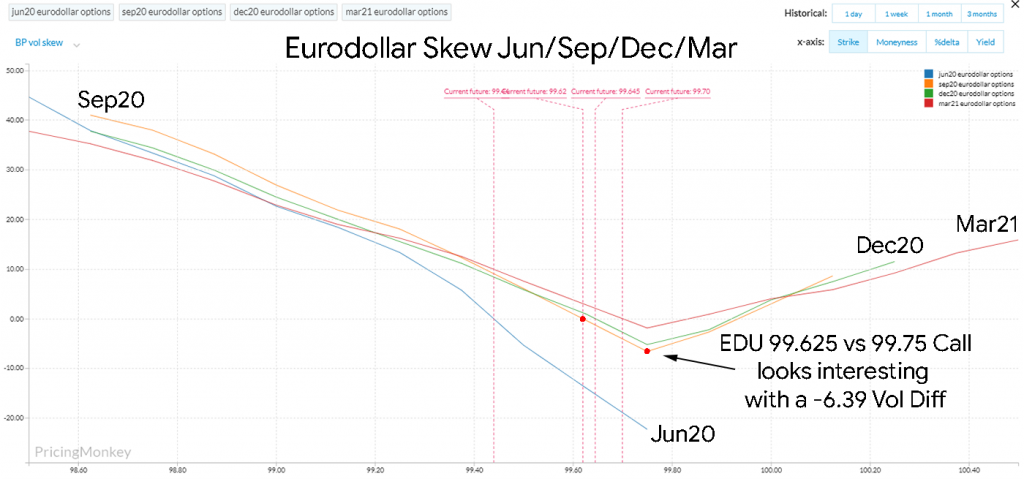

Multi-selecting and comparing skew is always a quick way to look for trade ideas, as it gives you a good way to spot potential vol anomalies that might be worth a second look.

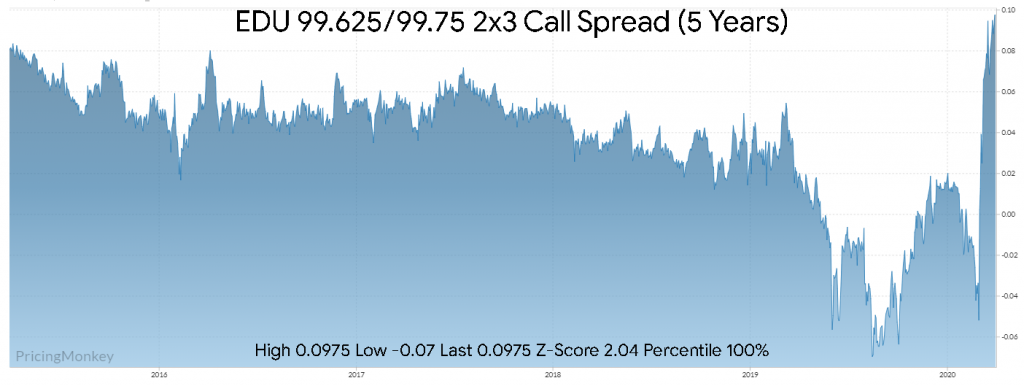

For example, check out the EDU 99.625/75 2×3 Call Spread, it closed at 9.75, on 5-year highs. If you expect continued pressure on Libor, and EDU to hold 99.625, this trade (Short) makes some sense.

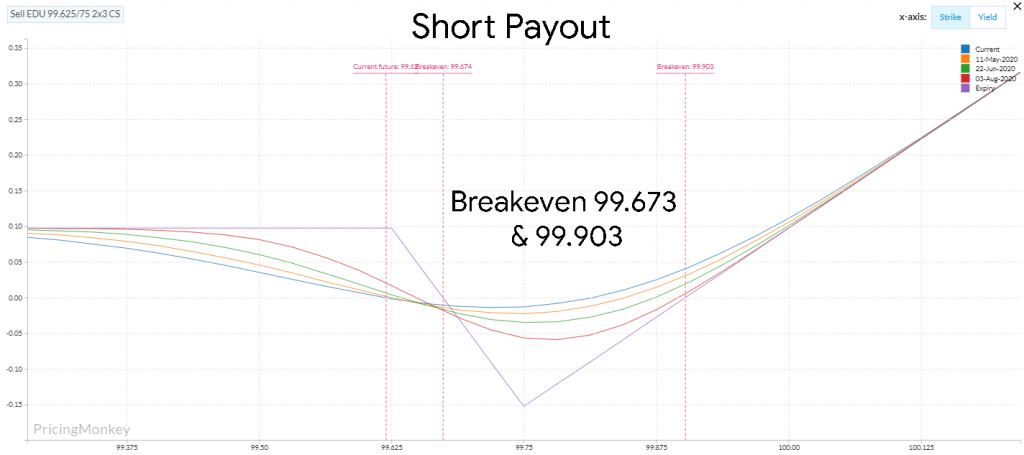

Payout from being short.

Also consider the EDU 99.625/875 2X3 CS, EDU 99.625/75 CS, the EDU 99.75/875 CS looks cheap at sub 1.5.