We recently introduced contingent backtesting that now allows traders to run in-depth backtests, using any number of criteria available in the PricingMonkey sheet to trigger a strategy test.

Here we look at a number of different products (option strategies) that seem to backtest well over 5 Years when different historic constraints are applied.

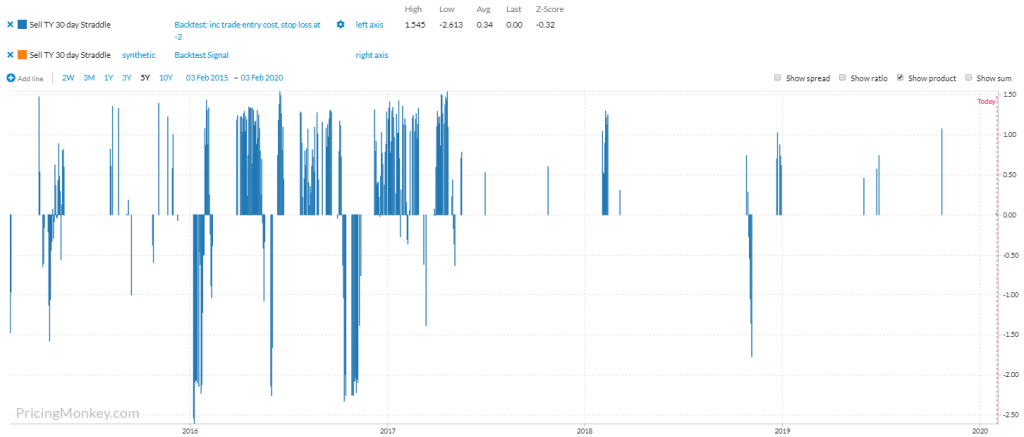

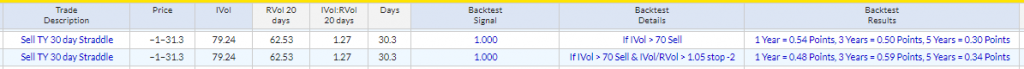

US 10 Year (TY) Straddles

We don’t have a solver yet, so this is very much trial & error at this early point. Hopefully, you will have a better idea of what trades will work than or guesses here.

We found that Generic 30 days TY Straddles sold when Implied Vol was above 70 and the Implied Vol vs Realised ratio was greater than 1.05 plus a 2 point stop produced an average of 0.34 Points per trade over 5-Years.

Using a second criteria and a stop here produced better returns when just selling the TY Staddle with Implied Vol above 70. Note that the Backtest Signal is currently active (1), suggesting that TY Straddles are currently a Sell.

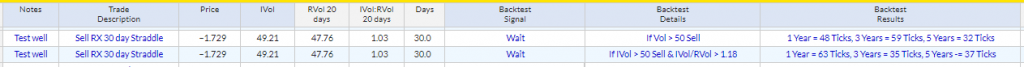

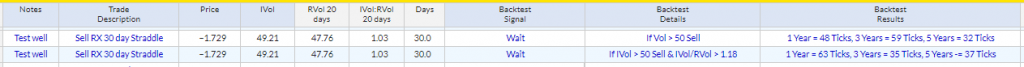

Bunds Straddles

Similar to selling TY straddles, selling Bund 30 day Sraddles with Implied Vol over 50, and the Implied Vol/Realised Vol Ratio over 1.18. Tests return an average of 37 ticks per trade over 5 years.

Trade has performed than just using an Implied Vol trigger to sell. Signals currently showing “Wait”.

SX5E & SX7E 50 Day Straddles

Interestingly both these produce decent straddle returns just using the Implied Vol/Realised Vol Ratio. Sell when Implied is 1.5times Realised. SX5E has returned 34 net ticks per trade over 5 years, the SX7E has returned 1.03 ticks over the same period using the same ratio.

SX5E has returned 67 tick over the last 12 months on average using this simple criteria. the SX7E 3.7 ticks. The currently SX7E Implied Vol/Realised Vol Ratio is 1.44 close to our 1.5 sell level.

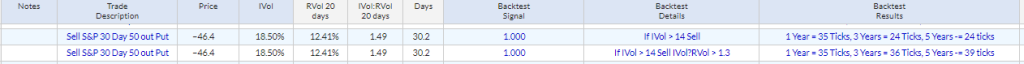

Selling S&P Options Premium

It seems super difficult to find a low delta based Options strategy that pays to short premium in S&P, so here we look at how the Implied Vol/Realised Vol ration can help when used as an extra trade flag. If you look at selling 30 day 50 put S&P Puts for example, you can see that using Implied/Realised in some form has kept you out of trouble.

Running the Backest for 5 Years selling 30 day 50 out S&P Puts when Vol is over 14, and the Implied Vol vs Realised Vol ratio is above 1.3, shows virtually no losses, the late 2018 mini-crash was avoided.

The trade has returned an average of 39 ticks per trades vs 24 for a test just using Vol over 14 for its trigger.

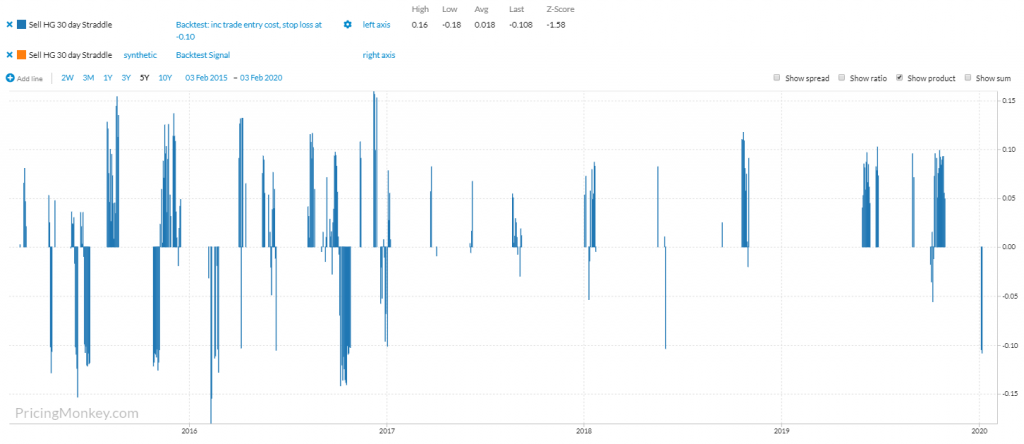

Copper Straddles

We haven’t found a short premium strategy in Gold yet, but we have spotted a Gold/Silver Straddle switch that looks promising (more on that in the next couple of days).

Selling the Copper Straddle using Vol at 15, Implied/Realised at 1.2, and using a 0.10 stop seems to pay. The last 3 years being a lot more productive than 4/5 years ago. 1-year return = 5.4 ticks, 3 years 4.5 ticks and 5 years 1.8 ticks.