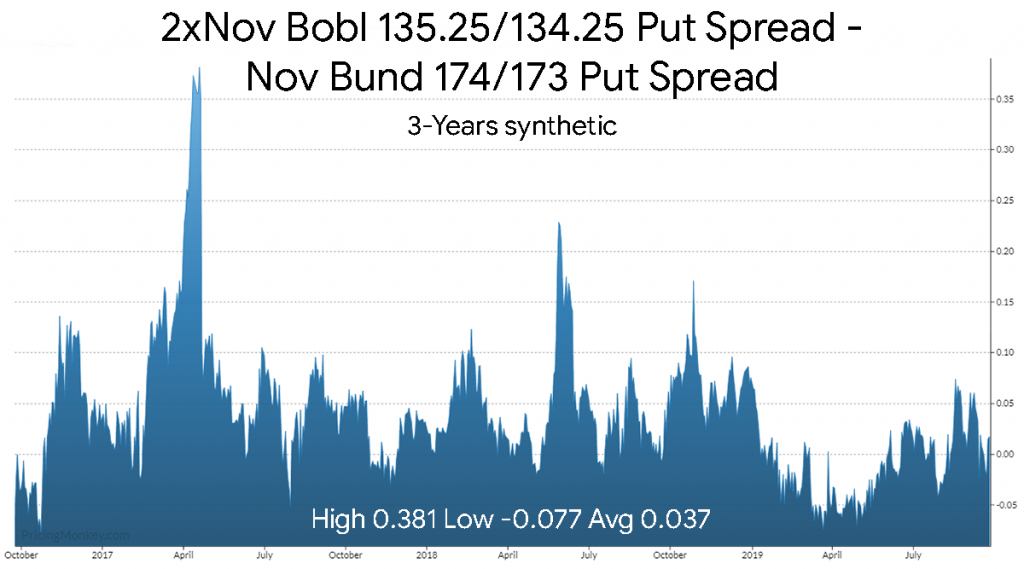

2*Nov Bobl 135.25/134.25 Put Spread- Nov Bund 174/173 Put Spread with 31.3 days to expiry

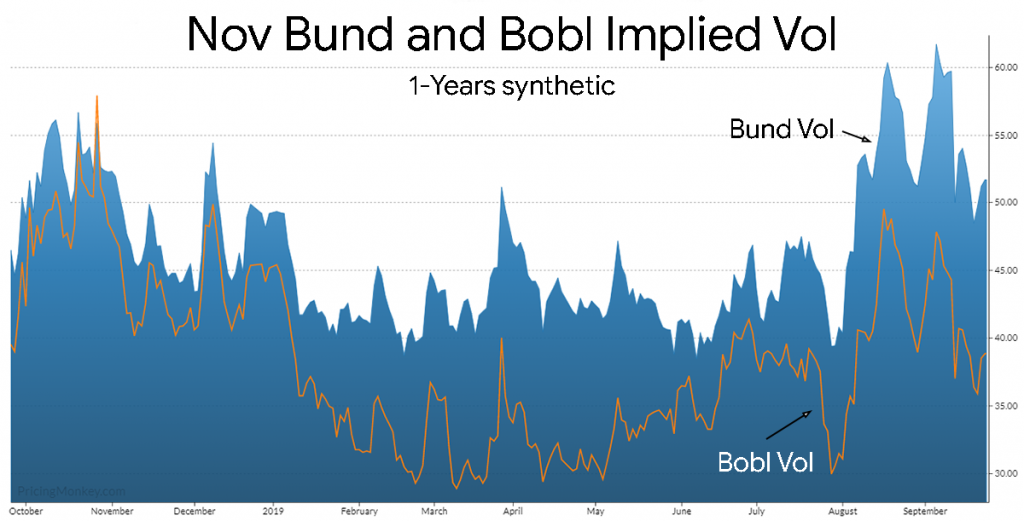

Using our Performance tool on strategies can turn up some interesting results, and check payout/risk history, especially useful when you’re looking for ways to play Volatility differences in different products. Bund vs Bobl difference vol highlighted last week is a good example.

If you have a view on the Bobl/Bund curve, and see Bobls as under performing here, this sort of structure might be worth a look.

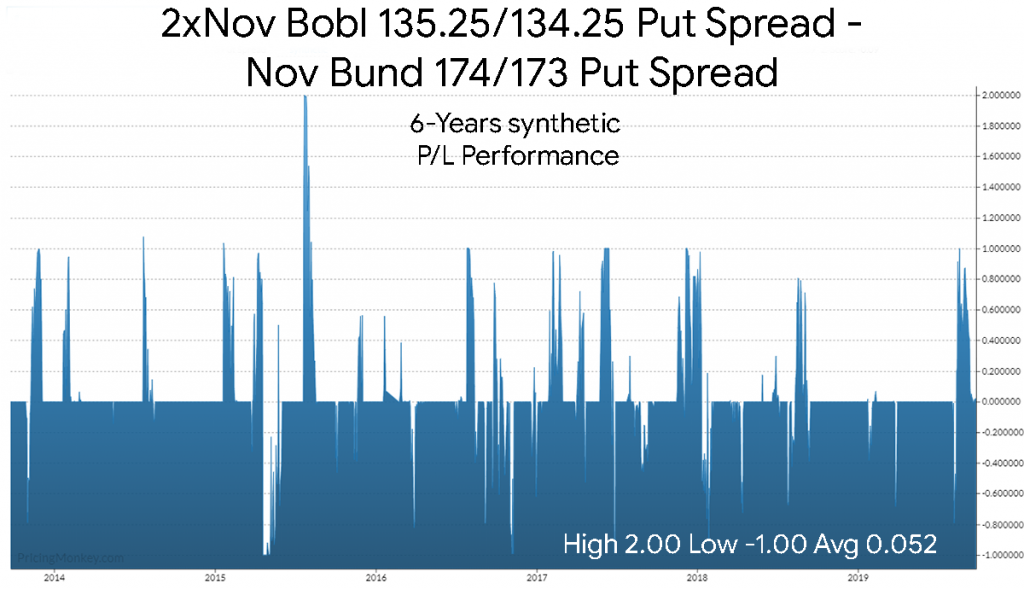

If you run the Performance function on this to see just how this has paid out over the years, you can get some idea of its value and risk. The 2.00 payout is when Bobls sold off but Bund didnt’t, 1.00 Payouts are when both sold off, -1.00 payout is when only Bunds sold off.

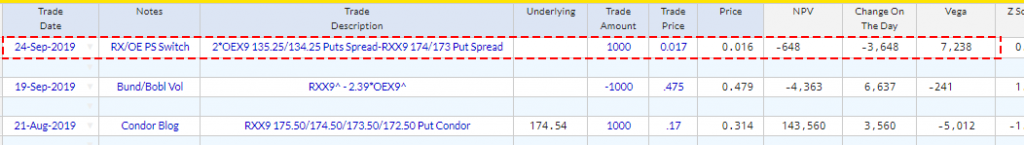

Trade booked for tracking