0EM0 98.50/98.375/98.25 Put Tree (EDH1) with 222 days to expiry 16.3 Delta (Sell)

We saw a lot of 2-way action post FOMC in the close-to-the money March(H) & June(M) Put Trees (Front + Midcurve), mainly from accounts buying the structures (Rates only going lower) and accordingly selling the out of money Puts that make up this structure. Out the money Put Vol taking the hit. One large Buy-Side contra flow we did notice, was a seller of 12k June Midcurve 98.375/98.25/98.125 Put Trees (EDM1) at -0.01 on Thursday. We think these sorts of trades (Selling Put Trees) probably look more interesting than the Buy-Side trade.

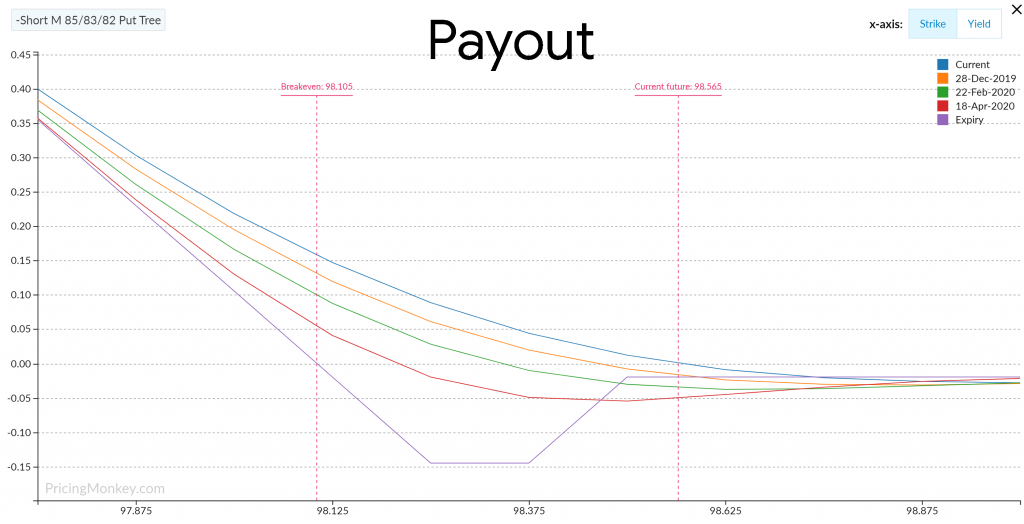

For example, this is the June Midcurve 98.50/98.375/98.25 Puts Tree synthetically priced over the past 5-Years. It rarely trades near zero but has been rallying hard recently on the back of trade flows, closed -0.02 Friday. Looks like it might have a push at par soon.

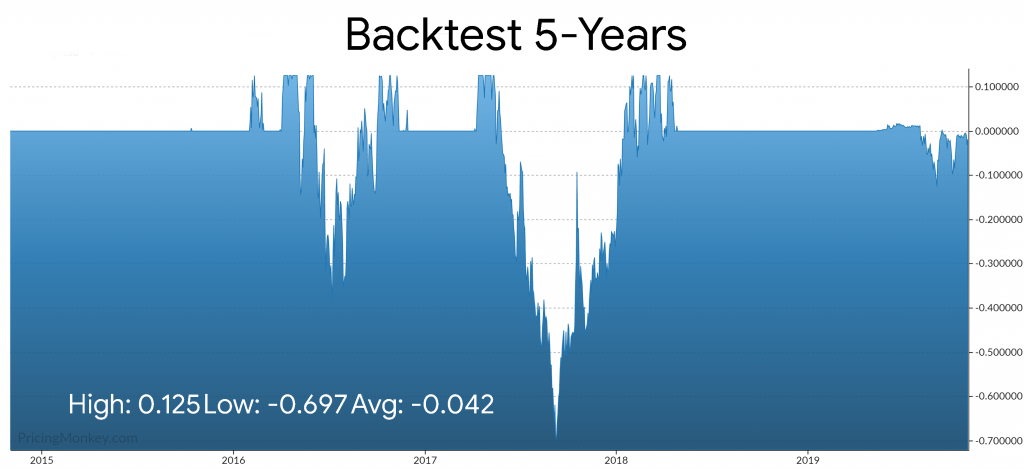

What’s the attraction of this trade? As you can see from our backtest below, people have been totally wrong-footed on 2 occasions in the last 5-years on their expectation of rates 222 days forward (June Midcurve Options expiry). People buying these structures for an increasingly small credit to try and make 12.5 ticks are exposing themselves to huge risk. Very visible when you review the past,

The payout also looks supportive, any move lower a before March, will support the payout on the short side, this doesn’t take into account the possibility of a positive shift you’d get in Put skew, which would help.

If this sort of idea makes some sense, I would suggest following all the Puts Trees around Mar/Jun/Sep to see how rich they can become historically. Also, look for 1×2 Puts Spreads & 1×3 Puts Spreads in this area richening further as potential structures to look at selling.