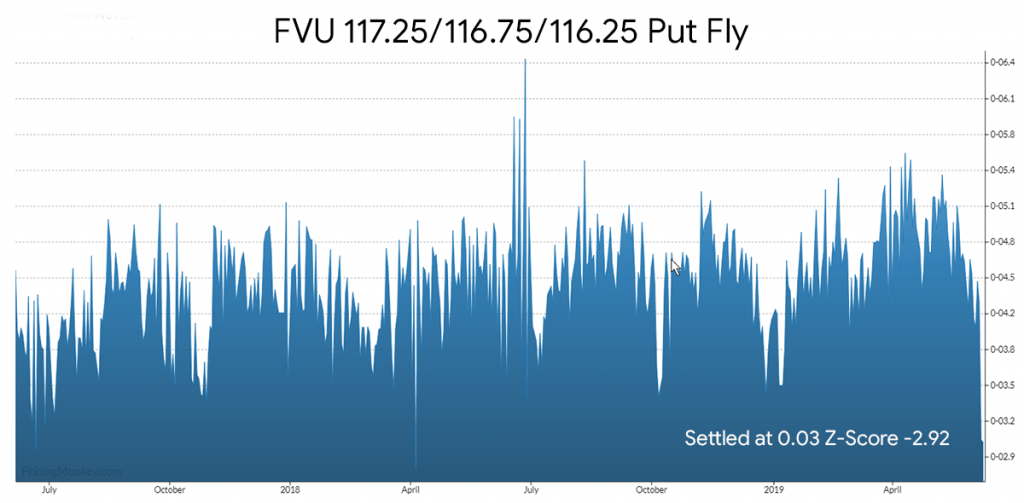

Seems the US Bonds are also seeing some skew moves that are also creating some areas of value that will be worth keeping an eye on.

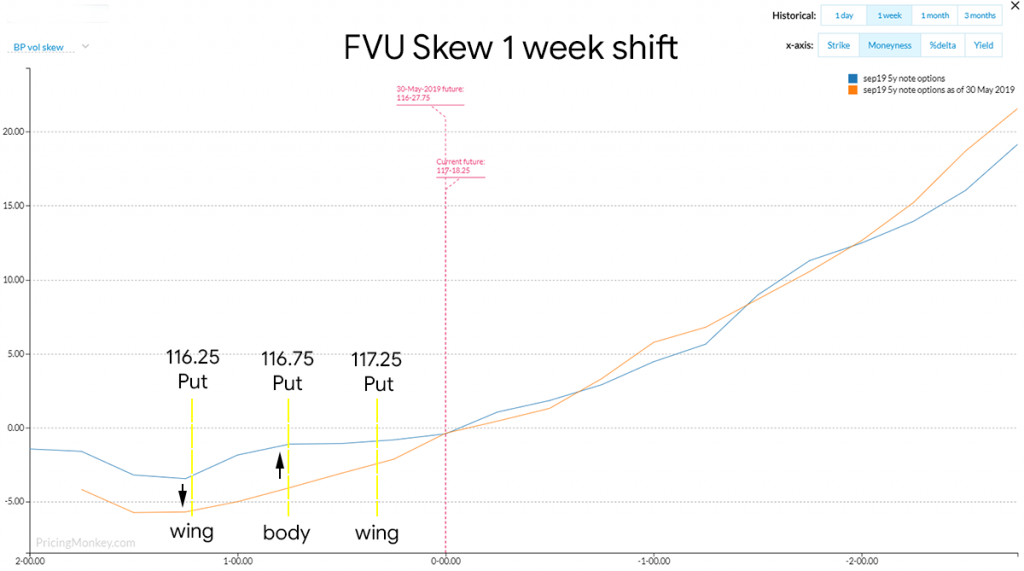

For example this is the FVU 117.25/116.75/116.25 Put Fly (77.6 days to expiry), which as you can see from the skew move at the bottom has benefited in terms of price (cheaper) from a move in the 116.75 (body) skew.

The move on the Put skew over the last week: