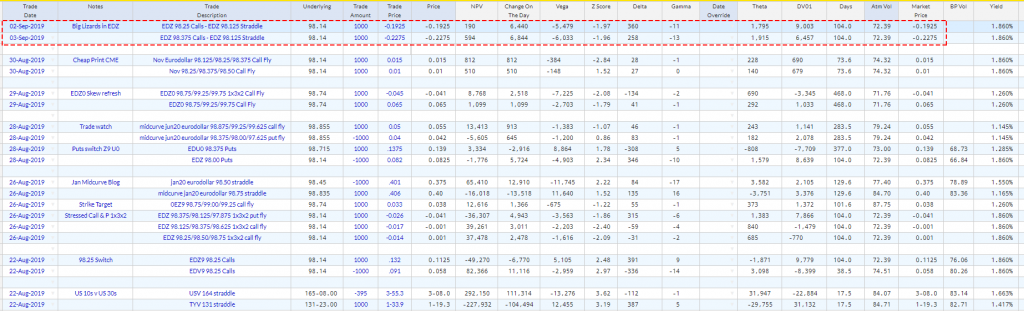

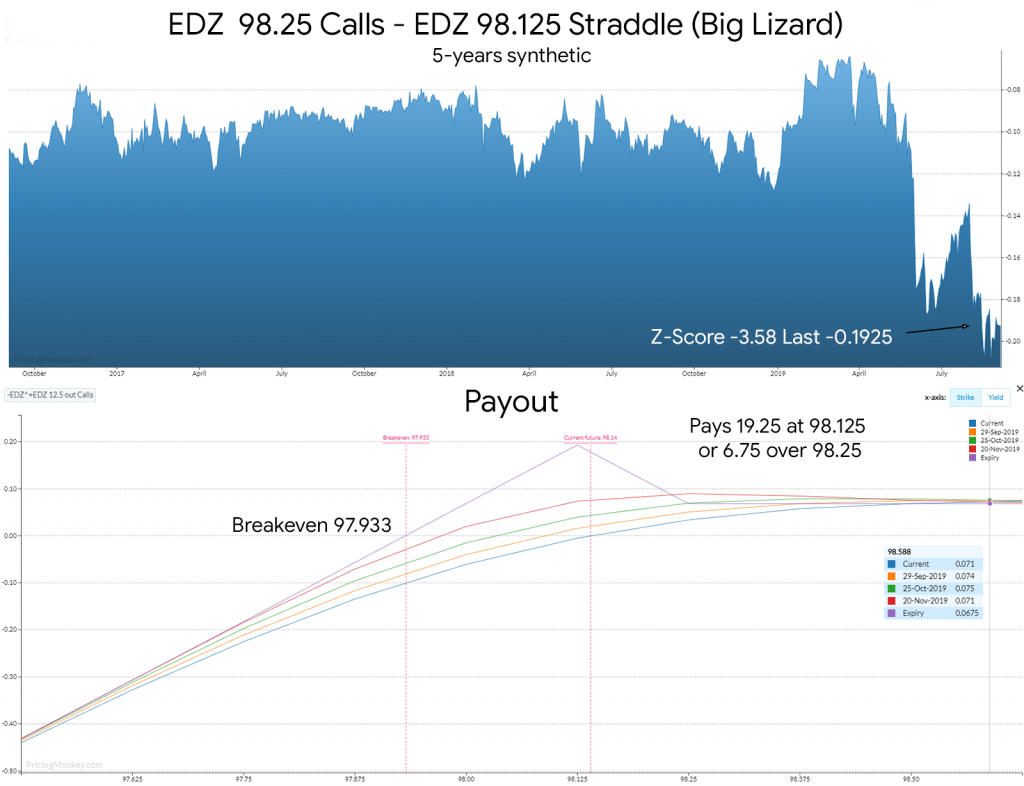

EDZ 98.25 Calls – EDZ 98.125 Straddle (Big Lizard) 104 days to expiry, 36% Delta, -3.58 Z-Score (5-Years)

This is a good structure to check currently as it’s trading very cheap (5-Year lows), and potentially covers a lot of potential risks to trades. If you don’t expect a decent sell off here, this or variations of this are probably worth checking in PricingMonkey.

Variations of this are to sell a straddle of buy an out the money call (Jade Lizard). If you’re bearish (someone must be) look at buying an out the money Put versus the short straddle (reserve Lizards).

Also look to moving the Call out , for example using the 98.375 Cals ( EDZ 98.375 Calls – EDZ 98.125 Straddle) moves the downside breakeven to 97.898, but opens you to a loss over 98.352 (-2.25 ticks). Certainly plenty to play around with here at these Vol levels.