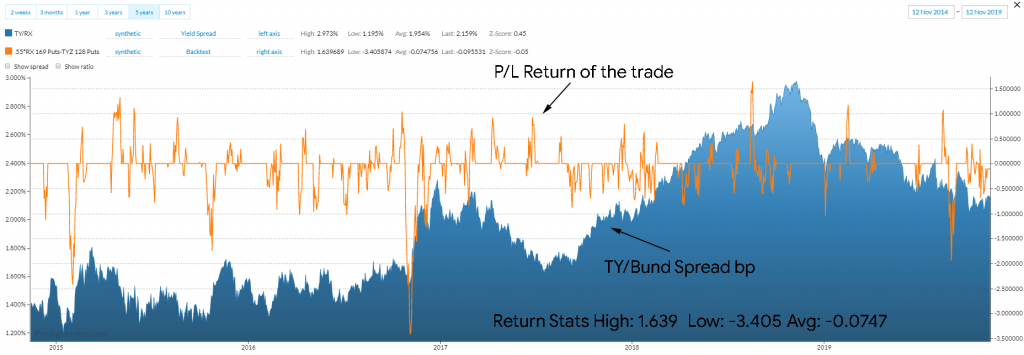

Risk + Historic Backtest profile

A quick becktest is already recommended to quick the risk on the trade, this can be looked at Delta Hedged each day or not Delta Hedged.

Unhedged the trade has returned an average of -0.07 (versus trade price of -0.09 currently) over 5 years, biggest loss was -3.405

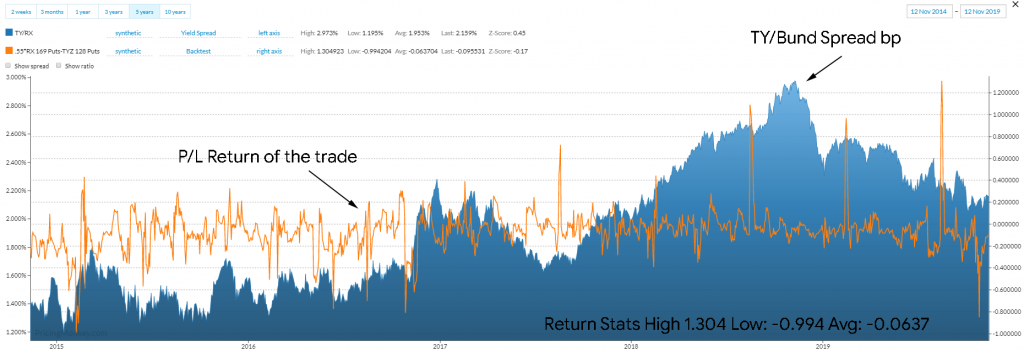

Assuming Delta Hedge you get average return of -0.0637 and largest loss being -0.994. Delta Hedging makes a lot of sense with this trade to reduce risk without impairing returns.

We booked the trade using a approx. Vega weighting 550 RX vs 1000 TY.