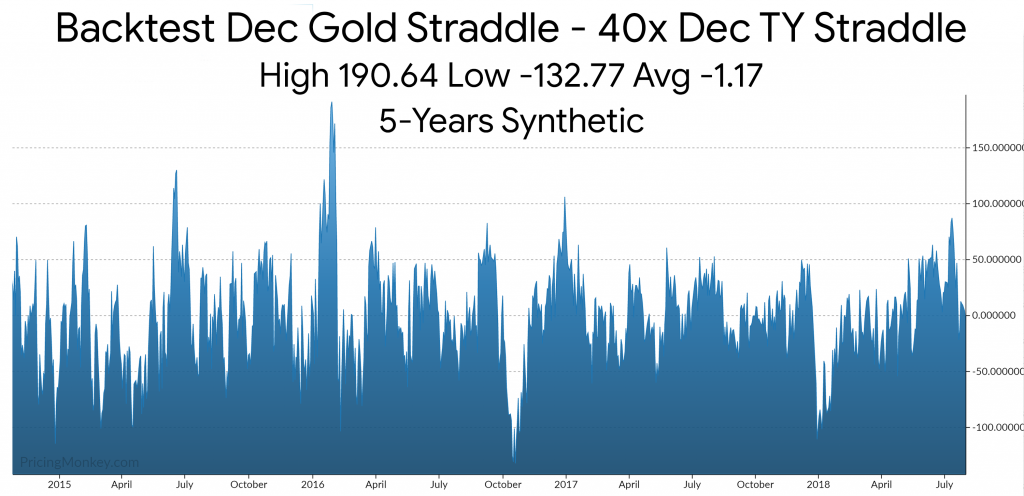

GCZ9 1495 Straddle vs TYZ9 130 Straddle with 37 & 34 days to expiry

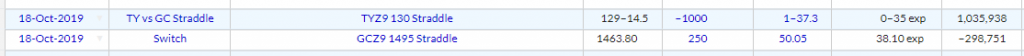

If you plot and scatter Gold and US 10-Year Vol you will see just how highly correlated it is. Here we plotted 1-Month Gold Vol against 1-Month TY Vol.

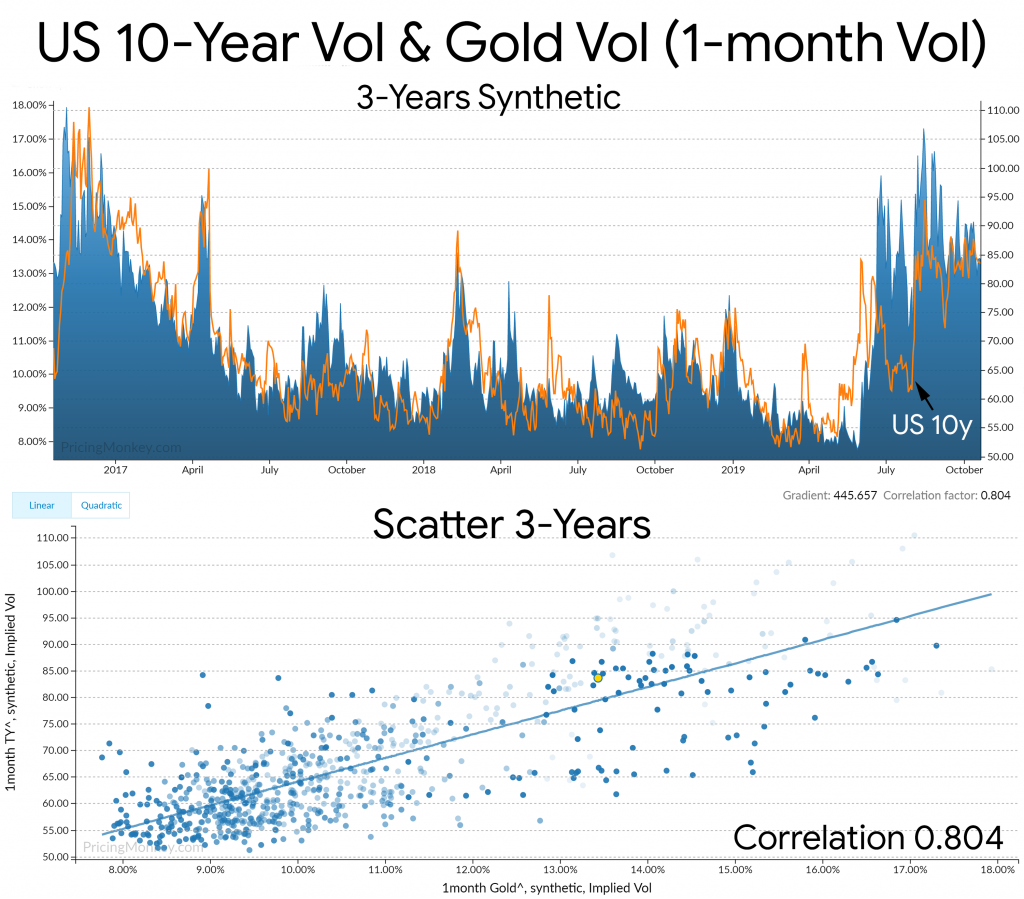

How can these be put together as a trade strategy? By creating a simple stable CIX from the 2 straddles you can gain an understanding of its relationship history and potential risks. The CIX is created using Vega weightings and contract size adjustments. Here we get Dec Gold Straddle – 40x Dec TY Straddle.

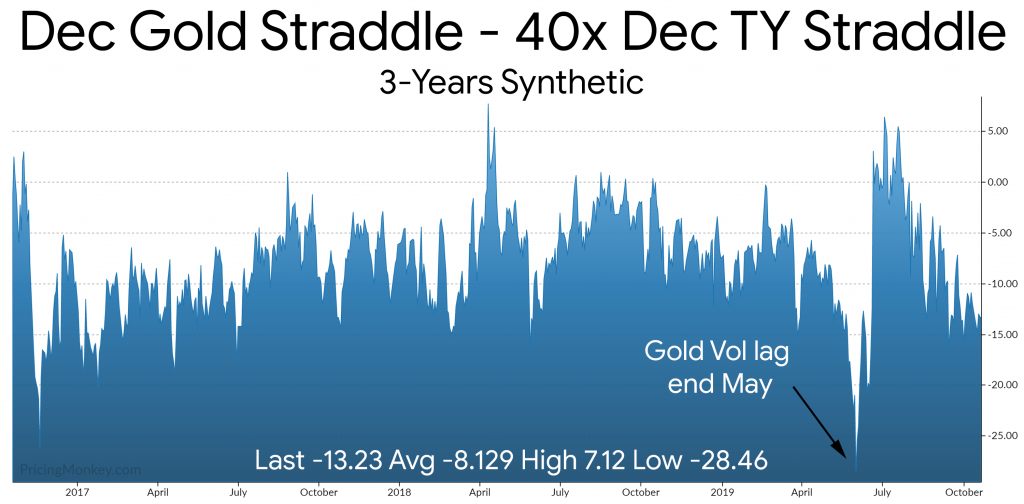

The key to fully understanding this trade and its value+risk is to backtest it and see how it historically paid out over time. Average payout (5 Years) is -1.17 vs current price of -13.23. Gold Vol is currently small cheap on a historic basis vs TY Vol. It looks a very good structure to follow if trading Gold Vol.

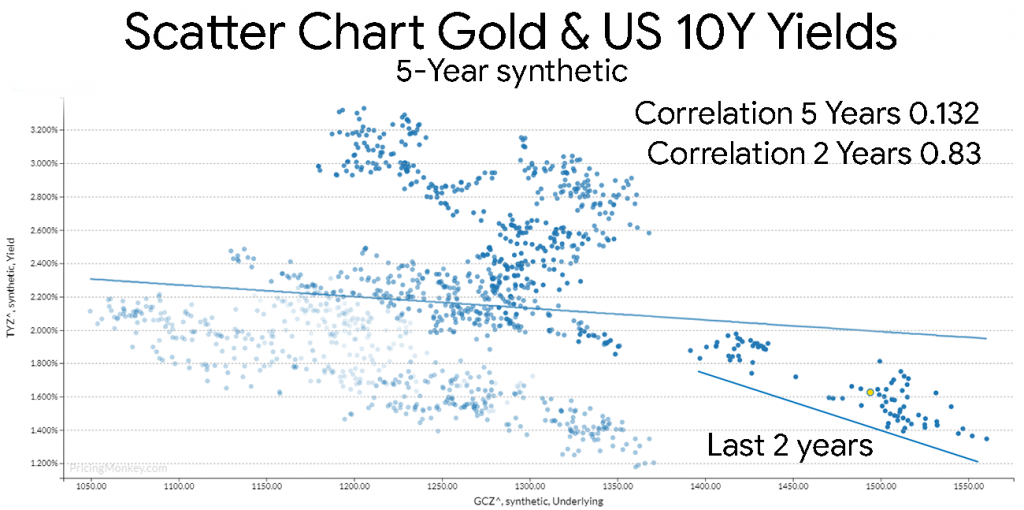

Gold vs US 10 year Price Correlation

Another consideration, the correlation in Price between Gold and US 10 year has also been very high over the last 2 years, although over a longer period it is negligible.

Another ideas to explore in this space, creating Put or Call spread strategy between pairs of Gold and TY options, and checking their historic backtest payouts.

Trade Added for tracking.

Update on this post 12th December 2019:

At expiry: