Dec S&P 3000/3100 1×3 Call Spread with 68 days to expiry – Selling this strategy

SX5E Dec19 3575/3700 1×3 Call Spread with 67 days to expiry – Selling

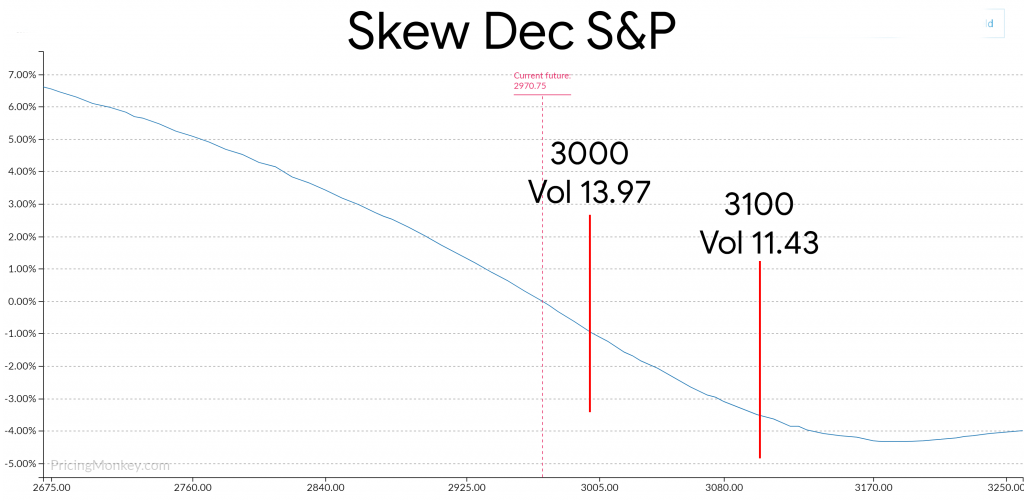

If you look at the move in synthetic skew between the 45% Delta Calls (just out of the money at 3000) and 20% Delta Calls (at 3100, approx. 5% above the current market) you will see that its at extremes and potentially offering an interesting opportunity to anyone looking at a “Melt Up” here in S&Ps.

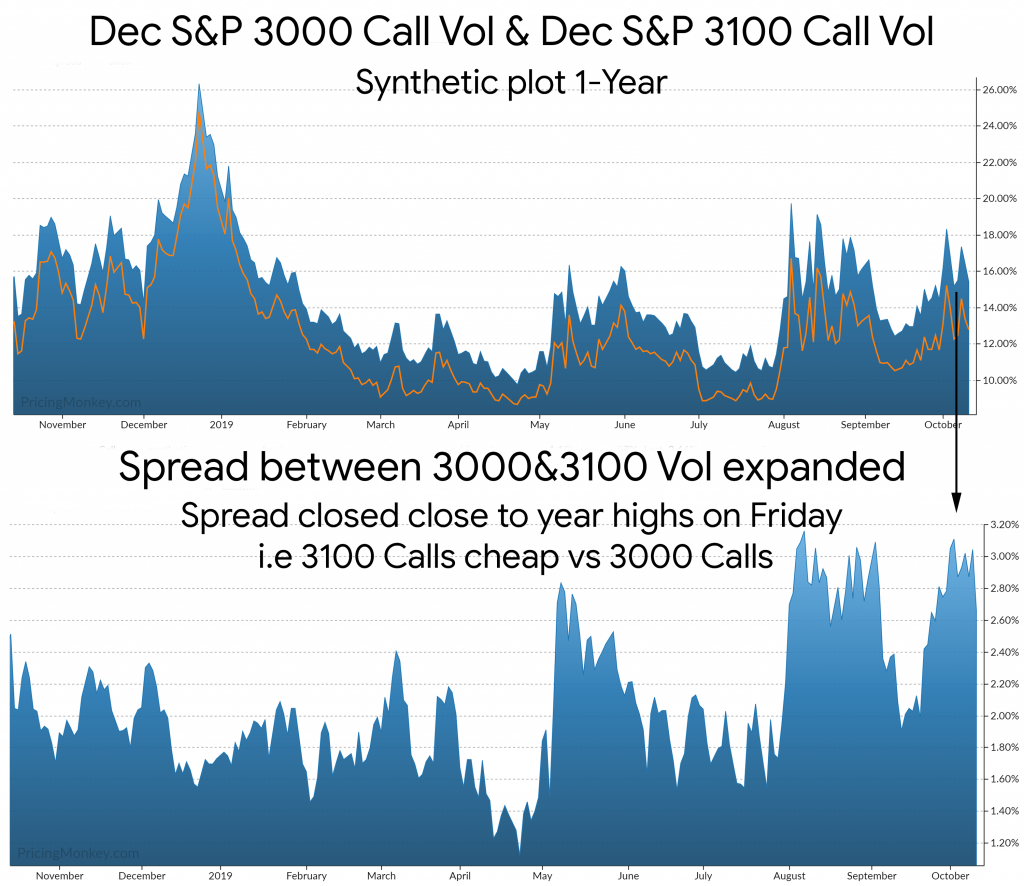

If you take these 2 strikes and plot their value over time, and can then derive the difference between them to see how they are interplaying (lower chart).

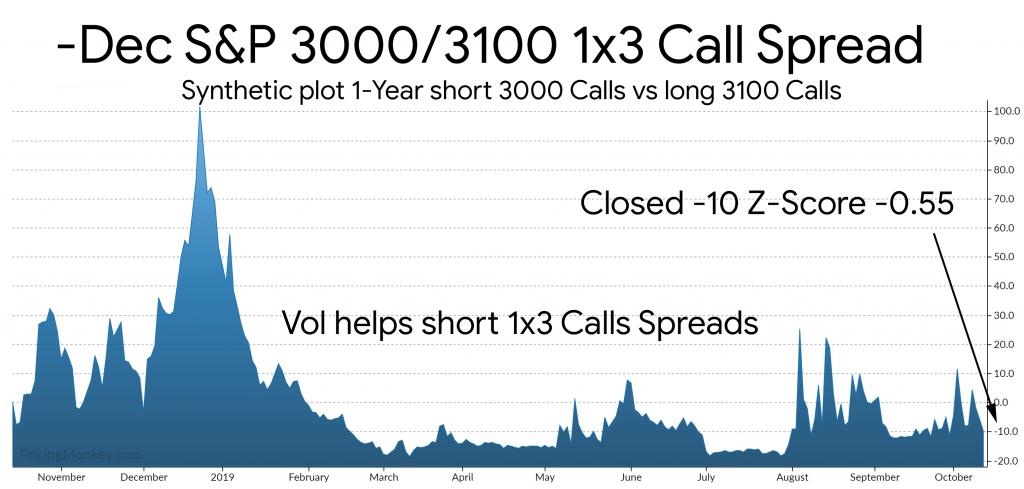

What’s does this mean? This means that 20 Delta Calls are currently at the cheapest level vs 45 Delta Calls this year, this can also be shown by plotting a structure that uses these strikes, the Dec 3000/3100 1×3 Call Spread (selling the 3100 Calls to buy 3 3100 Calls)

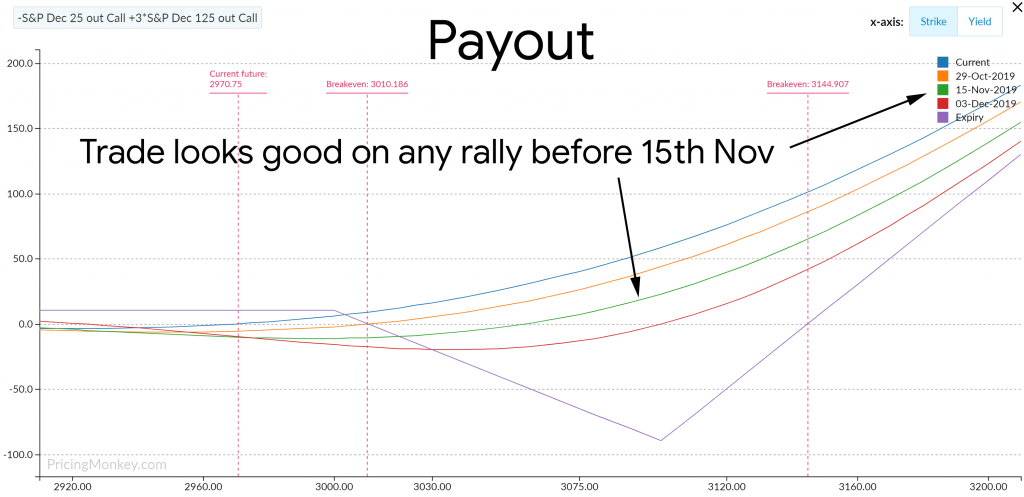

The payout profile is supportive, with any sharp rally before the 15th Nov causing the trade price to increase, if Vol also increases this will also help.

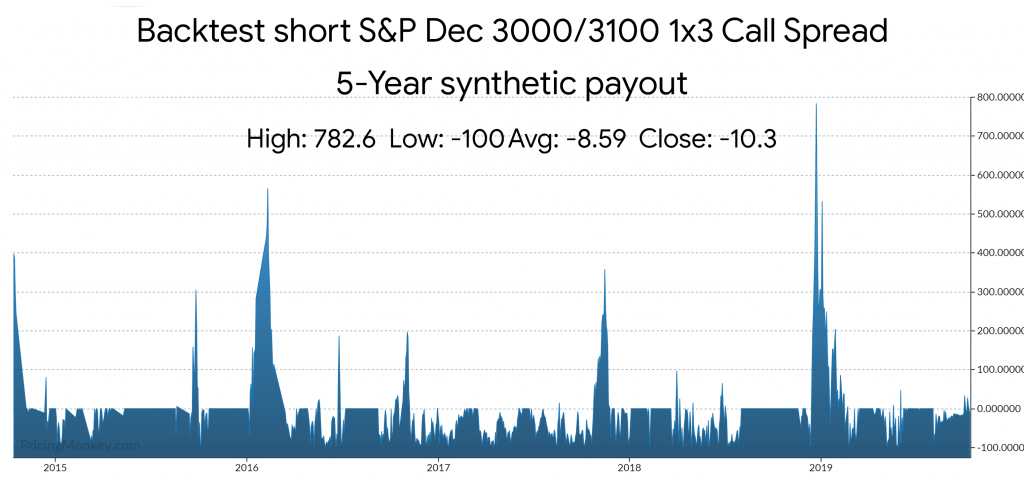

How has this trade performed historically? Backtesting it over 5-Years shows that it paid out -8.5 ticks on average vs its close on Friday of -10.3 ticks, so you’re buying it below its long term average payout as well. Its best performance in a sharp rally was 782 ticks which would have been if you’d brought the same structure on the 24th Dec 2018.

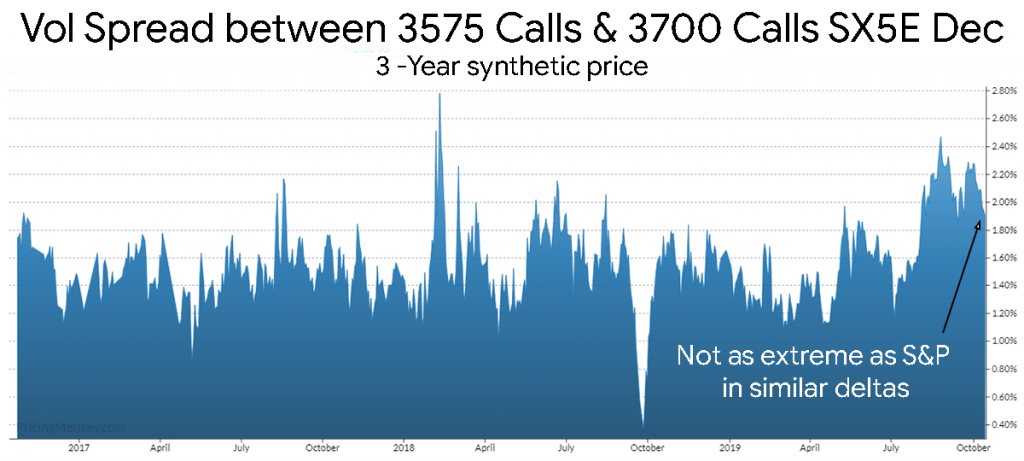

Alternatives might be to look at Eurostoxx, for example the SX5E Dec19 3575 call – 3 * SX5E Dec19 3700 call looks similar and should pay a small credit on the sell side. Interestingly, backtested the Eurostoxx version has a much better historic payout of 75 ticks than the S&P version.