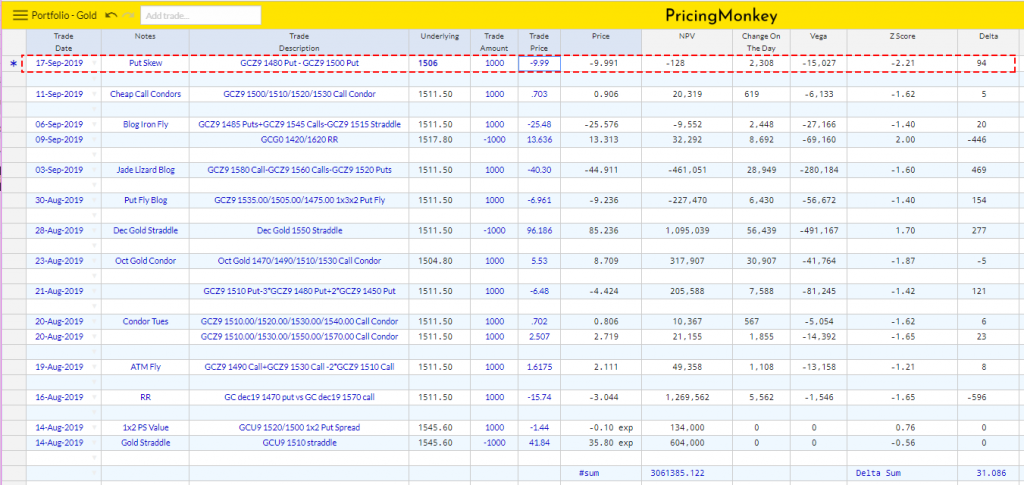

GCZ9 1480 Put – GCZ9 1500 Put with 69.4 days to expiry, -9.4 Delta

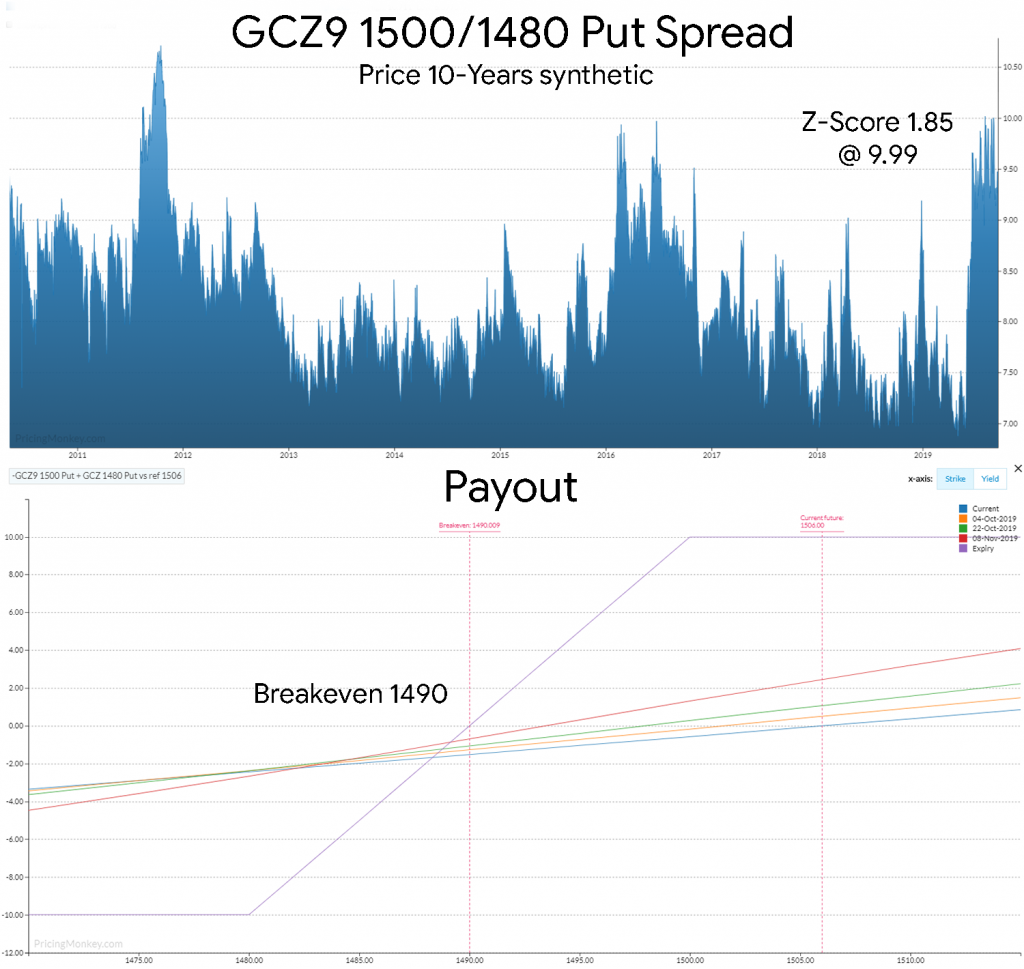

Out of the money puts look cheap verses at the money, if you’re expecting market to hang around 1500 or rally, selling the GCZ9 1500/1480 Put Spread at around $10 , with the market (GCZ) around 1506, looks a pretty decent value trade.

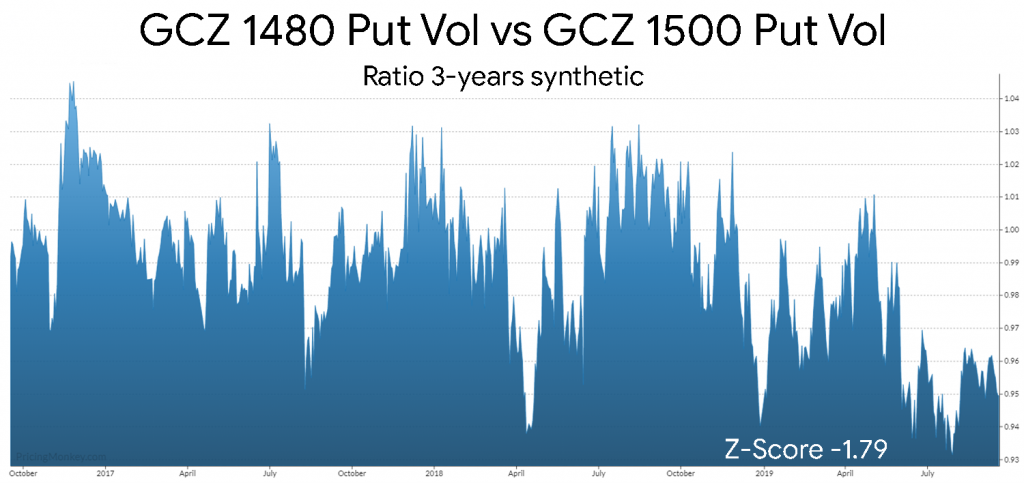

If the look at the ratio of the 1480 Put Vol compared to the 1500 Puts Vol you can also see that this current skew pattern is pretty unusual. Trading at around 95% on the ATM Vol verses a longer term average of over 1.

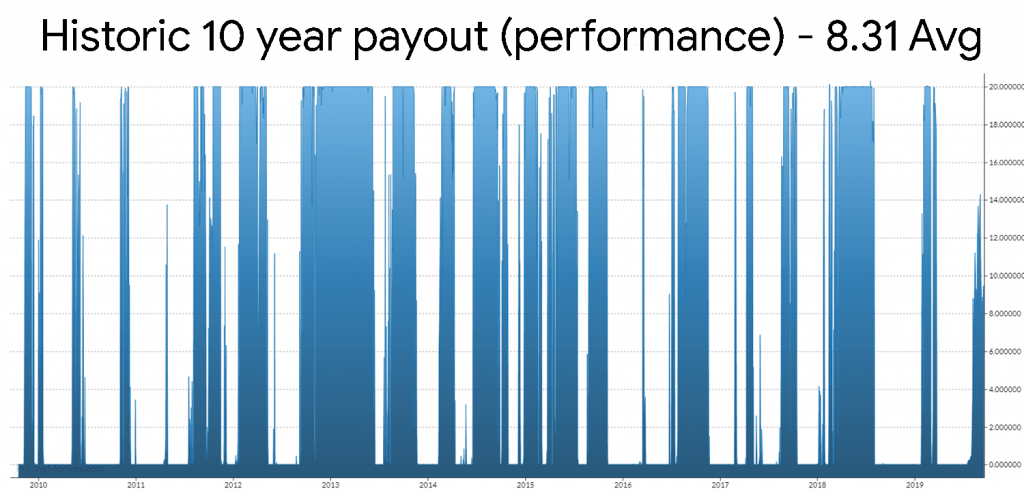

Looking at the historic data, i.e How much has the 20 wide at the money Put spread with 69.4 days to expiry delivered over time? $8.31 – so selling it at $10 is selling it above it’s long term payout.

Trade booked for tracking