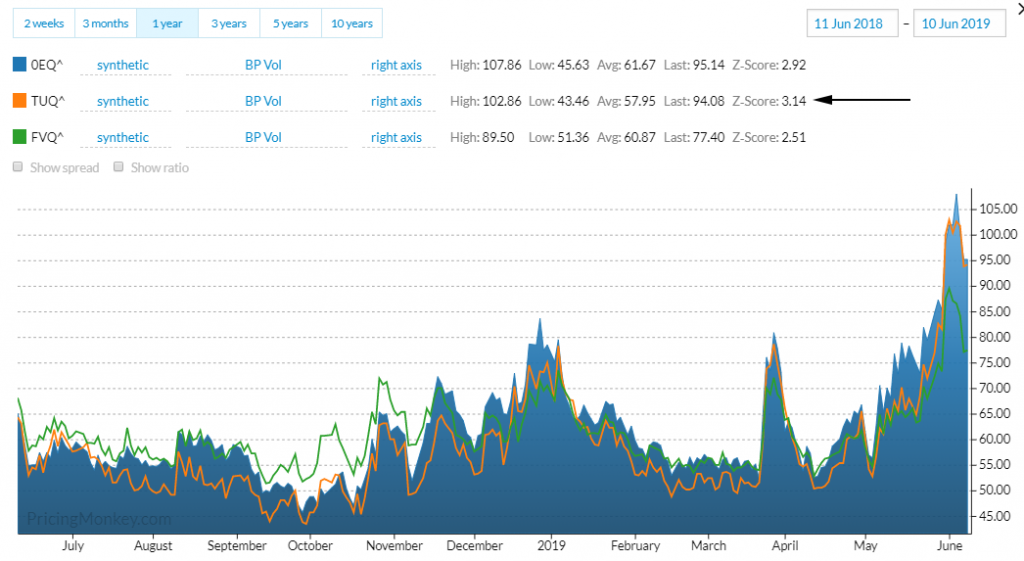

US 2-Yr Bonds (TU) vs 2-Yr Midcurve Eurodollars (2E) or US 5-Yrs (FV)

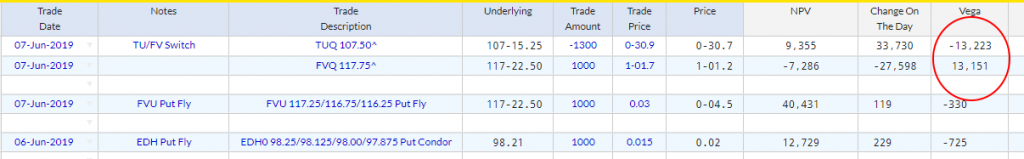

A trade we highlighted recently (US 2-Yr Vol strength) continues to outperform its proxy 2-Yr Midcurves, this trade is also worth looking at against the US 5-Yr(FV).

Tip: If you need to work out trade amounts on switches like this, use the Book Keeping function to get hedges quickly and also monitor position that need re hedging (delta) once on. Please chat us if you need any help with this powerful function.

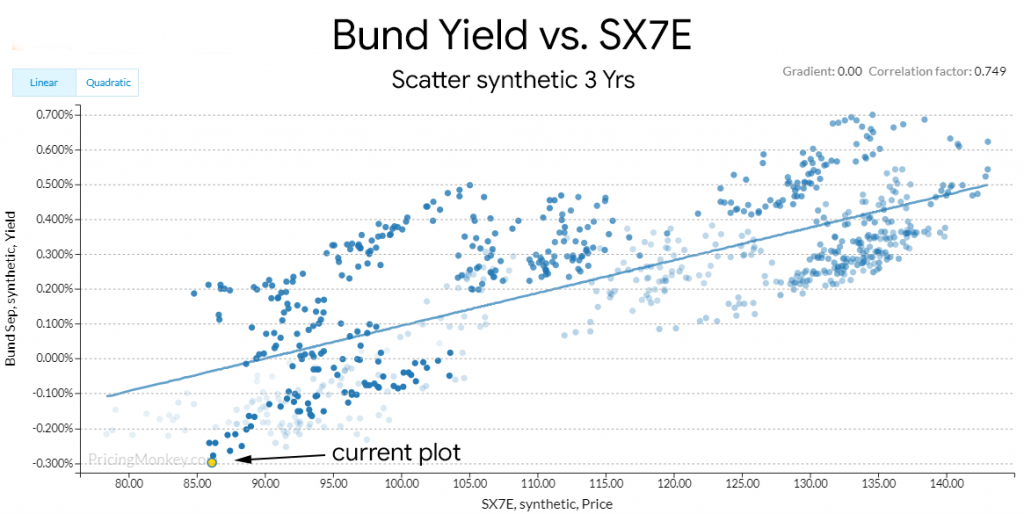

SX7E and Bunds

After last weeks dismal SX7E performance and Bund yields hitting new lows, the contracts have a .749 correlation, and Vol is correlated .70. If you’re very creative they look like interesting relationships to explore on PricingMonkey. SX7E post crisis low is 81 (July 2016), trading @ 87 this AM.

US Bonds

Skew moves last week were pushing out some interesting opportunities, as an example Thursday the FVU 117.25/116.75/116.25 Put Fly closed at 0.03 which we highlighted, closed at 0.045 on Friday, despite the market move up.

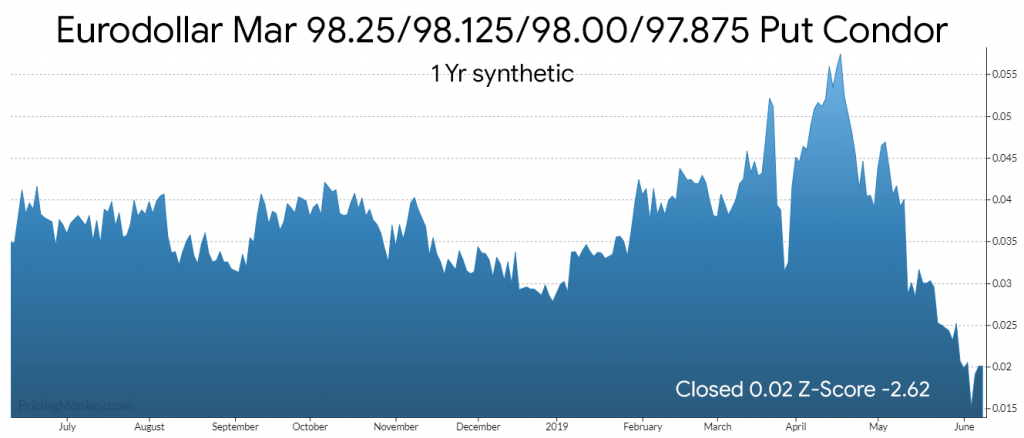

Eurodollars

A similar story the Bonds with skew moves seemingly initially distorting some structures, an example is the EDH 98.25/98.125/98.00/97.875 Put Condor, it was 4 cents in the money, and closed at 0.02 on Friday.

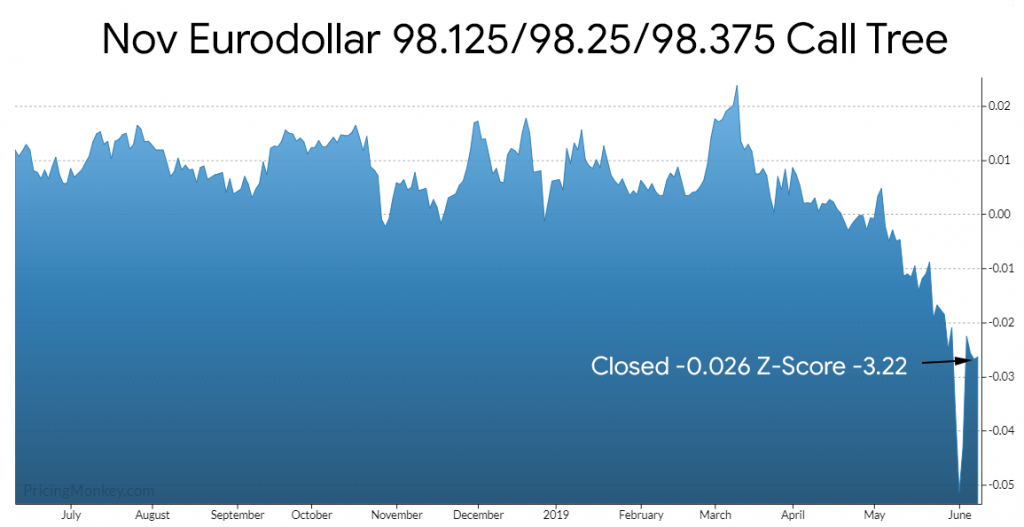

The upside skew still favors Call Spreads. Call Trees might be interesting now after the move last week, for example the Nov Eurodollar 98.125/98.25/98.375 Call Tree closed at -0.027 (Z-Score -3.22) well below its 0.006 average for the last 12 months.

Eurex

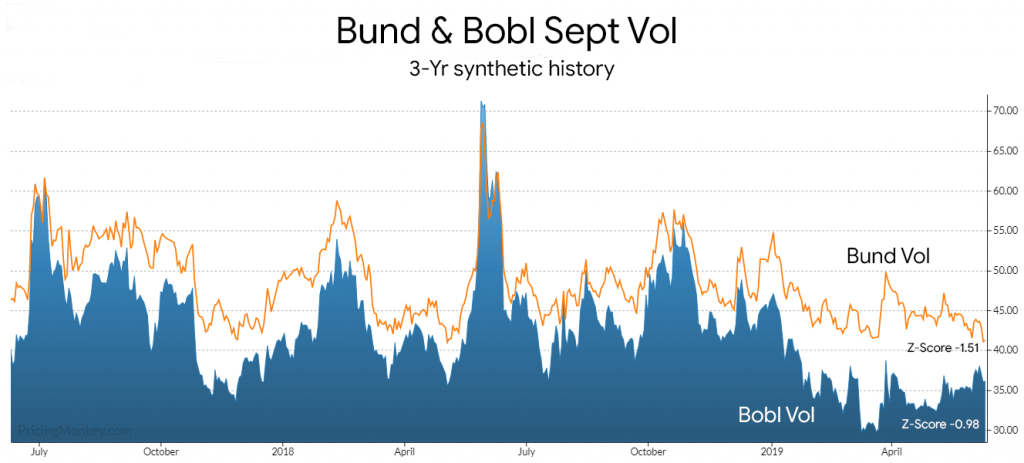

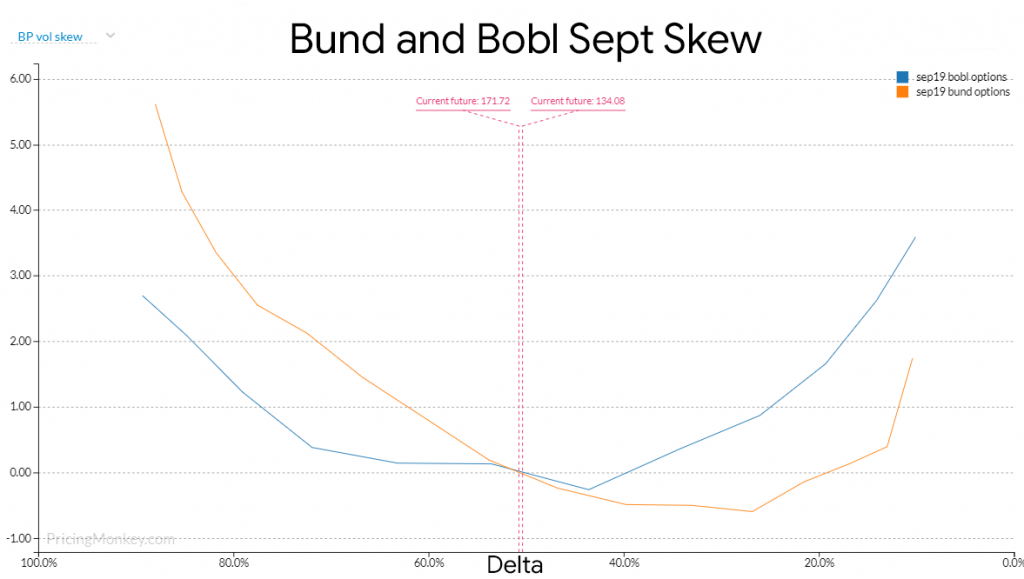

Bund Vol close to 7 years lows, and Bobl Vol ticking higher, it looks possible these might converge again. The 2 skews are also different which should suggest some interesting opportunities.