Always love Alex Manzara’s blog, it’s a great source of ideas and interesting thoughts. An essential daily read.

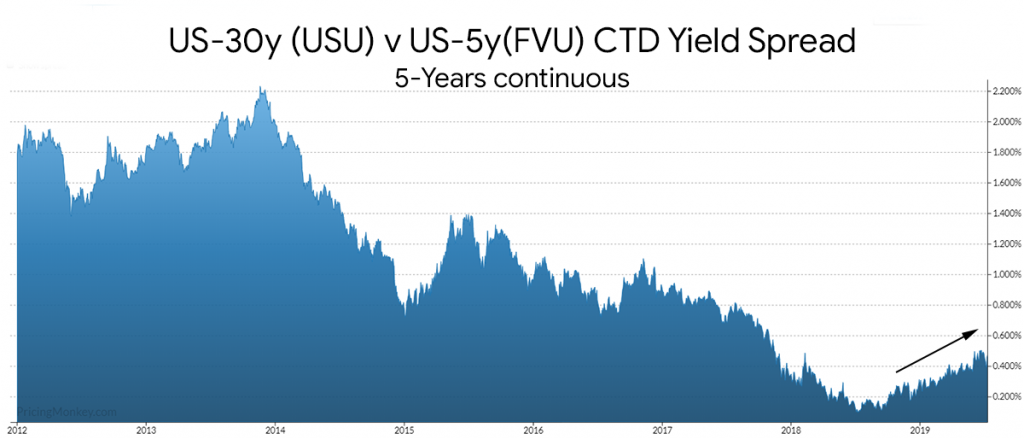

This weekend he discussed the US 30-Yr (USU) versus US 5-Yr (FVU) which is very much on his radar as a trade, looking for curve steepening, so US 30-Yr (USU) to underperform US 5-Yr (FVU).

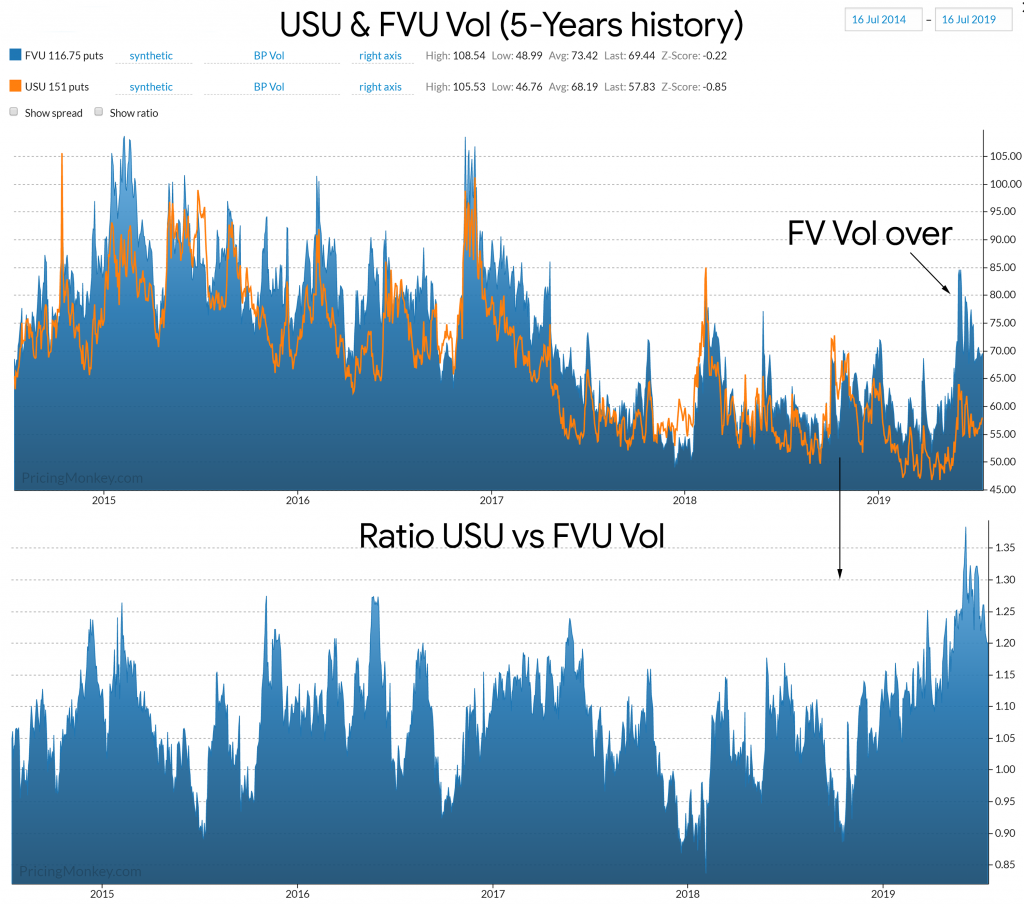

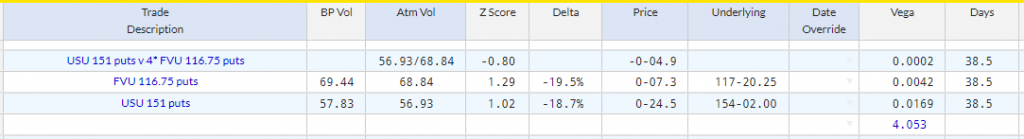

The suggested potential trade to look at would be buying USU 151 Puts versus FVU 116.75 Puts. Deltas are 18.7% and 19.5%. Vega 0.0042 and 0.0169. Vega weighting would be 0.0169/0.0042.

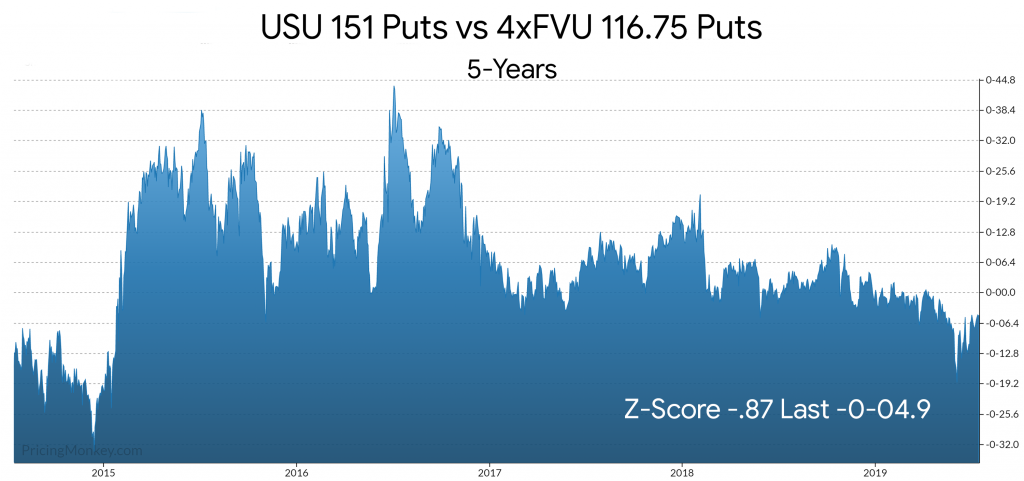

Creating a Vega weighted structure you get USU 151 puts v 4 x FVU 116.75 Puts (Buying the USU 151 Put vs FVU 116.75 Puts). This can now be plotted synthetically, it closed at -0.049 last night, so trades at a small credit.

Trade in our Booking System. Another way would be to scale into this position, quarter here, then add the other 3 quarters as the market moves over the coming weeks.