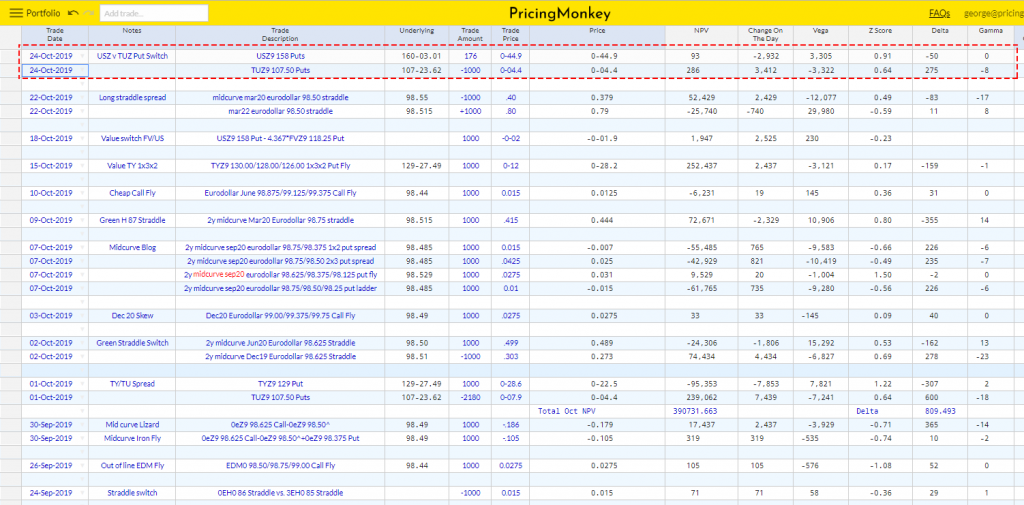

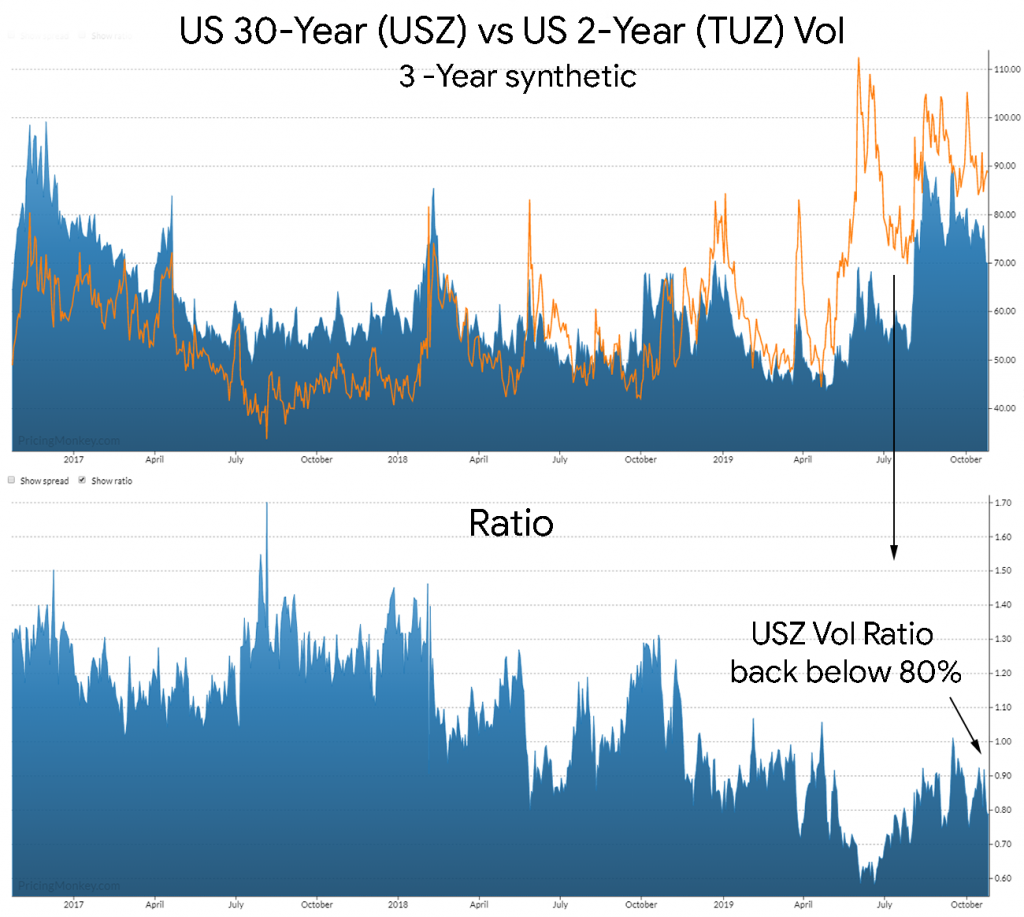

Good recent divergence in the US 2-Year (TUZ) & the US 30-Year(USZ) Vol has pushed 2’s/30’s switches into a potential credit again, i.e you can sell weighted US-2-Year (TUZ) Vol for a credit vs US 30-Years (USZ) Vol.

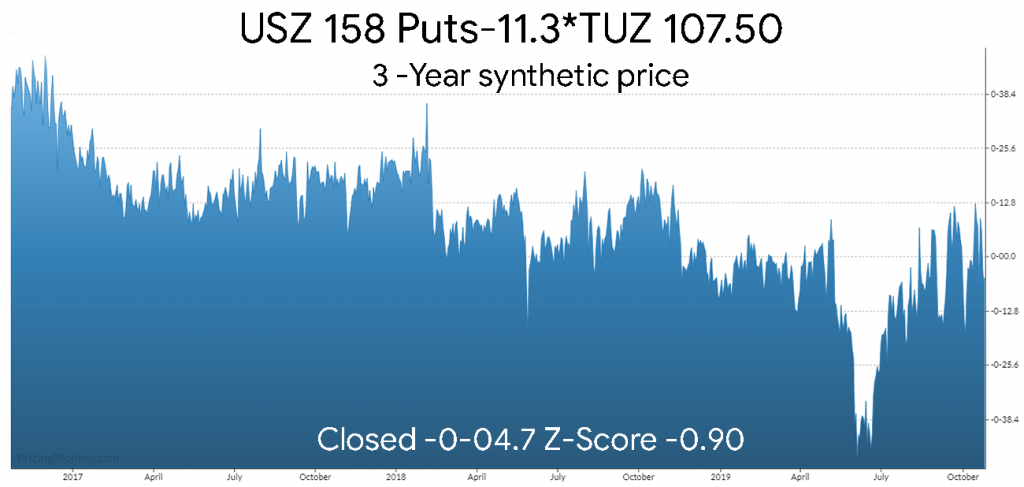

For example if you’re on the steepener trail here, you should be able to switch USZ 158 Puts (28.2 delta) vs TUZ 107.50 Puts (27.5 delta) for a credit. The Vega weighting is around 11.3 (TUZ/USZ). The CIX is USZ 158 Puts-11.3*TUZ 107.50 Puts. This closed at 0-04.7 last night, a small credit.

Other ideas to explore with the Vol difference, switch Calls for Flatteners, Straddles for Vol plays or look at cross asset Risk Reversals (Combos) using the Vol pickup.

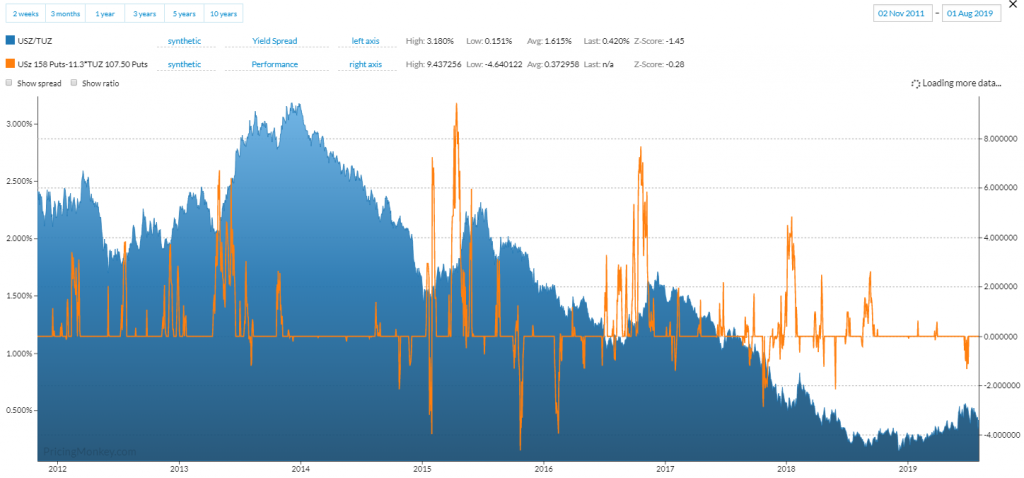

Risk & Backtest

Backtest (orange) vs the US/TU Curve spread, switch has a 9.43 high, -4.64 low, and a 0.37 payout average over 7 years.

Remember TUZ are double sized contracts and need to be down sized for trading.