In this post I take a look at the Canadian BA Options market. The atm strike has been offered down vs the wings over the last few months. Payout profiles that go against that flow are starting to look attractive.

Although BA midcurve & red options have been trading recently most of the option volume is in the front four contracts. With no hint of a rate move on the horizon and with central bank rates cut to 0.25, the main game has been selling the at the money 99.50 strike .

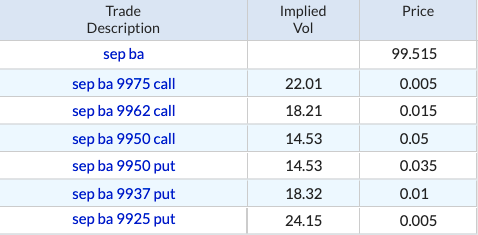

What buying flows there are more spread with most of the open interest in upside strikes. This has led to a smiley vol surface. Taking a look at the sep expiry:

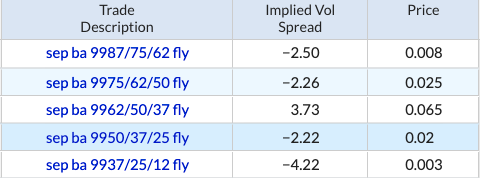

Here’s the run of September fly prices:

with over 6 months to go a price of 6.5 for the sep 9950 middle fly suggests the sep 50 strike is getting pinned. However cdor doesn’t look that pinnable . . . over the past 3 months it’s drifted down from 0.5 to 0.4375. The implied fixing of 99.5625 would give a payout of 0.0625 for the 50 middle fly. Given it currently costs 0.065 that means this fly has negative carry.

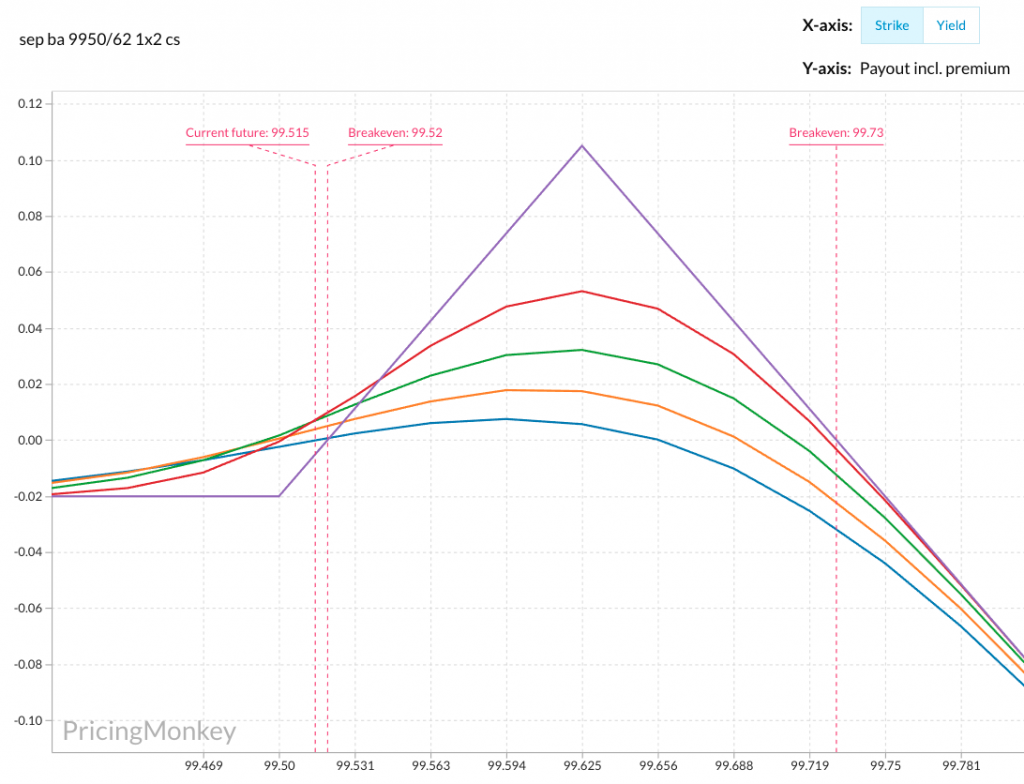

So if the 50 strike is on the cheap side vs the wings what trade to take advantage? With vol this low there’s not a lot of choice, we like the the 9950/62 1×2 call spread. Here’s the payout chart:

If you can trade at 2 ticks then you make money between 9952 and 9973, so if the fixing stays where it is you make 4.25 ticks, more if it continues to drift lower.

The bank of Canada cutting rates below zero is the main risk to the trade, if negative rates are a concern then the 9950/62/75 call fly would be a better choice:

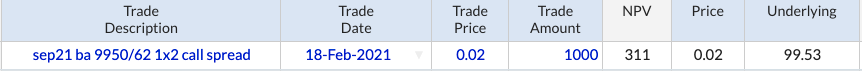

For PricingMonkey users you can follow how this 1×2 call spread trade performs here https://pricingmonkey.com/b/777cf423-d3ca-4ee4-bf77-7fb6b099c042

If you don’t have a Pricing Monkey account, would like one, and work at a financial institution, then please contact us about a free trial at [email protected]