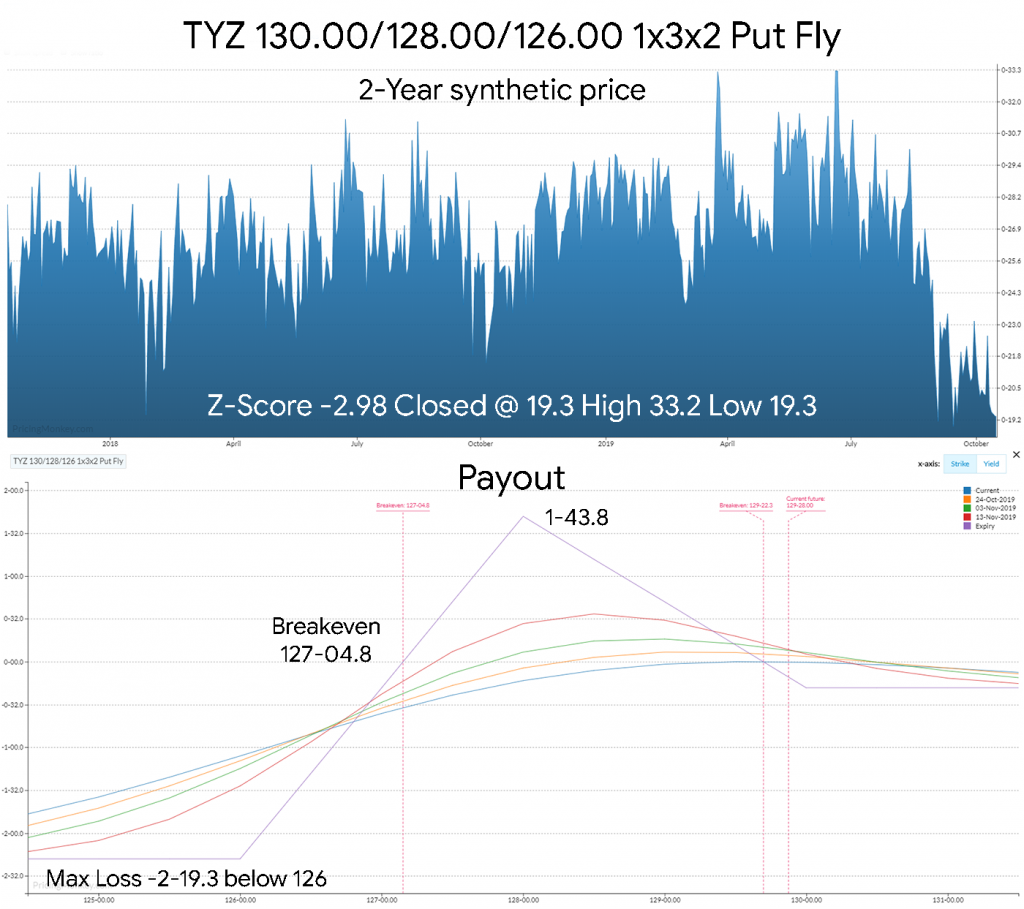

TYZ 130.00/128.00/126.00 1x3x2 Put Fly with 38.6 days to expiry, -2.6% delta.

US 10-Year Put skew remains very flat making it very tough to find cheap Put Spreads or Put Flys, very little value currently in selling out the money Puts to finance nearer Puts. One trade that might make sense as it involves buying far out of the money Puts (5% delta) and these have cheapened recently is the TYZ 130.00/128.00/126.00 1x3x2 Put Fly. Using 128 as the sell Strike, this should be around 2% yield in the generic 10-Year contract.

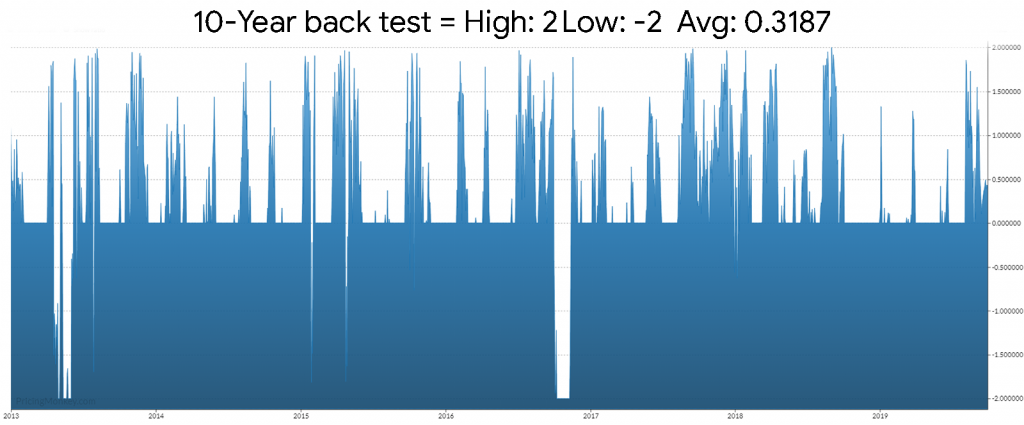

Back testing (7 years here) is interesting as it shows the historic risk of yields backing up more than 32bp in 38.6 days. It’s trading currently below is 7 year average of .3187.

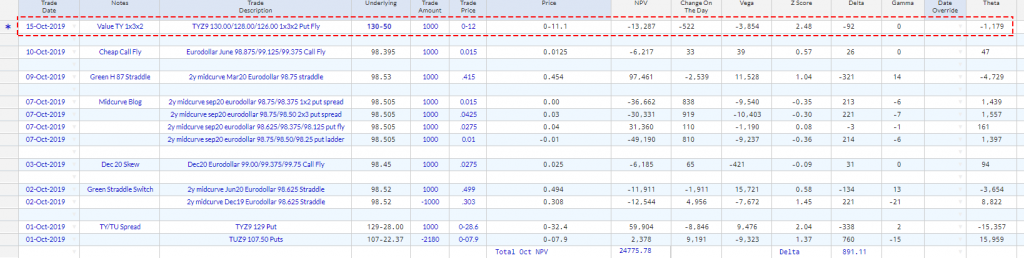

Octobers trades…