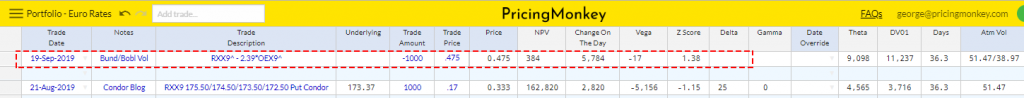

Nov Bund Straddle -2.39*Nov Bobl Straddle with 36 days to expiry

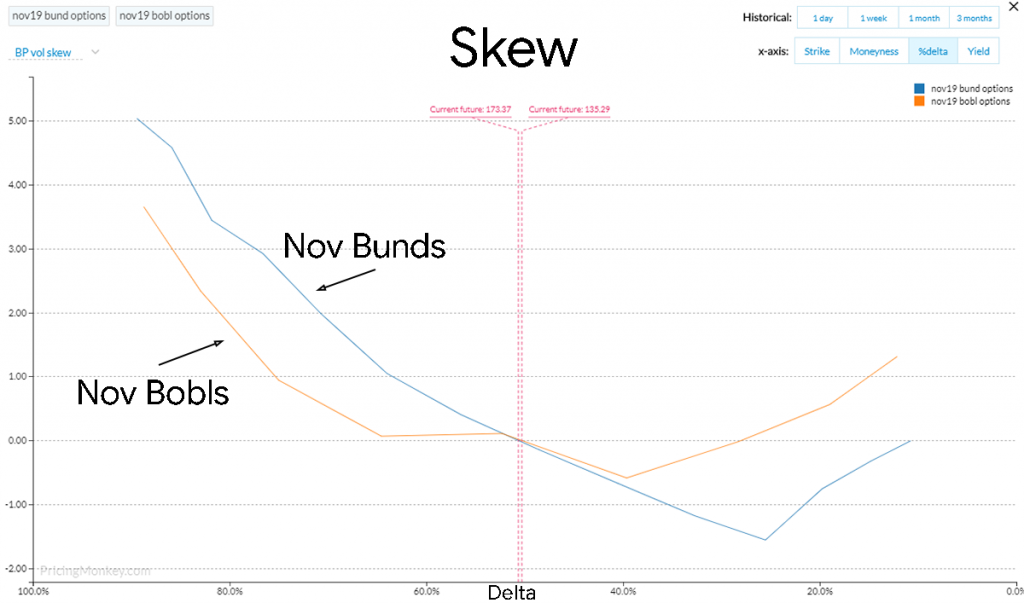

Vol and Skew differences in Bobl & Bund Options currently offer potential interesting opportunities, especially if you have a view on the German 5’s/10’s curve.

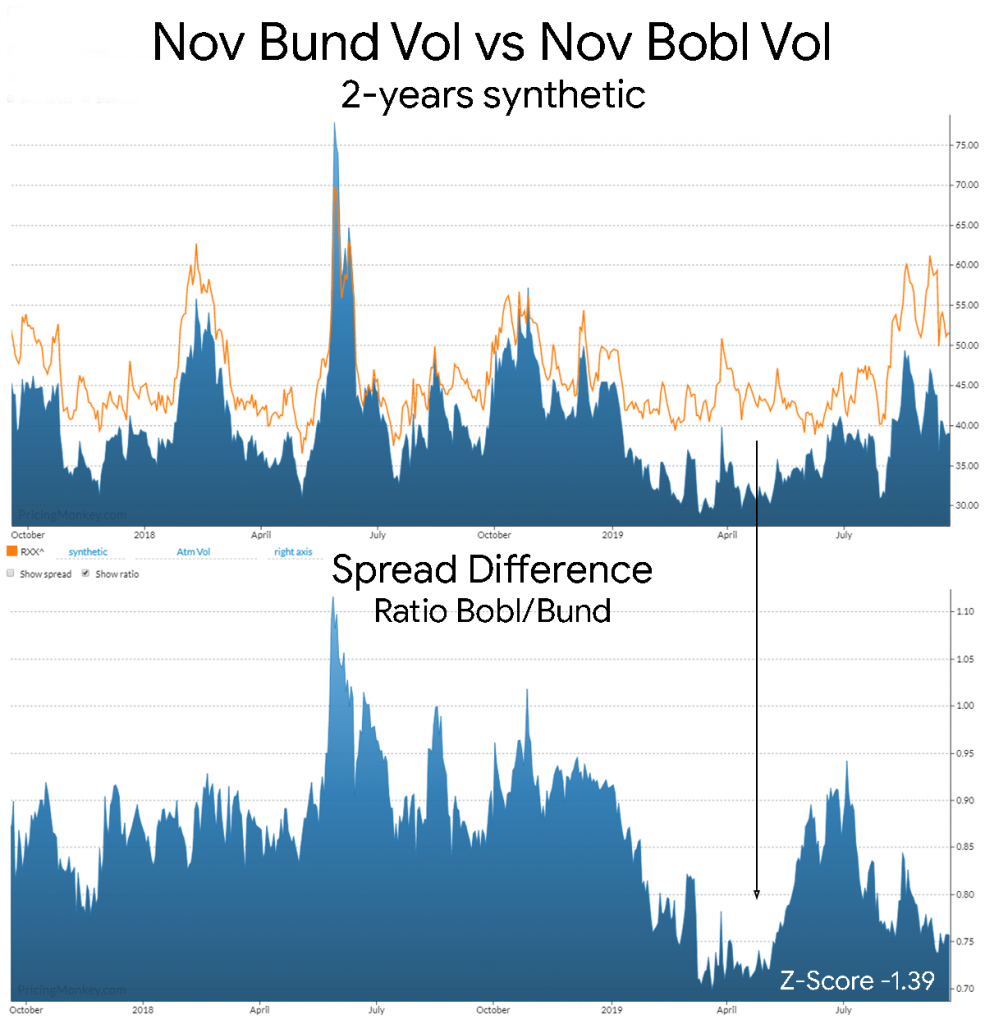

Bobl Vol is running notably below Bunds currently, close to 2-year lows.

If you have a curve view, this overlay of Bobl and Bund skew shows that Bobl Puts are especially cheap.

Bund vs Bobl Straddles

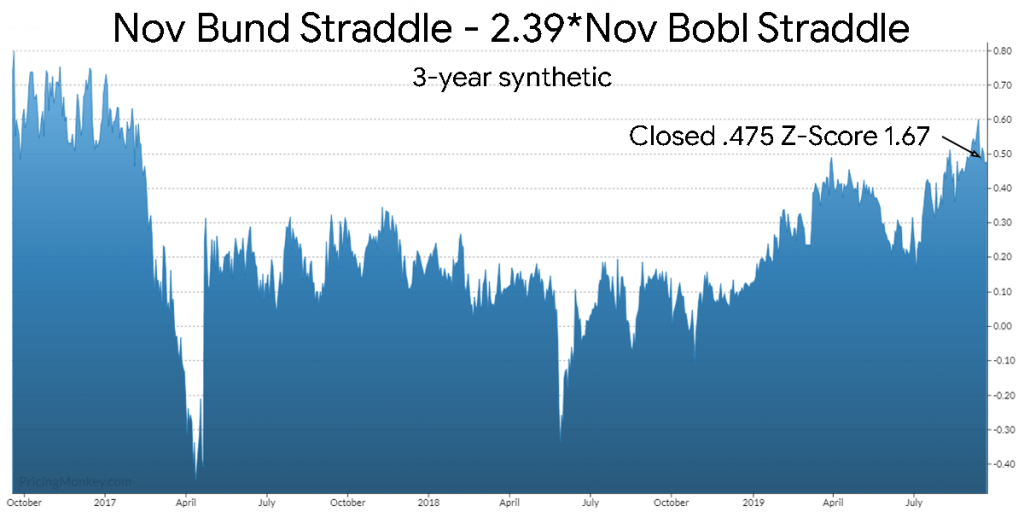

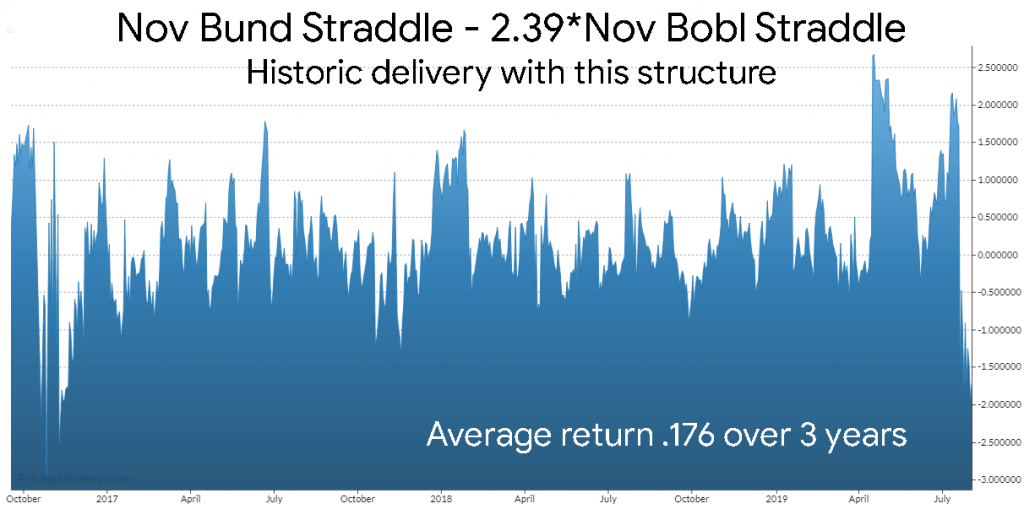

Alternatively looking at a neutral strategy (trading the two straddle against each other), you weight the Bobls (using Vega or DV01) to create a CIX, here Nov Bund Straddle – 2.39*Nov Bobl Straddle.

If you plot this structure you will see that it inversely mirrors the Spread Difference chart above. 3-years rather than 2-years above, a 1 year longer scale here.

Back testing this structure using our Performance tool over 3 years shows that it’s delivered .176 ticks, as we’re selling it at .475 this looks very supportive.

Booked for tracking, wow our last Bund blog was in August