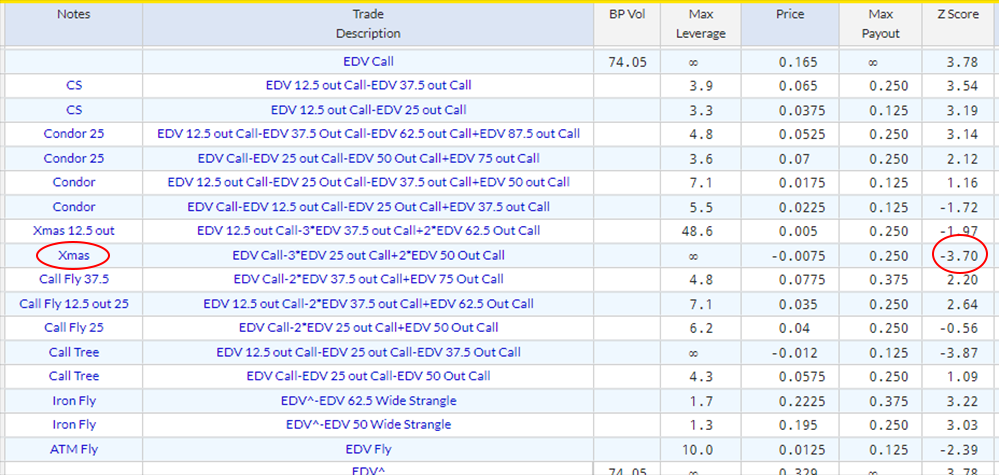

Have been noticing recently that a Call/Put Trees have been starting to run cheap, this is mainly down the emerging shape of the various contract skews.

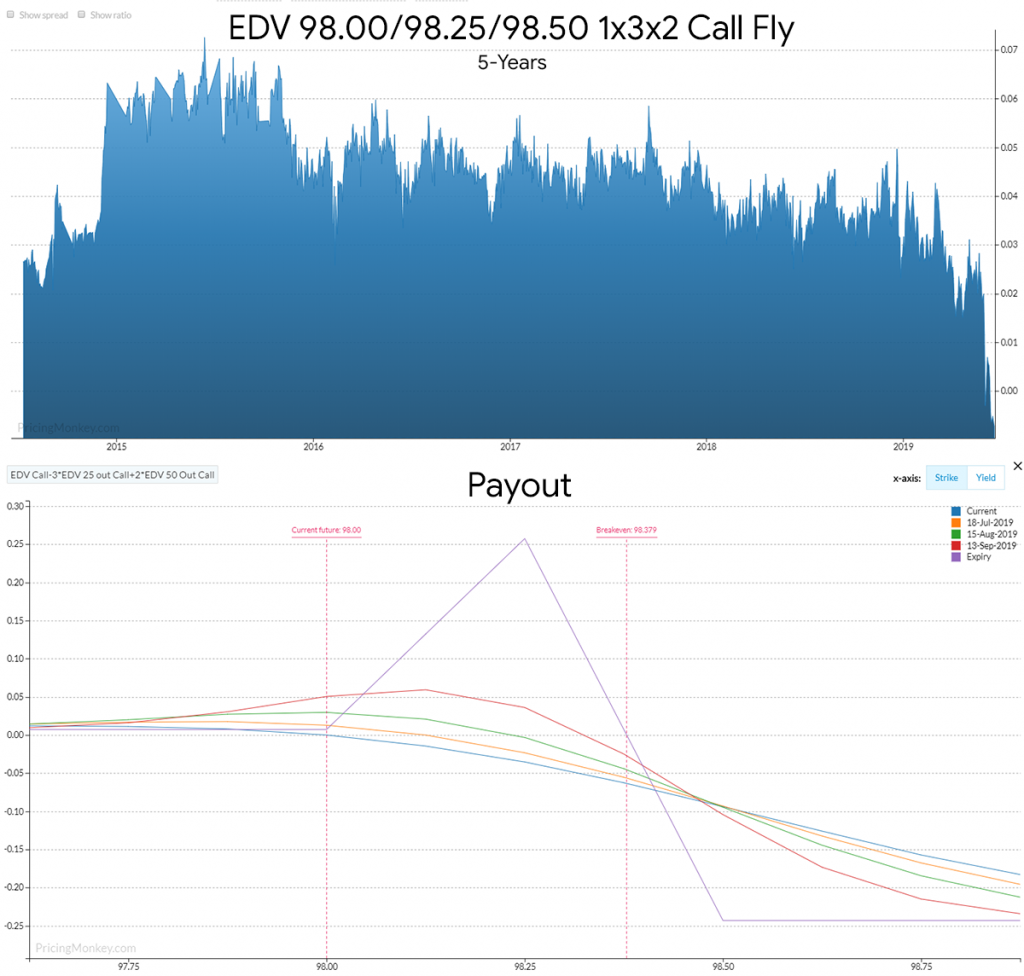

Plotting this EDV 98.00/98.25/98.50 1x3x2 Call Fly shows just how steep the second strike is to the third.

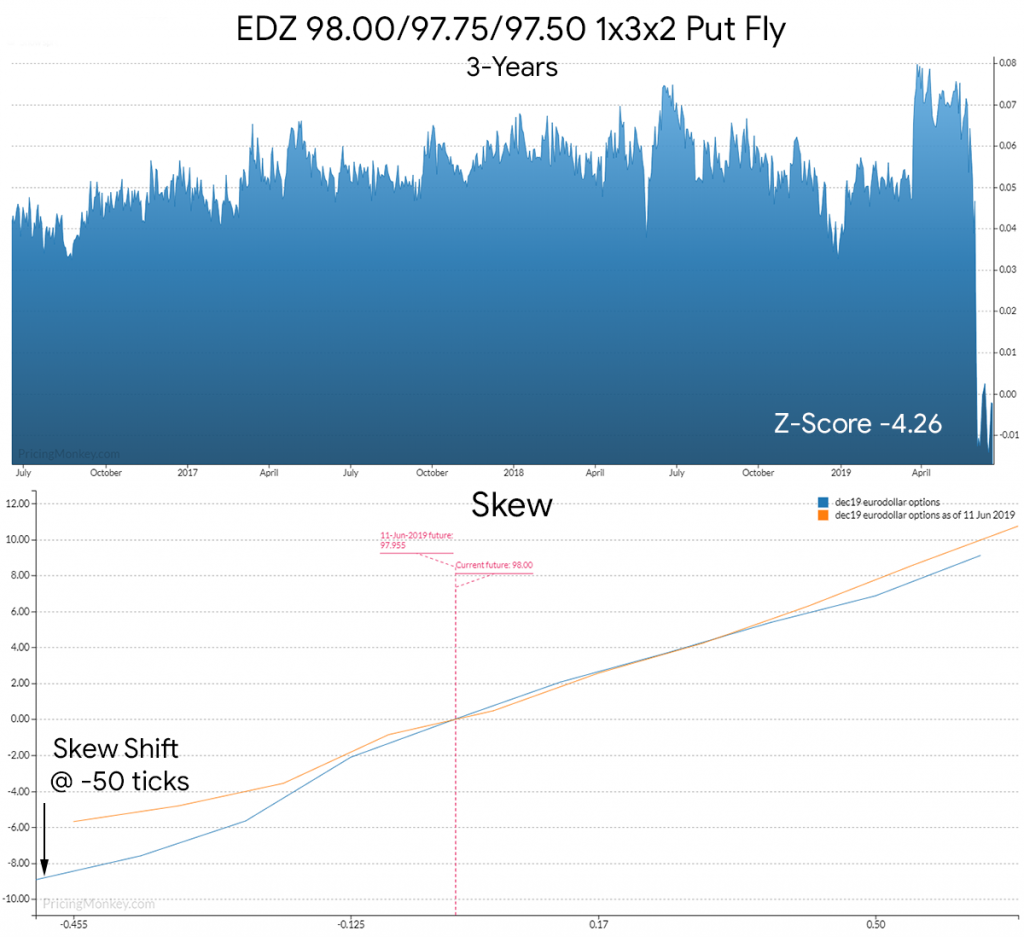

Puts

If you’re looking for a Put strategy using Trees then again scanning PricingMonkey for a decent structure with a low Z-Score gives us the EDZ 98.00/97.75/97.50 1x3x2 Put Fly, trading around 0.

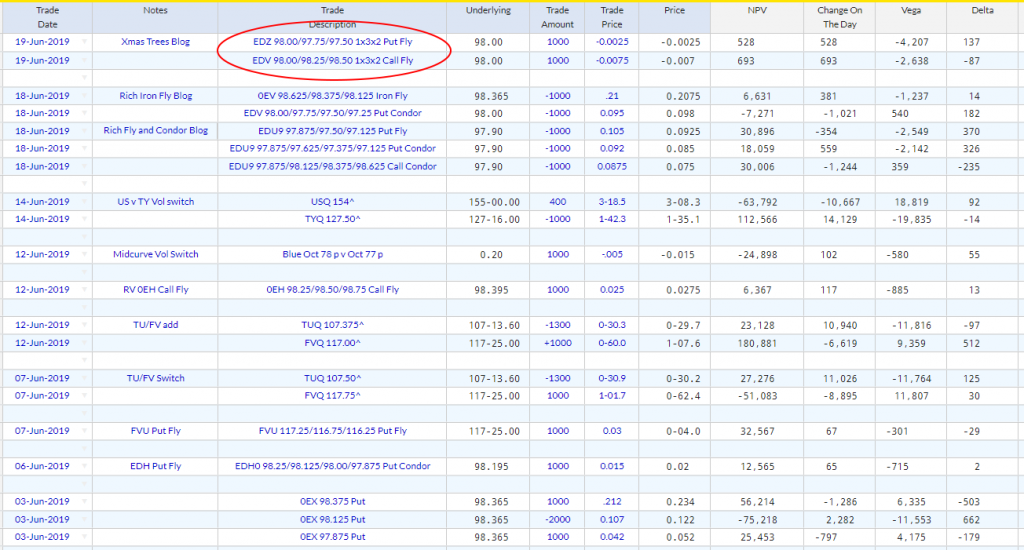

Example Trades booked into PricingMonkey.