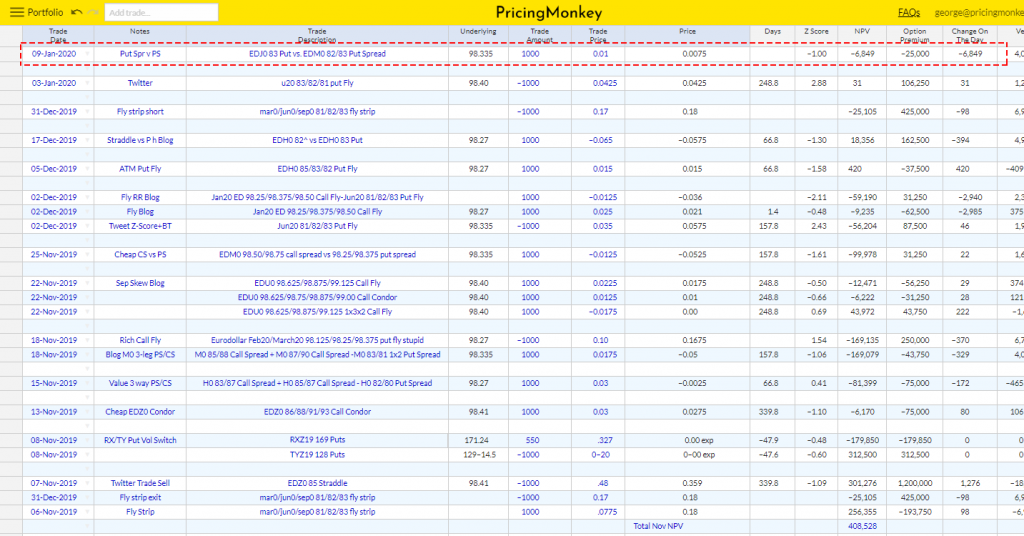

Buy Apr 83 Puts with 91 days to expiry Delta -59.8%

Sell Jun 82/83 Put Spread with 157 days to expiry Delta +28.5%

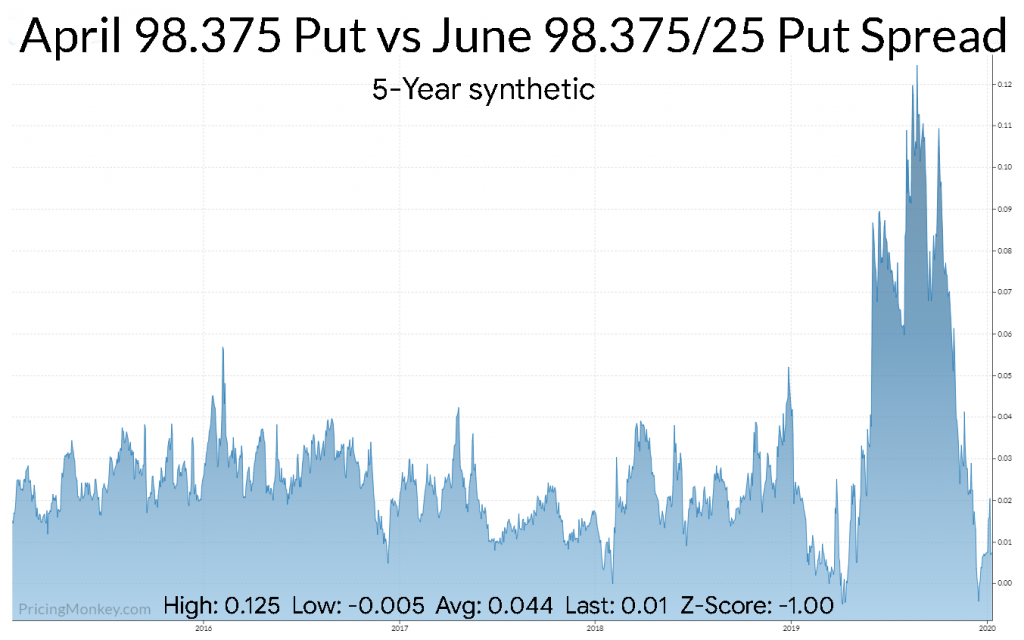

If you’re looking for some cheap downside protection, this looks good value. We just saw this trade printing at 0.01 on the Exchange in 10k. A rare Put strategy in today environment. It’s potentially interesting to hedgers/bears as it has a good performance history and is also trading relatively cheap (Z-Score -1).

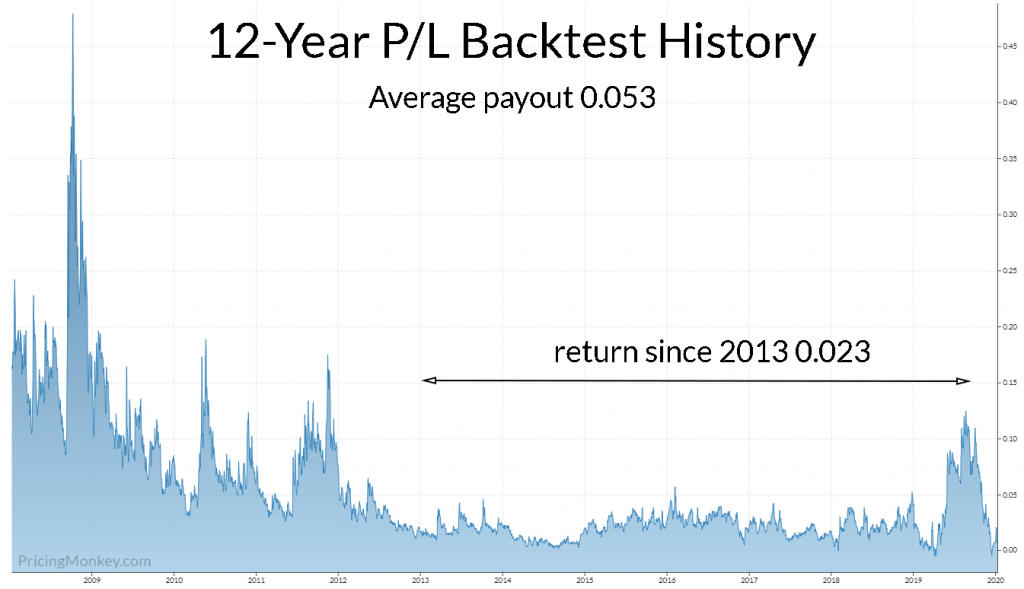

Backtest

This trade has done pretty well historically, returning 0.023 since 2013, this assumes valuation at the first expiry in 91 days.

Trade logged for tracking