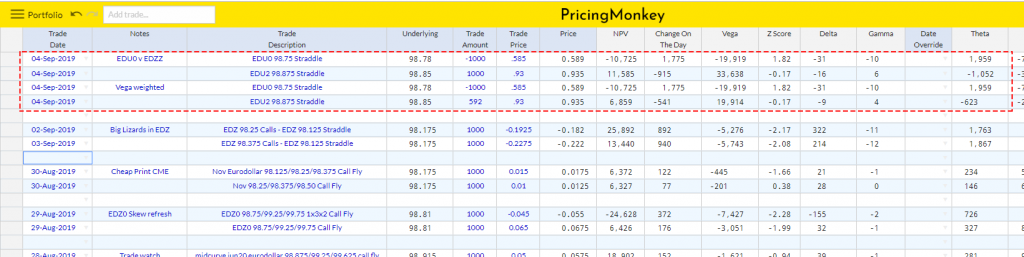

Eurodollar Sept20 98.75 straddle trading at 58.5, with 375 days to expiry, vega 0.008

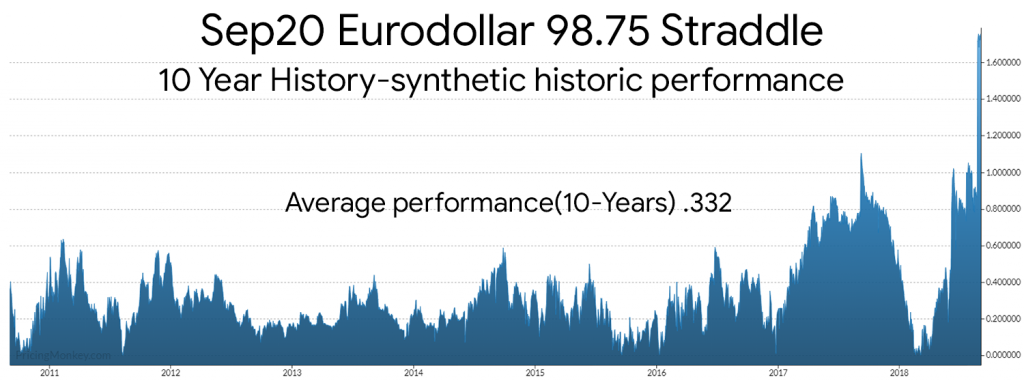

We’ve been spending a bit of time recently using our historic new performance tool, to look at the returns of straddles over time for different maturity’s. This trade going through today (BAML/Merrill Lynch selling) looks like a decent idea for example…

If you look at the synthetic historic performance of this trade over the last 10 Years you will see that its returned .332

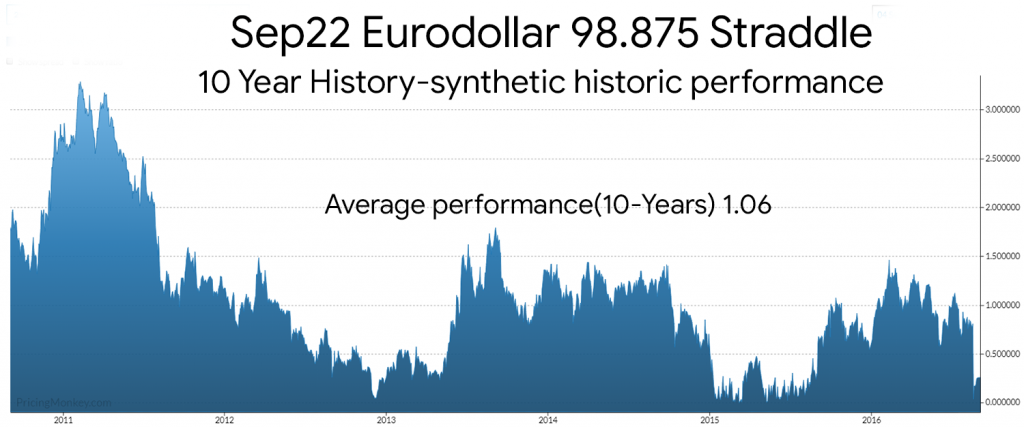

EDU2 98.875 Straddle closed .935, with 1110 days to expiry, vega 0.0135

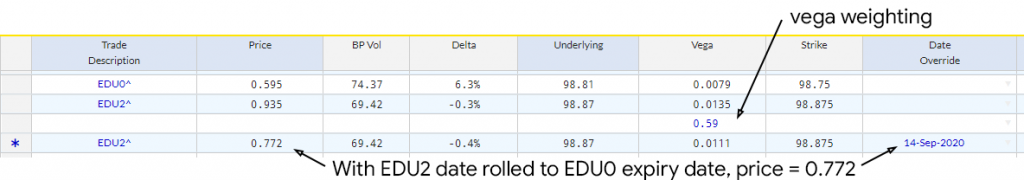

Selling this does makes sense here, but if you’re looking for a potential hedge, look at buying the EDU2 98.875 Straddle that closed around .935. This can be also vega weighted if needed.

Vega weighting calc and EDU2 98.875 with the date override set to 14th Sept 2020 (EDU0^ expiry)

Trade booked for tracking