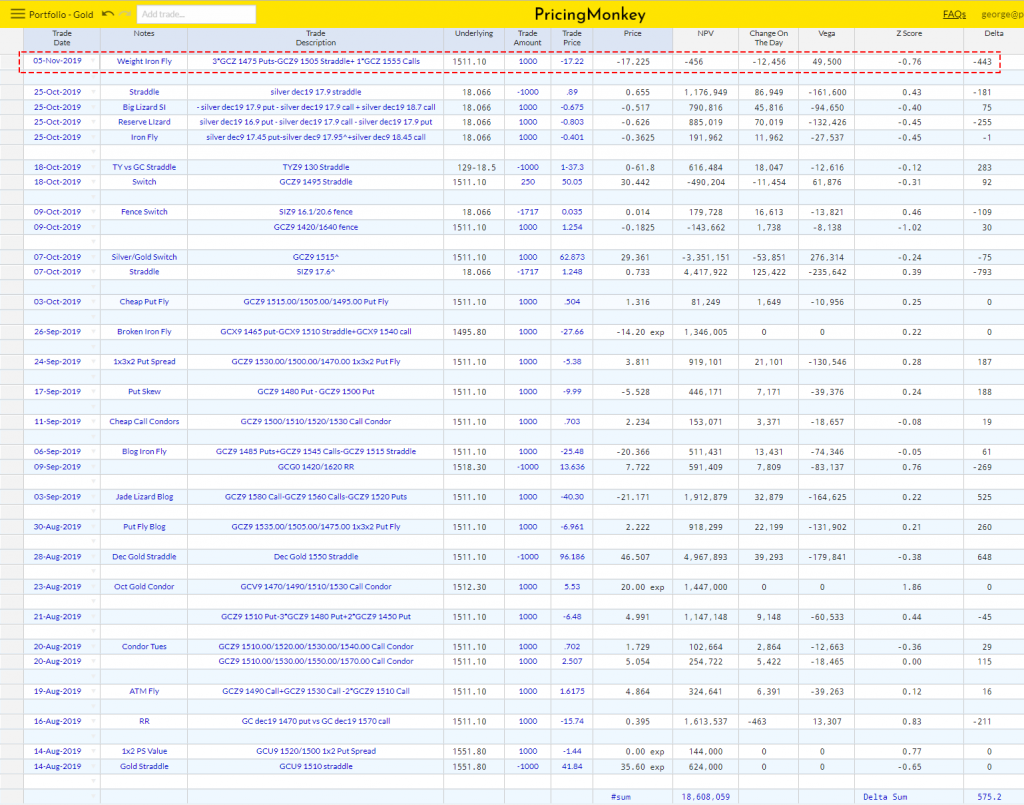

3*GCZ 1475 Puts-GCZ9 1505 Straddle+ 1*GCZ 1555 Calls, -46.4 Delta, -43.7 Sticky Delta with 20.4 days to expiry

Saw this trade flagged up this morning as being at the bottom of it’s long term range, might be interesting if you need a bit of downside protection (read – getting freaked by the record Gold OI & Speculator interest), but also see a good chance the market sits here.

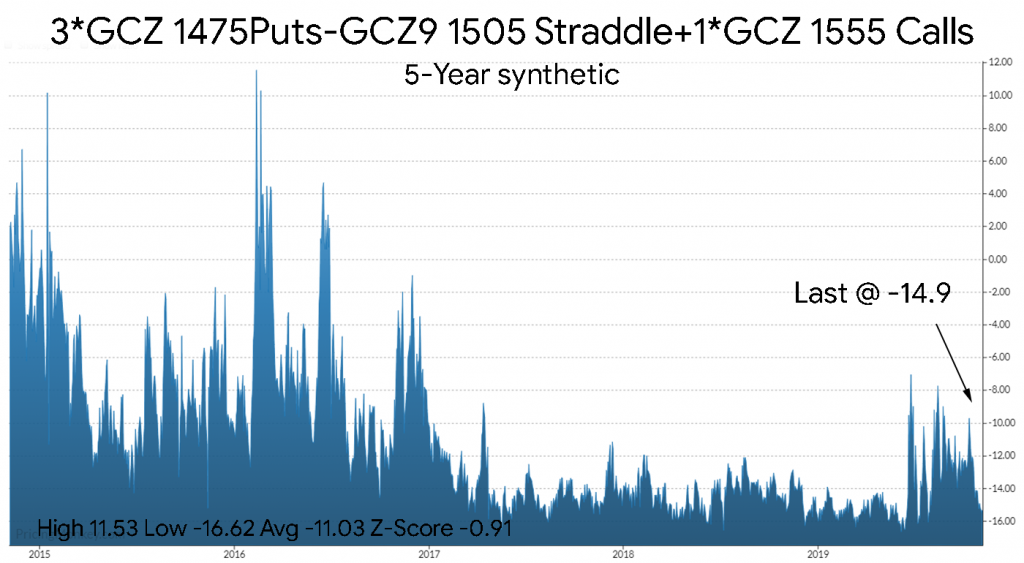

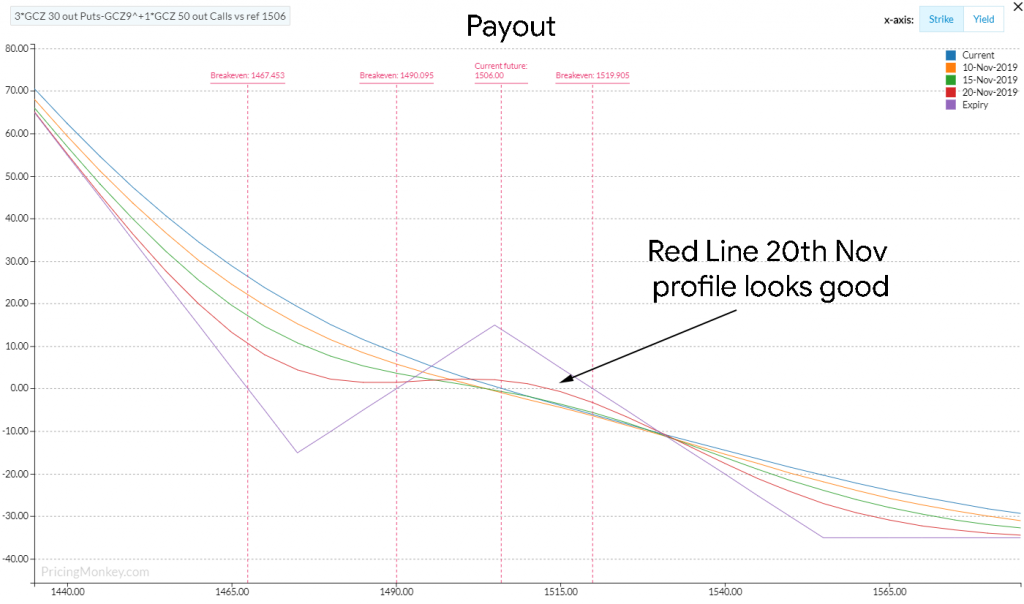

Payout shows the profile of this trade over a number of time horizons into expiry, any near term jolt towards the 1475 Puts will support the structure. Straddle breakeven between 1490 & 1519, Bear move breakeven 1467, max loss $35 on a move above 1555. Pays out the premium (≈14.9) on a 1505 expiry

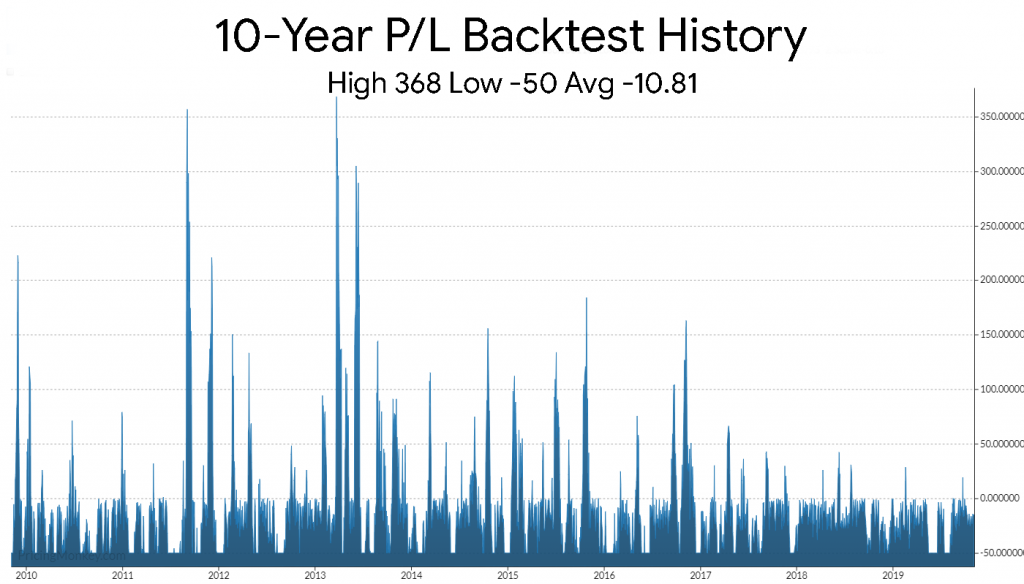

Also the structure also sits below it’s long team historic payout.

Trade booked for tracking,