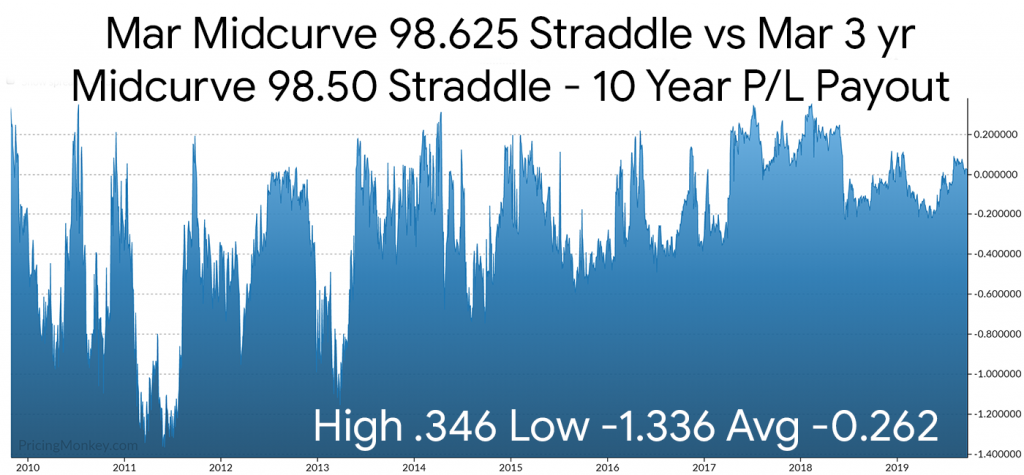

Mar Midcurve 98.625 Straddle vs Mar 3yr Midcurve 98.50 Straddle with 172 days to expiry

Have been seeing these types of Straddle spreads going through on a very regular basis recently. This one, which was sold (Selling Mar MIdcurve Paper vs 3yr Mar Midcurve) looks very interesting when you pull it apart historically, I think the client has the right idea here.

The payout over the last 10 years was -.262, with a High and Low of .346 & -1.336 respectively. Seems this trade has huge downside risk on this basis.

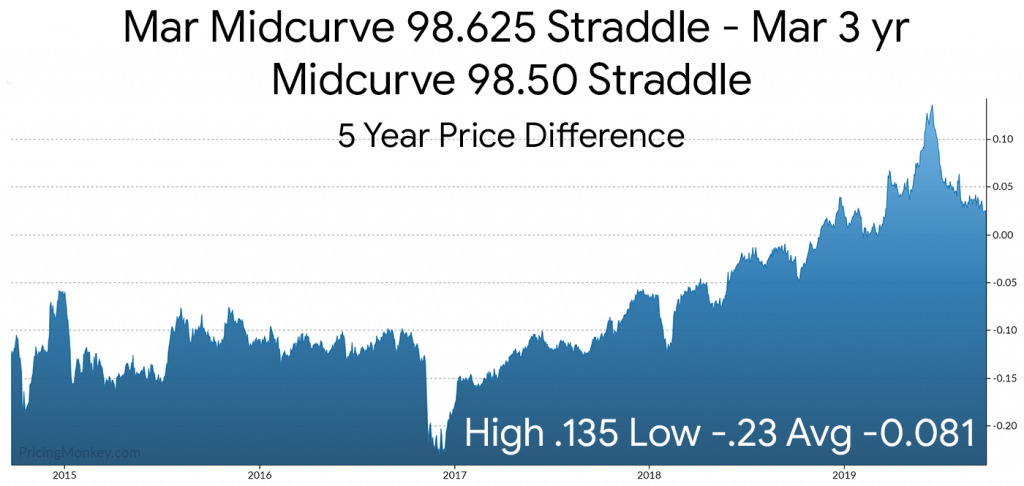

The spread history also supports this argument. The spread difference peaked at 13.5 on the 14th June. has been drifting since.

Trade Booked for tracking