This is a recent phenomenon that we flagged a couple of weeks ago that looks out of sync with realized vol and contract spreads.

As you can see below the 0E contracts(1-Yr Midcurve) implied Vol is adrift from 2E (2-Yr Midcurve). In addition Realized Vol doesn’t seem to support this move.

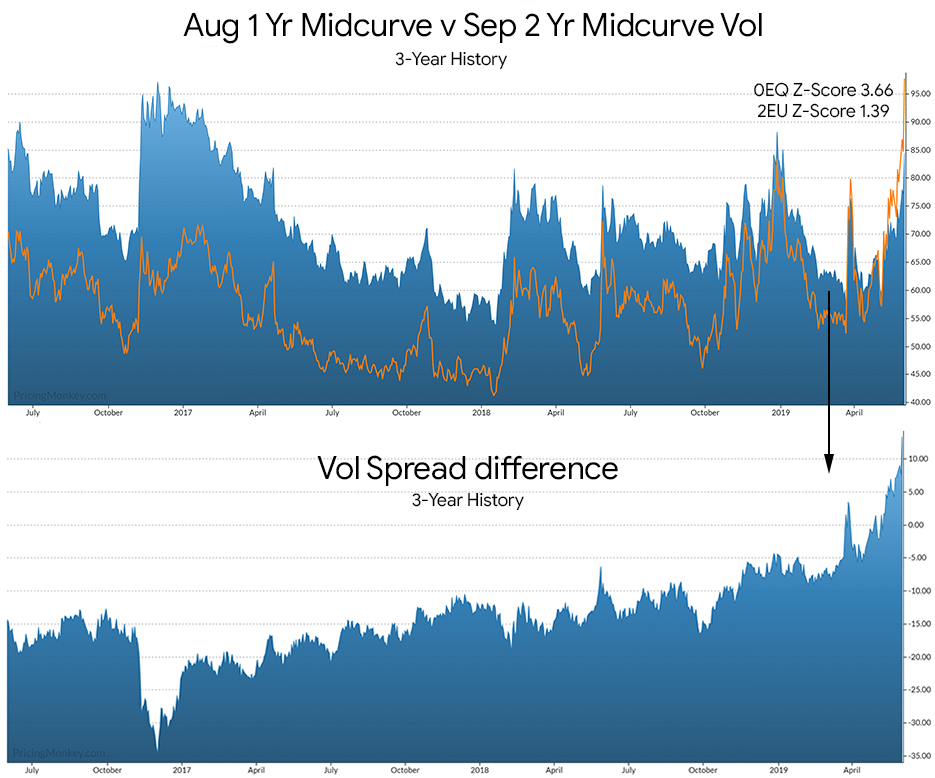

The nearer in you are to expiry on the OE contracts the more extreme this move is. Taking a look at the August 1 Yr Midcurve expiry (76 days to expiry) here versus Sep 2-Year Midcurve (104 days to expiry) clearly shows this.

This pricing might be useful to construct trades. For example, if you have a view of the EDU0/U1 not steepening any further after last weeks move (close -0.035 Friday), then trades that sell 0E Vol might look interesting.

The 2E2 Call-2*0EQ 25 out Call+2E2 50 Out Call = 2EU 98.25 call – 2*0EQ 98.50 Call + 2EU 98.75 Call, which is a Call Fly that sells the 0EQ body that expires in 76 days to buy 2EU wings that expire in 104 days. Closed at 0.021 Friday.