This seems to be an on going theme as the market has moved higher (price & Vol), with Eurodollars structures getting dislocated from historic averages and showing decent values.

Here we look at a couple of premium rich structures.

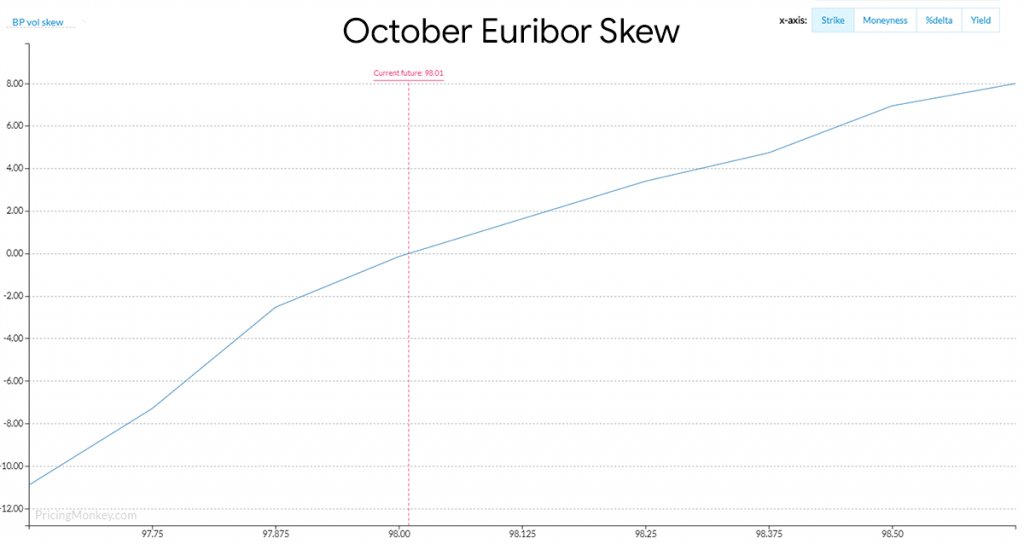

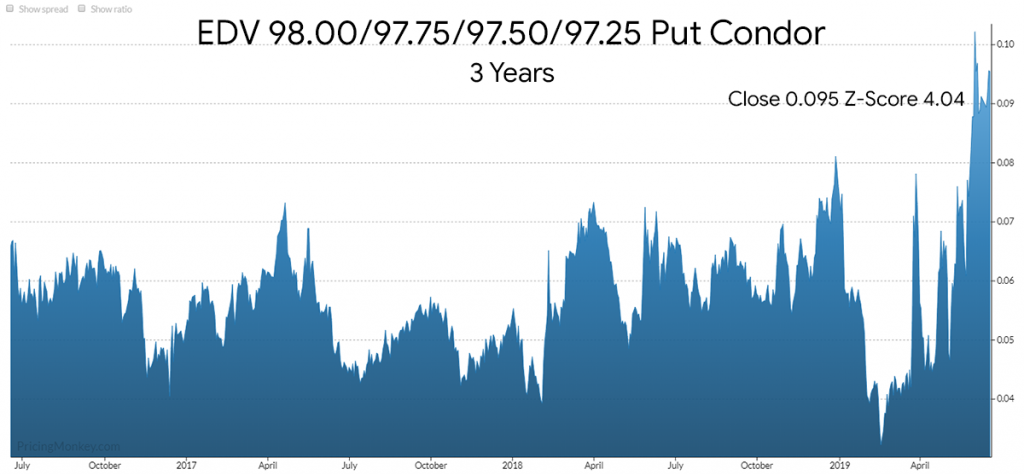

With the skew sloping away so sharply in Puts, and Vol very well bid, Put Condor look start to look very poor value, for example check out the Oct EDV 98.00/97.75/97.50/97.25 Put Condor which closed at 0.095, that has a max payout of between 97.75/97.50 for 25. If you think this scenario is unlikely, it’s definitely worth checking out.

The synthetic chart of this Oct EDV 98.00/97.75/97.50/97.25 Put Condor clearly shows its poor value.

Other Flys and Condors to check in PricingMonkey:

EDU9 97.875/97.50/97.125 Put Fly

EDU9 97.875/97.625/97.375/97.125 Put Condor

EDU9 97.875/98.125/98.375/98.625 Call Condor

0EV 98.375/ 98.125/97.875/97.625 Put Condor

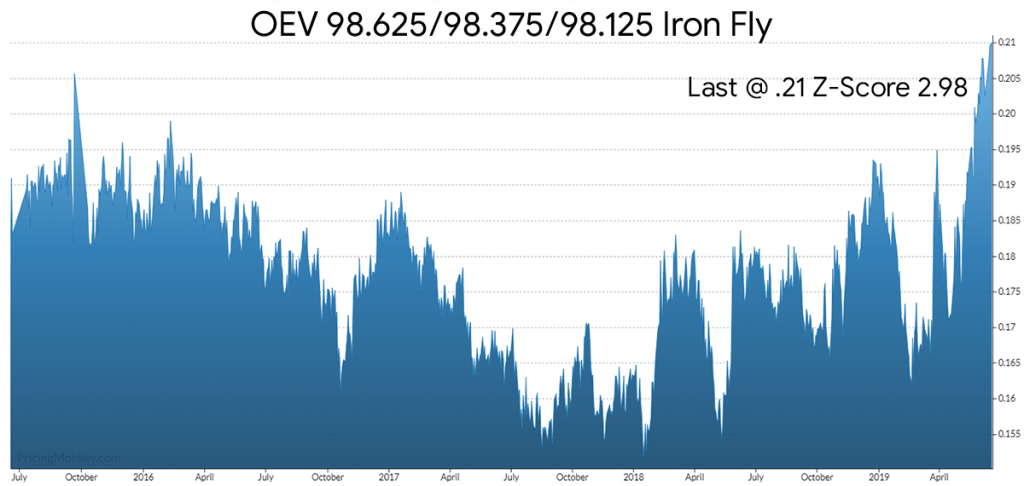

Iron Flys look very interesting

The OEV 98.625/98.375/98.125 Iron Fly trading at .21 max payout of 25 with a 116 days to expiry, looks very rich. Potentially a reasonable safe way to play the current vol and skew.

Other Iron Flys to check:

EDZ 97.875/98.00/98.125 @ 20.5 Z-Score 3.35

EDV 98.00/97.75/98.25 @ .20 Z-Score 3.3