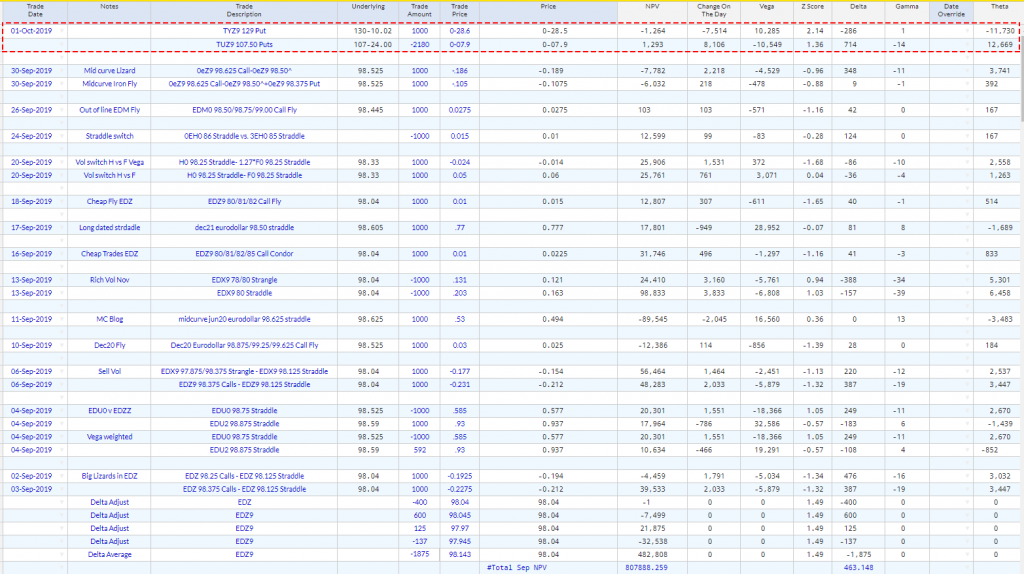

TYZ 129 Put -4.359*TUZ 107.50 Puts with 52.6 days to expiry.

With a lot of talk in the market of Steepeners being the big trade (link to Market Huddles interview with legend Nancy Davis from Quadratic) thought it would be good to look at a 2-10’s Steepener in Options using CME 2-Year T-Note Put options(TUZ) vs 10-Year Put options(TYZ).

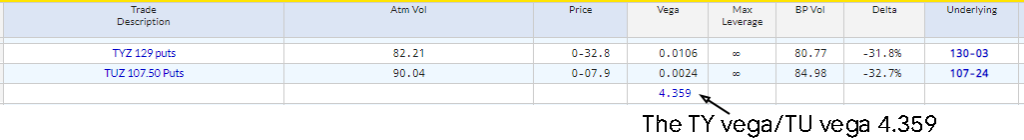

For example you can Buy TYZ 129 puts at around .32 (32 delta vs 130-03) and Sell weighted TUZ 107.50 Puts (32.7 delta vs 107.24) for around 0.08. The weighting can be calculated from the Vega:

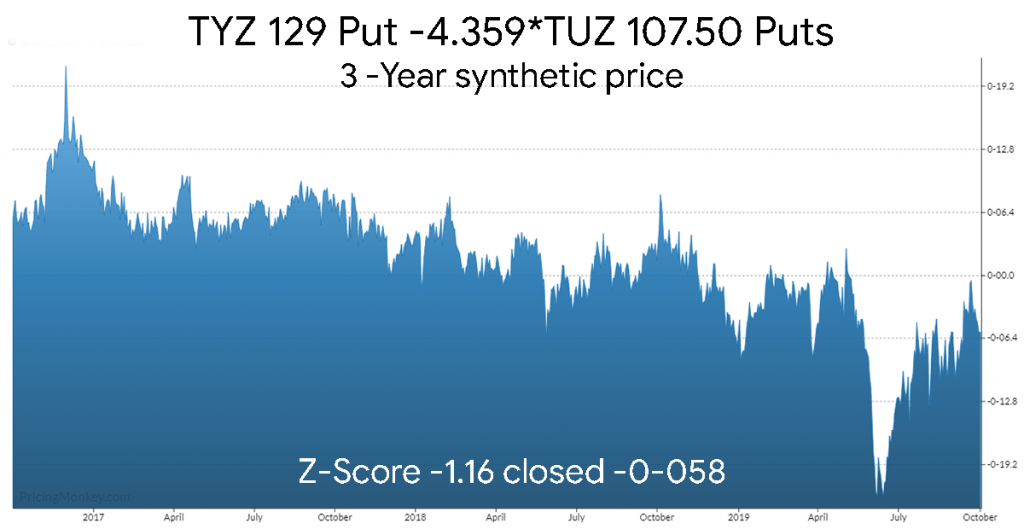

Plotting this structure synthetically with its vega weightings shows its recent history.

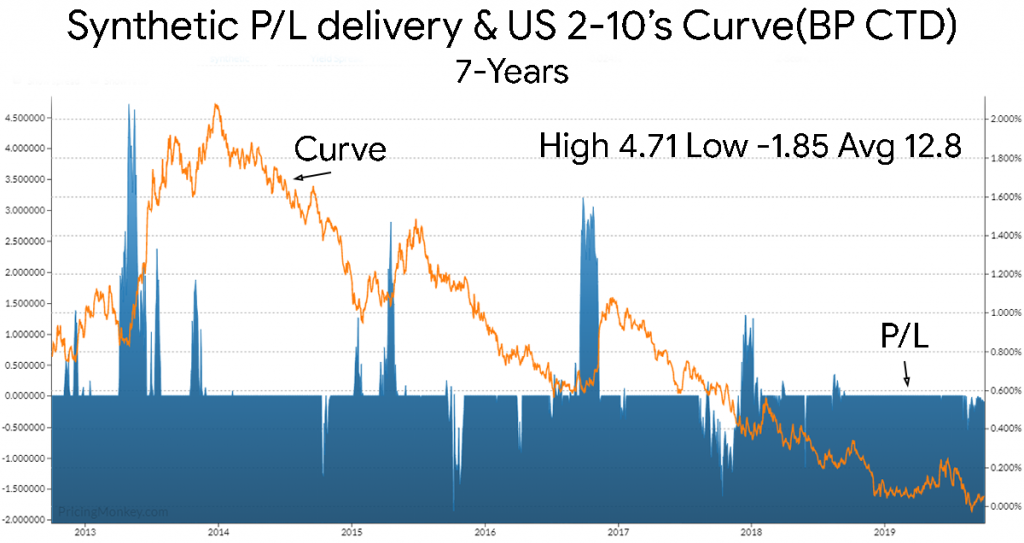

How does doing this trade over time look, does it have any major risks?

It’s returned 12.8 ticks in a huge flattening move, also periods of weak TU’s versus TY’s seem pretty few and far between, and not too damaging, lowest return was -1.85 in Oct 2015. This trade should play out very well if we see any TY driven steepening here.

Trade booked for tracking, note if you execute this trade you need divide the TU weighting by 2 is get the amount to be traded, as the TU’s are double size contracts vs TY’s.