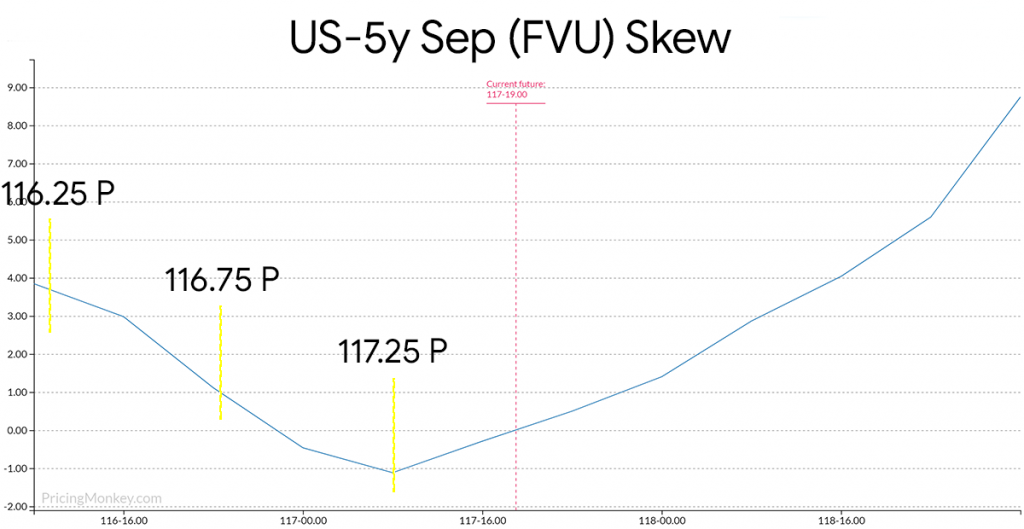

We saw Put skew steepen generally in the US Bonds Friday, as the market started talking up a more serious sell off. This skew move seems to have cheapened a number of Put structures, that might be worth watching if you expect any sell off here to be limited.

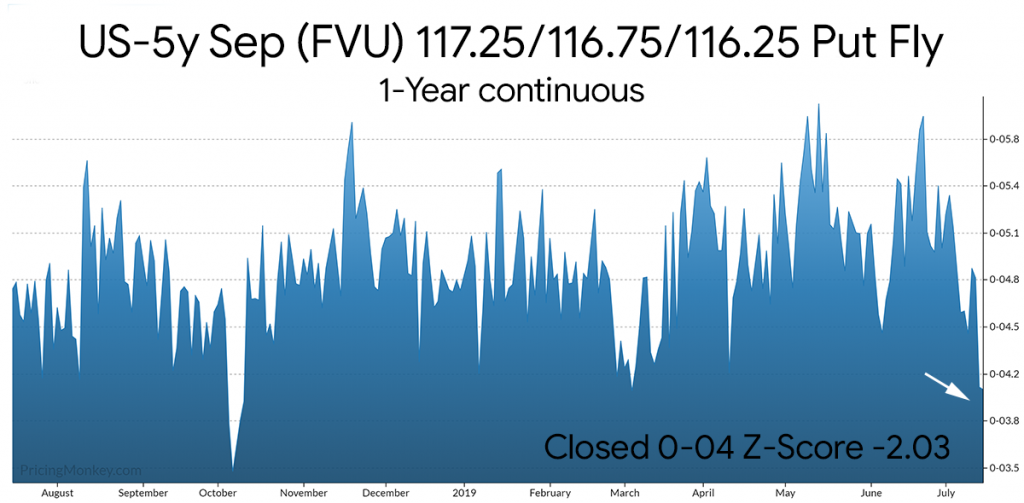

US-5y (FVU)

The synthetic FVU 117.25/116.75/116.25 Put Fly clearly shows that, trading on recent lows.

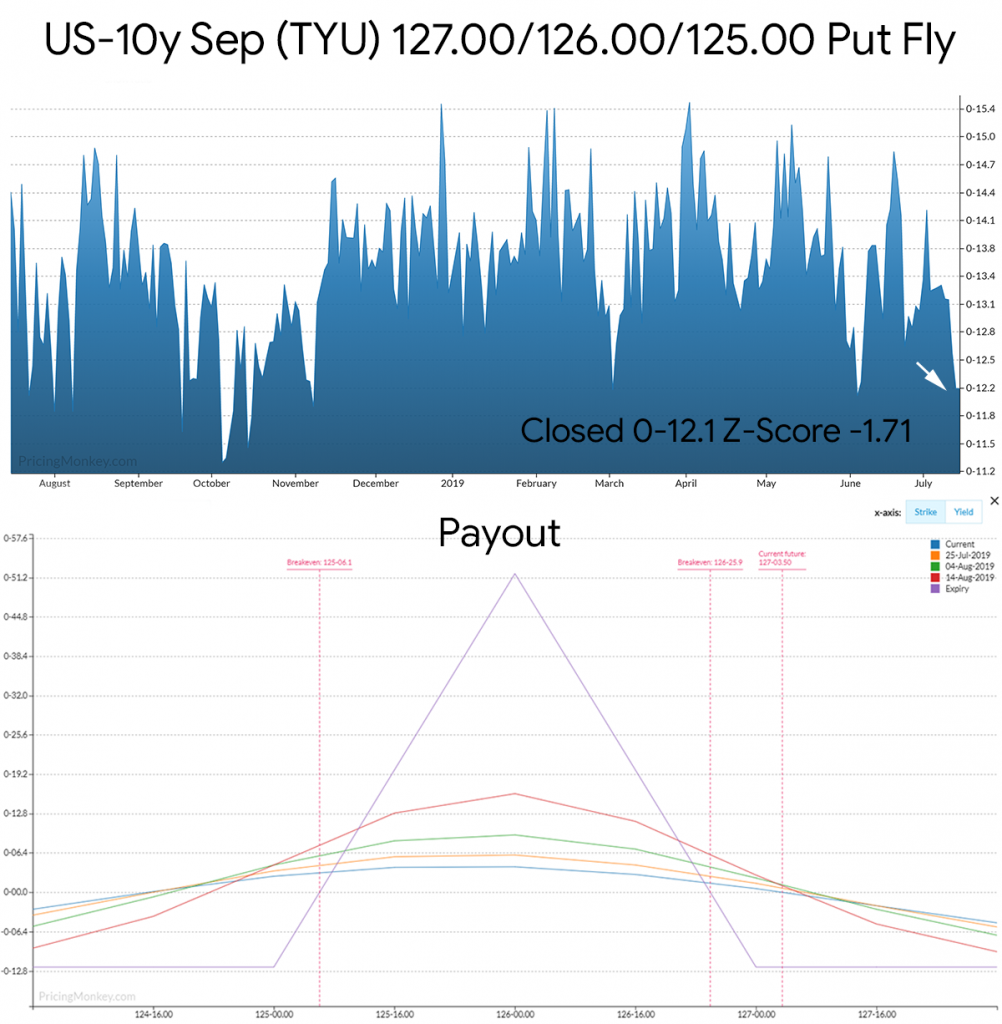

US-10y Sep (TYU)

The situation is very similar in the TYU where upward pressure on the Put Skew has caused the 126 Puts to richen relative to the wings.

These structures aren’t super cheap (Z-Score around -2), but worth following if they much your view, or can traded at better prices over the coming week. Added for tracking in our system.