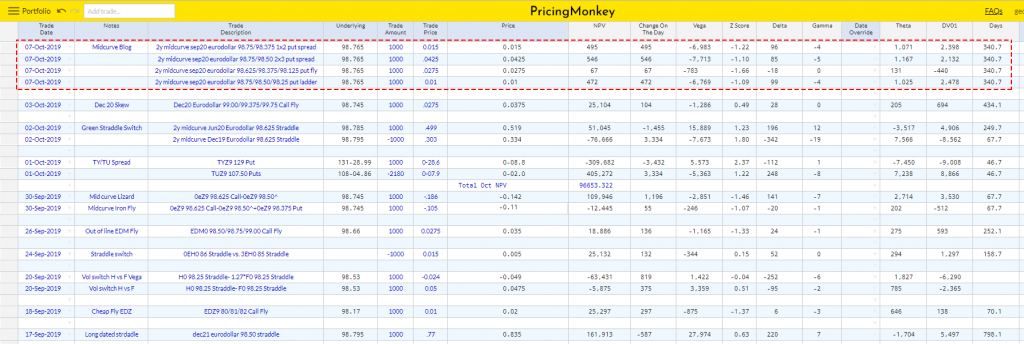

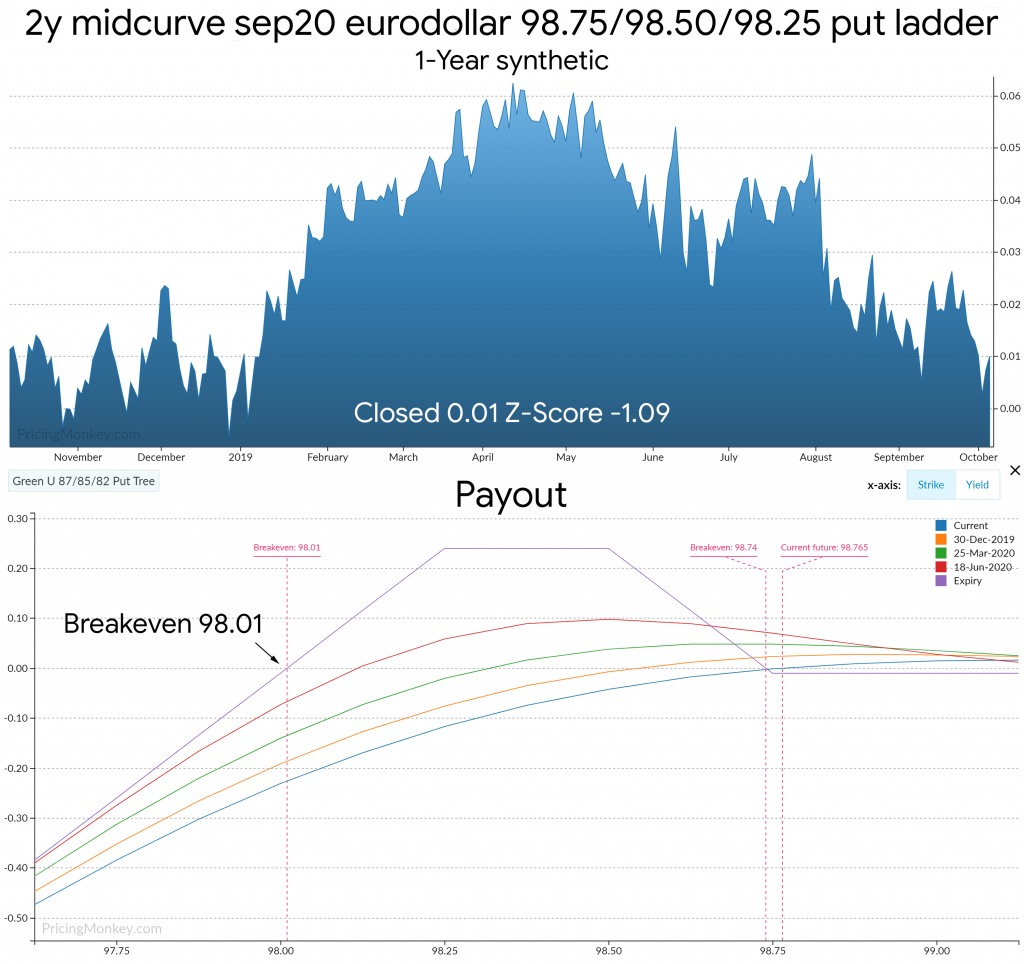

| 2y midcurve sep20 eurodollar 98.75/98.50/98.25 put ladder with 340 days to expiry, 10% delta, closed 0.01 |

Sifting through the trades on Friday, this structure caught our attention, as being one of few value trades that was being executed. The market focus seems to be entirely centred on ramming up the value of Call structures currently.

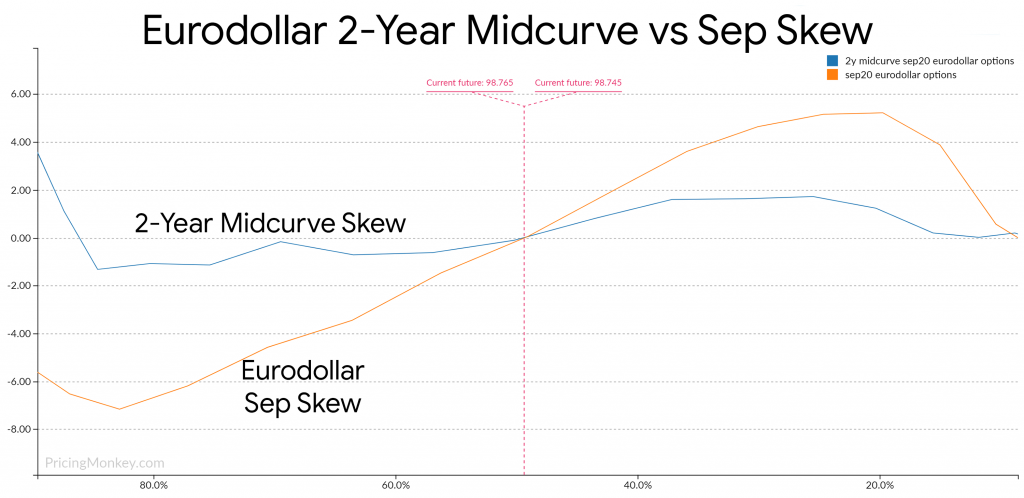

The 2-Year Midcurve Options also have a very different skew profile than front year Eurodollar options, with a very neutral skew profile.

If you expect some steepening (2-Midcurve vs Front) or just see 2-Year Midcurves as just too high here (EDU2 @ 98.74), the flat skew favours Put Spreads, Put Trees, Flys and Condors. Check out to start:

2y midcurve sep20 eurodollar 98.75/98.375 1×2 put spread, closed 0.015, Z-Score 0.015

2y midcurve sep20 eurodollar 98.75/98.50 2×3 put spread, closed 0.045, Z-Score -1.10

2y midcurve sep20 eurodollar 98.625/98.375/98.125 put fly, closed 0.0275, Z-Score -1.65

Trades booked for tracking