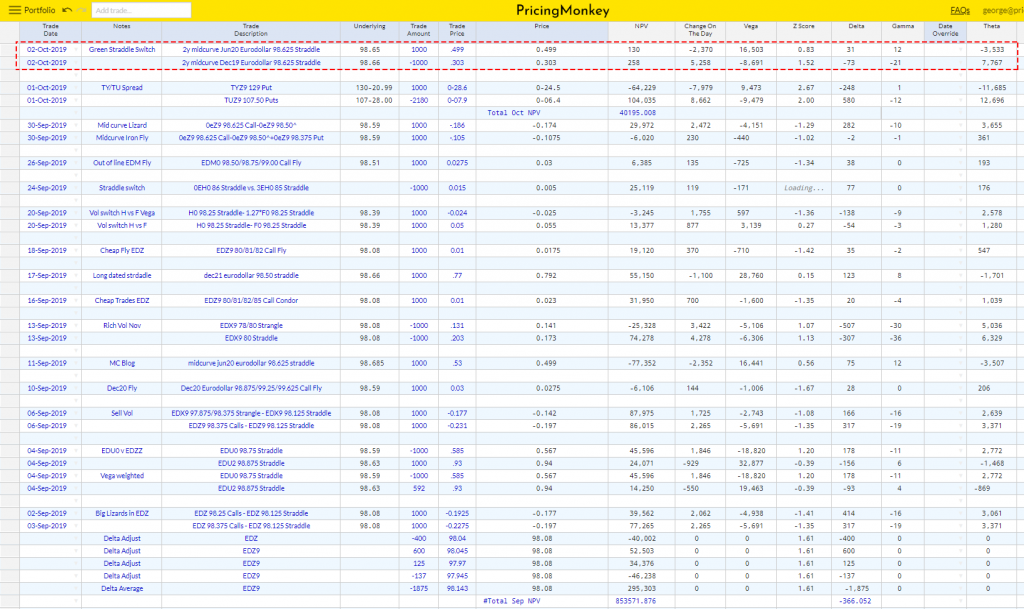

2y midcurve Jun20 Eurodollar 98.625 Straddle (254.7 days to expiry) – 2y midcurve Dec19 Eurodollar 98.625 Straddle (72.8 days to expiry) with -4.2% Delta

Noticed this trade printing yesterday in-between the non-stop buying of Call Spreads, Calls Flys and Selling of anything with Put in the name. This switch printed 19.5 in 2500, client buying the longer June Straddle vs the Dec. Dec Vol is 87.4bp vs Jun Vol at 75.7bp on the close.

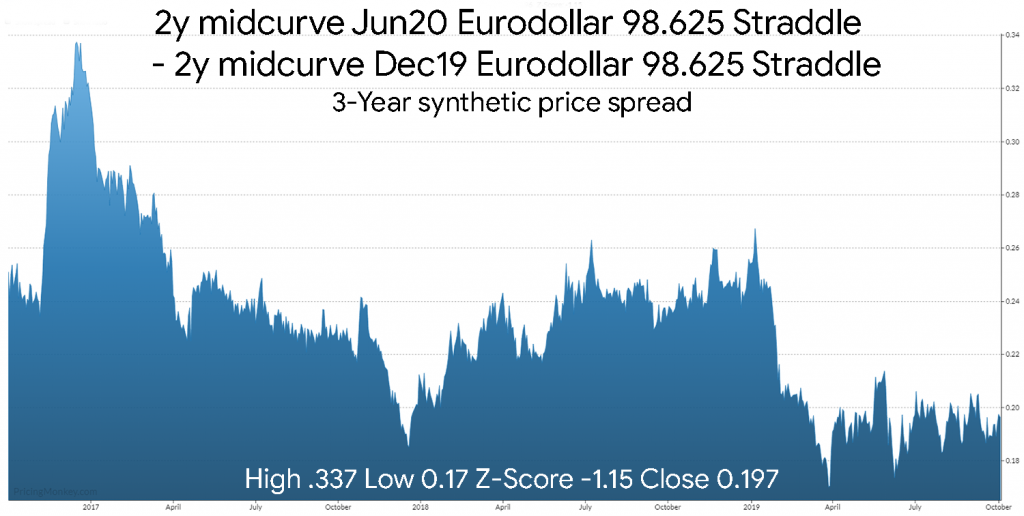

How has this switch paid out over time? Over the last 12 years this spread has delivered 34.5 ticks return on average(synthetic).

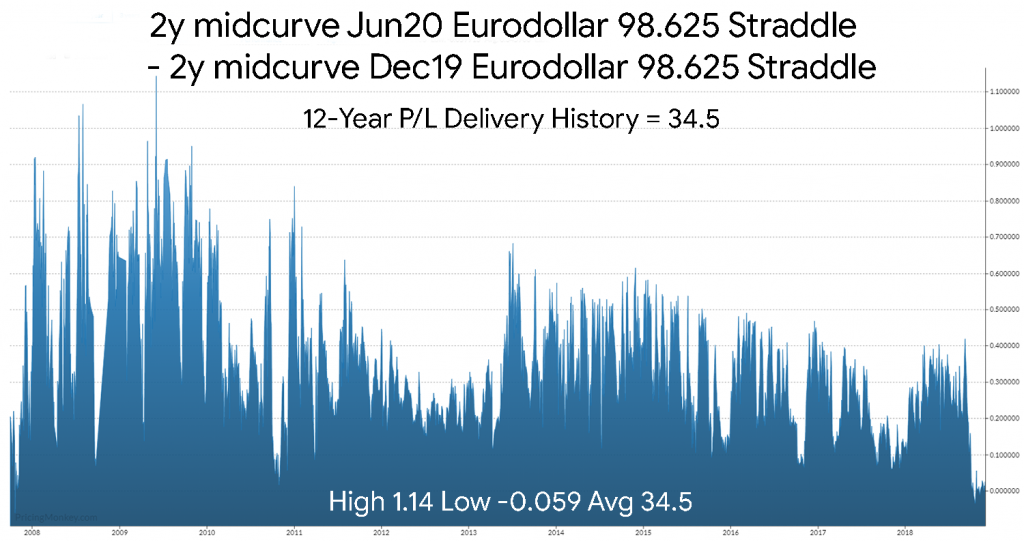

An alternative would be to trade the Vega weighted structure .527*Green M 86 Straddle-Green Z 86 Straddle, which closed at -0.04, this has a average payout of 0.0165 with a High at .49 and Low at .548. Pretty marginal P/L delivery I think.

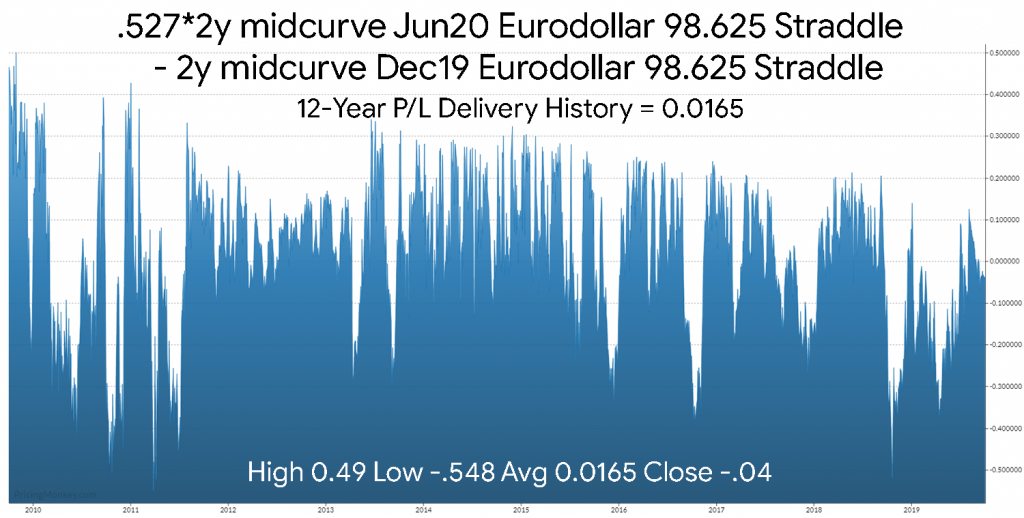

Booking the 2y midcurve Jun20 Eurodollar 98.625 Straddle – 2y midcurve Dec19 Eurodollar 98.625 Straddle for tracking.